The Valt Journal #07

Featuring Evolving Opportunities in Infra Debt by Barings; Credit Updates by TCW; Birth, Death & Wealth Creation by MS; Midyear Update by Neuberger Berman; Natural capital investments by Nuveen.

Hi, Welcome to the new edition of The Valt Journal. In every issue, we cover the best and the latest insights into the global private markets. The Valt Journal is a repository of time sensitive and timeless research, delivered to your inbox every 2 weeks, so you don’t have to look anywhere else! Clicking the headlines is all it takes.

Including a full series of videos on Secondaries, latest perspectives on GenAI meets asset management, infrastructure debt and future of fixed income trading.

We will skip the next edition as everyone breaks for summer, you will hear from us on Sep 3rd next.

REPORTS AND RESEARCH

The Evolving Opportunity in Infrastructure Debt

Barings

In addition to infrastructure debt’s defensive nature, diversification benefits and potential to offer compelling risk-adjusted returns, infrastructure’s “essentiality” underscores its appeal throughout the economic cycle.

The Future of Private Equity and Venture Capital

Preqin, DIFC

Middle Eastern interest in PE & VC is increasing with 65% and 56% of investors in the region seeking to maintain or increase exposure to PE & VC in 2023 respectively. How are family offices evaluating the asset class in the current context?

Global Asset Allocation Viewpoints

Principal Asset Management

Europe is weakening, China is disappointing, and the US is approaching recession. Will alternatives provide important diversification against traditional equities and fixed income in the decelerating inflationary backdrop?

Performance Measurement for Alternative Investments Portfolios

State Street in the Journal of Portfolio Management

Altering the facets of traditional performance measurement framework to handle nuances of alternative assets. What should be the impact where managers control the timing and cashflows, not the investors? Could using money weighted returns be the answer?

Credit Market Monitor 2Q 2023

Morgan Stanley

Higher yielding credit markets led the charge during the second quarter as spreads generally tightened, while government bond markets sold off. Which asset class emerged as the winner?

High Yield Credit Update: A Rising Tide

TCW

High yield bonds have earned attractive returns YTD despite retail funds seeing net outflows of -$11.2 bn during the first six months of the year. Can HY bonds continue to weather the current macroeconomic environment?

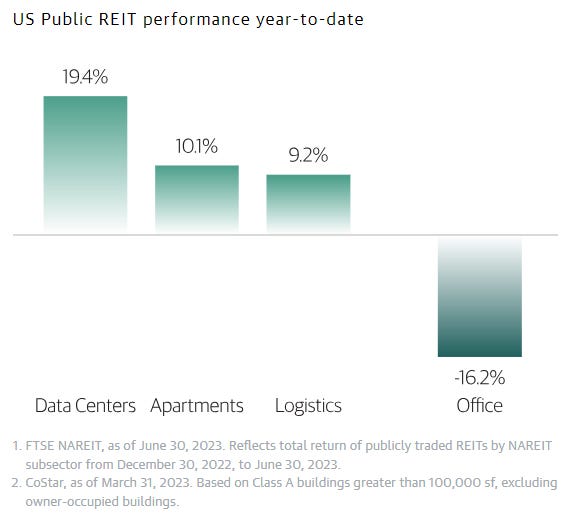

US Real Estate: Fundamentals Under Pressure as Values Correct

Barings

The challenged office property sector continues to deteriorate. Two bright spots: newer buildings have seen positive rates of absorption and the employees coming back to office. Can US Real Estate bounce back?

How do rising interest rates affect natural capital investments?

Nuveen

Recognizing that the impact of higher interest rates on portfolios will vary by sector and investment characteristics, many investors are wondering what the current rate environment means for their natural capital portfolios.

Birth, Death, and Wealth Creation - A different take

Morgan Stanley

Nearly 60% of public companies in the US over the last century have failed to create value. This report examines how companies are born and how long they live, why they die, and patterns of shareholder returns.

ARTICLES

How Asset Managers Can Transform with Generative AI

BCG

This piece explores GenAI’s impacts on performance, security and risks, and offers some practical thoughts on how asset managers can begin their transformation journeys. What is the possible medium-term impact of GenAI on asset management?

