The Valt Journal #11

Featuring research from KKR, HSBC on private markets; Adams Street, LGT, Manulife on co-investments and secondaries; Ares, Morgan Stanley, Neuberger Berman, PIMCO on private credit.

Hi, welcome to the new edition of The Valt Journal. In every issue, we cover the best and the latest insights into the global private markets. The Valt Journal is a repository of time sensitive and timeless research, delivered to your inbox every 2 weeks, so you don’t have to look anywhere else! Clicking the headlines is all it takes.

REPORTS AND RESEARCH

📝 The role of alternatives in a new investment playbook

HSBC

The alternative assets AUM is growing steadily and is expected to reach c.$20T by 2026. How do managers make the best of this asset class? This paper provides insights into the various alternative asset classes and the trends in the market.

📝 Dynamic private equity market fueling secondaries

LGT Capital Partners

This paper delves into the challenges faced by PE, showcasing how PE leverages long-term operational improvements to navigate them, highlighting the role of secondaries and other liquidity solutions.

📝 Co-investment advantages boost investor interest

Adams Street

Co-investments are becoming increasingly integral to PE strategies, offering investors direct investment opportunities alongside trusted managers at often-reduced fees. These opportunities address the prevalent concern of illiquidity and offer flexibility and ease of operation.

📝 The case for co-investments

Goldman Sachs

This report details the advantages that a thoughtful co-investment program can bring to a portfolio, for both LPs and GPs, and offers insights into how to successfully execute the strategy.

📝 Mid-life opportunities

Neuberger Berman

The demand for co-investment has surged, transitioning from sporadic opportunities to a central equity capital source for transactions. This report discusses the rise of mid-life deals, emphasizing the importance of due diligence, alignment, and the distinct value they provide.

📝 Private equity discussion note

Norges Bank

A comprehensive overview of PE: Growth of the market, the value creation process, and after cost performance and considerations for prospective investors such as investment costs, potential principal-agent conflicts, and ESG.

📝 US PE report Q3 2023

Pitchbook

Q3 deal value at a 6-year low at $200B leading to a slow quarter for US with lesser exits. Optimism on the fundraising front with mid-market funds leading the fundraises and LBO expected to pick up. Pitchbook report on US private equity market.

📝 Finding equilibrium in public and private credit

KKR

Private credit is solidifying as a staple for investors. Senior secured direct lending is gaining prominence due to its appealing income, which can be enhanced by high-yield strategies or those less correlated to market risks, like asset-based finance or Asia credit strategies.

📝 Specialty Finance: The $20T next frontier of private credit

PIMCO

Allocators' need to diversify their private credit could be met with specialty finance assets offering hard asset backing, diverse return sources, and high cash flow velocity structures.

📝 Ares alternative credit newsletter

Ares

Amid the complexities of the current market, it's vital to critically assess perceptions of risk and conventional wisdom. A quick overview of emerging opportunities in fintech lending and fund finance.

📝 An introduction to alternative lending

Morgan Stanley

P2P or marketplace lending, traditionally funded by individuals, has matured with most loans now backed by institutional investors, including banks. This evolution has expanded the credit risks covered. Will this be an interesting opportunity?

📝 Yield capture

TCW

Investment grade credit spreads showed resilience in September, with spreads trading consistently and yields nearing October 2022's highs. IG credit market valuations appear optimistically priced amid potential challenges like rising credit card balances.

📝 Emerging markets debt monitor

Morgan Stanley

Emerging Market Debt (EMD) markets saw a quarterly outflow of $15B from dedicated-EMD funds globally and witnessed negative performance in all sectors with credit spreads tightened due to the robust US economy.

📝 Asset Allocation Committee Outlook

Neuberger Berman

While the U.S. remains robust due to strong consumer and corporate balance sheets, Europe's growth stumbles. Quality-driven investments are critical with opportunities in U.S. large caps, and Japan with cash emerging as a safe, high-yielding option.

📝 Global real estate viewpoint

Blackrock

While fundamentals remain stable for most property types, office spaces face higher vacancies with UK and European markets correcting the most. Investors should prioritize high-quality real estate, which tends to outperform during the early stages of the recovery.

📝 Q4 2023 commercial real estate outlook: Push or pull

FS Investments

Despite potential reasons for concern, the current CRE market remains steady, offering promising investment opportunities. However, the actual challenges faced don't fully align with the pessimistic expectations that ushered in the year.

