The Valt Journal #20

Featuring latest research on Private Credit (Blackrock, Barings, KKR, PIMCO); Real estate, Infra, Real assets (M&G, L&W, Abrdn); Alternatives as an asset class (Pantheon, JPM, Partners Group, UBS)

Hi, welcome to the new edition of The Valt Journal. In every issue, we cover the best and the latest insights into the global private markets. The Valt Journal is a repository of time sensitive and timeless research, delivered to your inbox every 2 weeks, so you don’t have to look anywhere else! Clicking the headlines is all it takes.

Check out TVJ Spotlights 🔦 and Charts in Focus 📈

Interesting insight: Where do most family offices source their deals from? Scroll down to find out.

PRIVATE CREDIT x FIXED INCOME

📝 Private Debt: The core middle market

Blackrock

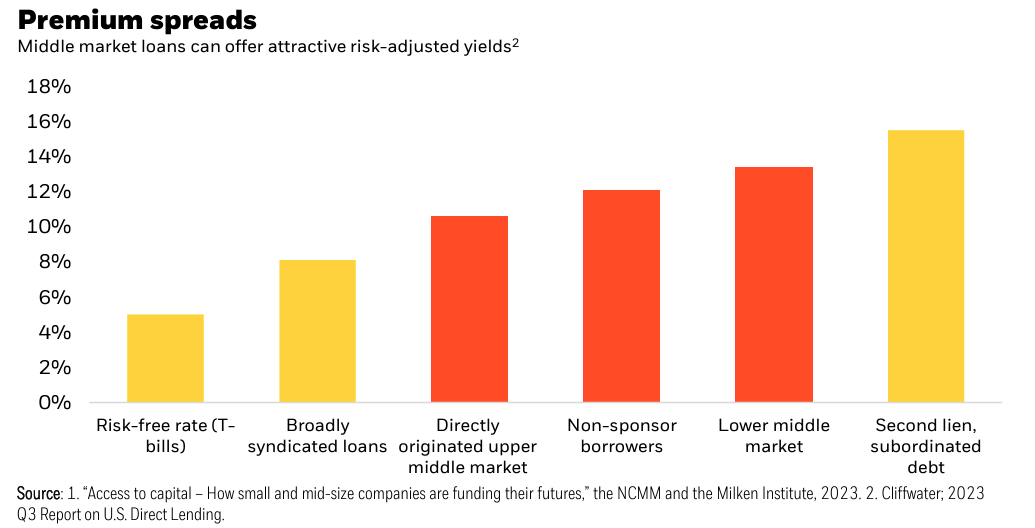

Middle market companies (annual revenues between $10M-$1B), constitute roughly 400K businesses across the US and EU, driving about one-third of each region's GDP and employment. Despite experiencing double-digit growth in revenue and employment during 2022 and 2023, these markets face a significant shortfall in capital and financing options. For firms with $50-100M in revenue, private debt accounts for 40% of their debt, vs 26% for companies with $10-50M in revenues. Compelling opportunities expected in the core middle market segment (annual EBITDA between €10M and €50M in Europe, and $25M and $75M in the US).

📝 Five reasons to consider IG credit in 2024

Barings

Following a challenging 2022, investment grade credit rebounded in 2023 with 9% total returns, against the backdrop of a market that has expanded by 3x since the GFC to $15T. With the Fed likely at or near peak rates and a shift from negative term premiums, it's time for investors to transition from cash to investment-grade credit, leveraging a liquid and diverse market for potential returns.

📝 Five key success factors in the European direct lending market

Partners Group

Private debt's global assets, reaching $1.7T in 2023, are expected to nearly double by 2028, particularly in Europe where the market continues to expand. Success factors include strong local presence, platform-wide coverage to draw upon sector expertise and relationships, focus on mid-market spectrum, discipline to build resilient portfolios across cycles and aligning with key ESG factors.

TVJ Spotlight 🔦

📝 Private credit CLOs: 101

Barings

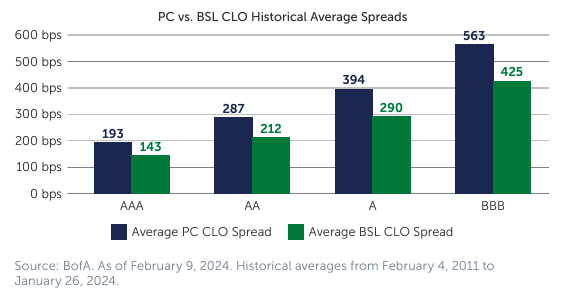

Private credit CLOs, capturing roughly 11% of the $1.3T CLO market and seeing $27B issued in 2023, are drawing significant investor interest with expectations to exceed 30% of total CLO issuance this year, mirroring the broader growth in the $1.7T private credit loan market as companies increasingly opt for non-bank financing alternatives. Private credit CLOs provide a higher spread vs broadly syndicated loan (BSL) CLOs, have higher subordination and, historically, have seen lower default rates.