Ten for 2023—Midyear Update

Neuberger Berman

Explore the key themes for the second half of 2023, outlined by the top professionals at Neuberger Berman. Do we have a clear winner?

The power of NAV finance

17 Capital

The potential to finance the unrealized value that exists in private equity has huge benefits for funds, firms and for investors. What are the benefits of utilizing NAV finance?

Fixed income perspectives 3Q 2023

Principal Asset Management

Themes, outlook, and investment implications across global fixed income markets.

Q3 2023 Credit Outlook: Opportunity Knocks in Europe

Man Institute

Lower-quality companies may face a refinancing reckoning soon. Companies in Europe appear to be in better health vs their global counterparts. Can Europe outperform other markets?

How Multi-Manager Platforms Find Strength in Numbers

Morgan Stanley

Multi-manager platforms are experiencing a surge in investor interest. Why are these vehicles attracting so many investors and how do they compare with traditional hedge funds?

Private Market Insights – July 2023 Edition

UBS

Quick snapshot of latest trends, drivers and news across private asset classes.

Alt Perspectives

Institutional Investor

Alternatives Have Been ‘Kryptonite’ to Alpha at least for US public pensions generating negative alpha since 2008 while Small, Esoteric Private Equity Strategies Keep Crushing It vs larger peers based on a niche index. Private Credit Outlook isn’t rosy for all, there will be some winners and some losers and Family Offices Are Patiently Watching These Asset Classes for Opportunities – especially real estate and private debt.

The State of Private Equity: A look back at Q2 2023

Juniper Square

Even though investment activity is at pre-COVID levels, it’s dominated by small add-ons. And while fundraising for the middle-market is surprisingly strong, overall, the industry remains stuck. GPs must improve their value-creation techniques to create profitable growth in their companies.

The Hidden Enclaves of Private Wealth

Juniper Square

US states with the biggest populations have the greatest number of high-net-worth LPs. But those investors don’t write the biggest checks. Where is the wealth concentrated in the US?

The AI revolution

Schroders

Financial markets are particularly excited about the application of generative AI to businesses and the productivity gains that can realised. What does it mean for productivity, investing and financial advice?

VC fund stacks

Signature Block

A quick guide to the key tools and applications investors use to run their funds.

Charting it out

Source: Pattern Recognition by Blackstone

PODCASTS, VIDEOS AND INTERVIEWS

Investing Across the Spectrum

PIMCO

Mike Cudzil (Portfolio Manager, Fixed Income) and Jason Steiner (Portfolio Manager, Alternative Credit) discuss the current real estate landscape and what opportunities exist in real estate. (~5 min)

Is the Future of Credit Quantitative?

Man Institute

In this webinar, quantitative credit experts Paul Kamenski and Robert Lam, Co-Heads of Credit at Man Numeric, discuss the revolution in credit trading and what these seismic market changes mean for fixed income investors. (~37 min)

2023 Midyear Private Equity Update

Bain & Co.

Hugh MacArthur (Chairman, Global PE) shares key takeaways from Bain’s 2023 Midyear Private Equity Report. (~53 min)

Asset based private credit

Castlelake and Bloomberg

In this podcast, Evan Carruthers (Castlelake Co-CEO ) covers the trends that are defining the aviation finance environment and how Castlelake approaches consumer financing and how to make strategies adaptable across market cycles. (~57 min)

Q&A with Tom Kerr: Secondary Markets

Hamilton Lane

In this series of interviews, Tom Kerr (Head of Secondary Investments) breaks down the secondary markets into 3 parts: Secondary Market deal activity; insights on the valuations; and the overall landscape.

Thank you for reading The Valt Journal!

Check out our other editions here.

Disclaimer:

The content provided on this platform contains references and links to external sources, including articles, reports, websites, images, or videos. We do not own or claim copyright over the content found in these external sources. The ownership and rights of the content belong to the original creators.

The content, specifically regarding markets, is intended for informational purposes only and should not be construed as investment advice.