📝 Real estate climate risk premium

Natixis

With continuing progress in data and analytical tools, both climate transition risk and physical climate hazards are critical. Managers must focus on quantification of the impact of transition risk and physical climate hazards on European prime real estate returns.

📝 Clean technology and the paradox of progress

Morgan Stanley

Global supply chains present major vulnerabilities, introducing risks like biodiversity decline and human rights violations. Adopting a realistic strategy with robust governance can address these issues, with emphasis on superior ESG performance and enhanced returns.

📝 Investing today in the car of tomorrow

Blackrock

A roster of select private companies that are driving the future of the automotive industry with the next generation technologies focused on low-carbon car of the future.

ARTICLES

✏️ Private equity deep dive

Wellington

A comprehensive yet concise overview of the private equity industry - what is private equity, associated risk-return profile, venture capital vs buyouts, and how it fits into a portfolio.

✏️ Opportunity in the private equity liquidity squeeze

Neuberger Berman

The secondaries market has witnessed significant growth, from $20B annually to $100B+, aligning with the private markets' expansion from $2T to $10T between 2010 and 2022. Why are well-capitalized secondary investors best positioned to target high-quality assets?

✏️ An LP’s guide to a reckoning in private equity

Manulife Investment

PE flourished as returns were strong and fundraising abundant, and everyone was able to grow but this might change now. While some firms will adapt and flourish, others won’t. Minding two megatrends may help alert LPs to discern the difference.

✏️ The definitive guide to venture capital fund-of-funds

Mountside Ventures

A new report by Mountside Ventures reveals and analyses what the largest LP base in Europe, fund-of-funds, looks for when investing in VCs.

✏️ State of private markets Q3 2023

Carta

Carta's preliminary analysis of Q3 data for U.S. startups indicates a modest rise in median pre-money valuations, especially for Series D and E+ rounds. Median round sizes remained consistent, with noticeable growth in Series A.

✏️ The time for private credit is now!

FS Investments

Private lending, especially in areas like commercial real estate and corporate loans, offers strong potential for capital protection and growth. Private lenders with available capital are poised to benefit significantly.

✏️ Understanding the rise in bond yields

PIMCO

The surge in bond yields offers fixed income investors a chance to diversify their portfolios with longer-duration assets that promise high initial yields and potential capital gains. What are the implications and opportunities for investors as bond yields rise?

✏️ Long-term asset funds (LTAFs) and investment trusts

Schroders

LTAFs aim to facilitate investments in long-term, less liquid assets for a broader audience, including retail investors, enhancing access to private markets and giving investors various options to maximize returns and diversify portfolios.

✏️ Bond funds vs individual bonds?

Schroders

Bond funds generally offer wider diversification, flexibility, and cost advantages, while individual bonds come with specific risks and costs. What should investors pick and how to navigate the complexities of bond investments?

✏️ Middle market deal terms at a glance – Sep 2023

The Lead Left

An infographic providing a quick overview of the mid-market deal terms in Sep 2023.

✏️ Insurance companies binged on private credit. Moody’s is a little worried.

Institutional Investor

Insurers have been turning increasingly to alternative asset managers and have invested more in private credit. But the high returns also lead to heightened risks.

✏️ Systematic investing in mortgage-backed securities

Dimensional

Dimensional team explores how systematically constructed MBS and TBA (to-be announced) portfolios overweighting securities with higher expected returns can reliably outperform the market.

✏️ Why economic growth will be less important to long-term returns in real estate

Abrdn

The link between real estate returns and economic growth is being influenced by evolving factors like global capital flows, changing property definitions, and sustainability. Real estate remains a valuable investment, but understanding its evolving nature will be critical.

✏️ European student accommodation: testing the theory

Abrdn

The European student accommodation sector faces a supply-demand imbalance as increasing numbers pursue higher education. While the UK's purpose-built student accommodation (PBSA) market is mature, Europe's is nascent, with a 98% occupancy rate in major cities.

✏️ Decoding impact expectations: Best practices for impact investors & companies

Wellington

The impact investment sector, with over $1T in assets, faces challenges in accurately measuring and interpreting impact data. This paper presents recommendations for impact investors and companies to enhance impact measurement and management.

✏️ Why climate change matters in private markets

Wellington

Climate change is a crucial investment challenge. Companies should develop and maintain thoughtful approaches to building climate resilience into their business models. The focus should be on the various risks, mitigants and the opportunities.