✏️ Private junior debt: The intersection of syndicated and private corporate credit

KKR

A hybrid approach combining syndicated senior and private junior debt is emerging, filling gaps and offering benefits to both investors and issuers as market conditions evolve. Best-in-class companies that trade at premium multiples may run into a gap in capital structures between the amount of senior debt available and the quantum of equity a rational shareholder can or will invest to capture an “equity-like” return. Often, private junior debt will be the best way to fill this gap.

📝 EM debt: The benefits of a blended approach

Barings

Emerging markets debt represents a diverse investment landscape with opportunities across sovereign hard currency, corporate credit, local interest rates, and currencies, comprising 23% of global GDP. Despite common misconceptions, this sector offers significant value, especially as most EM sovereign and corporate debt markets are investment grade, challenging the perception of high risk.

✏️ Asset-based finance: A credit check on the consumer

KKR

US homeowners with strong credit scores have shown financial resilience amid high inflation and rising interest rates, presenting prime consumer lending opportunities, especially as banks retract from this sector. The improving economic outlook increases the appeal of high-quality consumer credit for private lenders as banks divest from these assets. Pockets of opportunity to lend: home improvement loans, loans for RVs, solar panel loans; in all cases for prime borrowers, where demand is driven by current economic conditions, and loans tend to be high priority for borrowers.

✏️ Prudent execution in private credit is key for 2024

Goldman Sachs

Success in private credit hinges on deploying capital to high-quality companies, particularly in health care, software, and renewable energy sectors, despite challenges such as the increased cost of debt for borrowers and the need for prudent, experienced management to navigate complex market conditions and maintain credit underwriting standards.

✏️ Term premium poised to rise again, with widespread asset price implications

PIMCO

Investors typically expect higher returns for higher risks - longer maturities usually offer greater yields to compensate for increased uncertainty. However, the current inverted US yield curve defies this logic, suggesting an impending correction possibly through Federal Reserve rate cuts or a resurgence of the term premium, historically diminished since the financial crisis.

✏️ Disintermediation and market repricing create opportunities in alternative credit

AXA Investment Managers

As markets adjust to higher yields, reduced liquidity, and increased volatility, opportunities arise for alternative lenders, particularly in commercial real estate debt, with market repricing offering attractive entry points. Success will depend on careful credit selection, active risk management, and diversification into uncorrelated asset classes within alternative credit.

✏️ A favorable starting point for Emerging Market debt?

M&G Investments

EM bonds show promising prospects for continued strong performance into 2024, though selectivity is crucial due to potential election-induced volatility. Despite the dampening of opportunities in high-yield and distressed credits after significant gains in 2023, the outlook remains optimistic, with carry expected to play a more significant role than capital appreciation.

✏️ Why private credit is the alternative asset class everyone covets

Wealth Management

Private credit is valued by investors for its current income, lower volatility, and higher yields in a high-interest rate environment, with a survey revealing 98% of financial advisors already investing in it, and a significant portion planning to increase allocations. Despite private equity's popularity, private credit's appeal is growing, especially for income-seeking wealth management clients.

🎥 More than just a moment in time for private credit (Blackstone)

🎥 Asset-Based credit: The post-bank era (TPG)

🎥 High-quality credit opportunities (PIMCO)

🎥 Unlocking the power of private credit (PIMCO)

🎥 Aviation finance: Capturing opportunities in private credit (PIMCO)

🎥 The rise of credit risk sharing (Man Institute)

PRIVATE EQUITY

TVJ Spotlight 🔦

📝 Public PE and GP deal roundup

Pitchbook

Deal volume for GP franchises rebounded in Q4 2023 with a surge in strategic deals, while GP stake funds saw a decrease in activity, reflecting a need for fundraising stability. Meanwhile, overall fundraising declined by 15% in 2023, despite a strong Q4, and perpetual capital sources grew to 42% of total AUM, emphasizing a shift towards more permanent capital pools for fee-related earnings growth. Median gross PE returns stood at 10% in 2023.

✏️ Meet us in the middle market: An engine of growth

FS Investments

The US middle market, a key economic engine, represents a third of the private sector GDP, employing about 48M people, and has seen sustained double-digit growth in revenue and employment for three years. With its diversity across crucial sectors and predominantly private ownership, it offers unique investment opportunities despite access challenges.

✏️ Next in private equity: Strategic industry trends in 2024

PWC

Portfolio companies faced challenges in growth and value creation due to rising interest rates and management turnover, prompting a shift back to fundamental strategies and careful cash management. To navigate these challenges in 2024, companies are focusing on digital transformation within specific subsectors to drive value creation, despite increased operational costs and liquidity pressures, leveraging tech for faster and cost-efficient implementations.

✏️ Mega PE’s exit woes trickle down to smaller buyouts and endowment investors

Institutional Investor

More focus on lower middle market buyouts now even though the sector is facing challenges due to mega private equity funds not purchasing, leading to a market slowdown. Despite a 28% decrease in private equity exit volume, there is a continued interest on this segment due to less competition and potentially easier returns.