✏️ DLT: How a new technology may revolutionize asset management

Abrdn

Distributed ledger technology (DLT) offers transformative solutions by streamlining operational models, reducing costs, and enabling asset tokenisation. DLT democratises investment opportunities for all investors and enhances liquidity for large asset holders. Can DLT revolutionize the mutual fund landscape?

✏️ Driving growth with usage-based pricing

Permira

Due to advances in generative AI, there's a shift towards usage-based pricing (UBP). This transition offers a model where costs align with actual usage, benefiting both vendors and consumers. What are the benefits and challenges?

✏️ Family offices care less about succession right now. It’s all about returns.

Institutional Investor

A Citi Bank survey suggests that preparing younger generations to lead is less important during down markets as it used to be a top priority of the wealthiest families, who are now focused on one thing: investment returns.

PODCASTS, VIDEOS AND INTERVIEWS

🎥 A world of opportunity

HarbourVest

Simon Jennings of HarbourVest highlights the emergence of evergreen vehicles that offer flexibility, lower entry barriers, and immediate asset exposure.

🎥 The edge in quant investing in credit

PIMCO

Quant investing in credit is an exciting frontier, but success relies on more than just the application of what is known to work well in equities.

🎥 All about secondaries

The Lead Left

A special series on private equity secondaries focusing on LP and GP perspectives: Part 1 and Part 2.

✏️ Q&A with Joe Dowling: Approach in alternative asset management

Blackstone

Joe Dowling (Global Head, Blackstone Alternative Asset Management) talks about alternative asset and how Blackstone offers a broad spectrum of investment strategies, from seeding new investors to acquiring stakes in private investment firms.

In Focus: Technology sector returns by Hg Capital

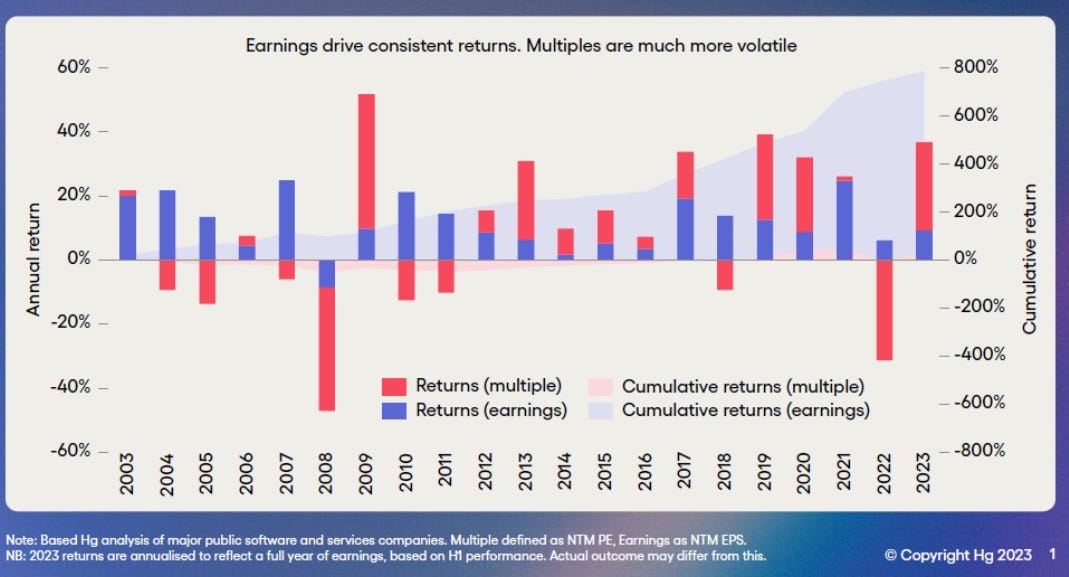

“Across two decades of performance in the software and services industry, we calculate how much of investors’ returns come from multiple (in red, in the chart below) and how much from earnings (in blue). For 19 of the last 20 years, earnings have been positive, which means that the power of compounding has made investors 8x their original investment while multiple contribution has been low.”

Source: Hg Capital

Thank you for reading The Valt Journal!

Check out our other editions here.

Disclaimer:

The content provided on this platform contains references and links to external sources, including articles, reports, websites, images, or videos. We do not own or claim copyright over the content found in these external sources. The ownership and rights of the content belong to the original creators.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.