✏️ A compelling growth opportunity in private equity secondaries?

FS Investments

PE AUM has surged, leading to a demand for a more robust secondary market to address liquidity needs, with PE secondary funds outperforming the broader PE universe thanks to strong portfolio performance and attractive pricing. These funds also offer a low correlation with traditional investments and provide a diversified entry point into private equity, benefiting from countercyclical attributes during market volatility.

🎙 The key to persistent performance with TPG’s Jim Coulter (Bain)

SECTOR FOCUS

📝 US real estate: Positioned for recovery

Barings

Core real estate values have declined for six consecutive quarters by 20%, with transaction activity poised to increase in 2024 despite ongoing inflation uncertainties and a reduced US recession probability from 65% to 50%. Real estate debt distress, particularly in office and multifamily sectors, along with a 41% yoy drop in transaction activity and a 44% fall in public REIT share prices since the end of 2021, indicate continued market adjustments ahead.

📝 European real estate: The fight back begins!

Barings

The Eurozone narrowly avoided a technical recession in the latter half of 2023, with minimal GDP growth due to tight monetary conditions affecting consumer and investment spending, especially in Germany. A gradual economic recovery is expected in the real estate sector later in the year, supported by inventory restocking and improved household purchasing power as interest rates drop and wages increase.

✏️ Real estate credit: Gear up for the year of transactions

KKR

2023 marked a year of muted commercial real estate activity due to macroeconomic uncertainties and rising interest rates leading to property value declines and reduced transactions. Looking ahead to 2024, it's anticipated to be a year of increased transactions, offering opportunities for well-capitalized lenders in a market adjusting to higher interest rates and cautious lending practices. KKR notes, that in some situations, “possible to lend at a significant discount to replacement cost and often at 50% of peak valuations, while earning low-to-mid teens gross returns on mezzanine-like exposure at loan-to-value ratios near 65%. In other words, it is possible to earn equity-like returns at a favorable position in the capital structure, and the scarcity of debt capital in the market means that these conditions should persist”

TVJ Spotlight 🔦

📝 Global living in focus: Opportunities in housing a generation

M&G Investments

Globally, the chronic underproduction of housing in developed economies has led to a supply-demand imbalance, driving up house prices and rents and making home ownership increasingly elusive for many, particularly the younger generation. The rental market, now a more common path, is fraught with challenges, including lengthy waiting times for affordable housing and significant rent hikes.

📝 Strong tailwinds keep infrastructure debt on course

Barings

Barings has invested $19B in its infrastructure debt business since 2013. Energy transition and digital infrastructure are key growth drivers. The need for private sector funding of essential works by cash-strapped governments, along with the sector's inherent resilience, has bolstered infrastructure debt as a robust asset class.

✏️ Data centers: The hubs of digital infrastructure

KKR

In 2024, the world is expected to produce 1.5x times more digital data than two years prior, driven by cloud migration and the rise of artificial intelligence. Data centers, evolving with technologies like AI and the internet of things, are crucial digital assets, akin to utilities of the digital age, supporting the surge in data production and the digital economy's entire value chain. Evolving market dynamics, for example: data centers focused on AI training may be in more remote locations as these data centers need enormous amounts of computing power, but have a lesser need to be close to large population centers than a data center used in cloud computing. Edge data centers, which are located near the enterprises they serve, could become more prevalent. However still growth still expected around the major metropolitan areas.

✏️ Real assets: Bolstering portfolios as inflation lingers

PIMCO

As developed market central banks may have ended their rate-hiking cycles, the importance of crafting portfolios resilient to various inflationary outcomes is underscored, including the strategic inclusion of real assets like TIPS (Treasury Inflation-Protected Securities), commodities, and gold. This approach not only significantly improves a portfolio's ability to hedge against inflation but has also been shown to enhance performance and reduce volatility during both high and mild inflationary periods. With TIPS near their most attractive valuations in 15 years and commodities still buoyed by geopolitical factors and supply constraints, investors could potentially benefit from an inclusion of real assets (in the range of 5% to 30%).

TVJ Spotlight 🔦

✏️ Extracting the best from natural resources

Man Institute

In the face of cyclical and secular challenges, natural resource investments—spanning agriculture, oil and gas, and metals—offer essential diversification benefits, including inflation hedging, low correlation with other asset classes, unique supply-demand dynamics for alpha generation, high liquidity, and volatility protection, underscoring their value in a well-rounded portfolio.

✏️ Responsible investing 2.0: Focus on generating sustainable returns

Nuveen

Amid debates over sustainable investing's impact on returns and societal benefits, challenges persist due to inconsistent ESG metrics and the scarcity of data. However, focusing on measurable investment themes like energy transition, inclusive growth, and corporate governance can influence financial performance and offer a viable approach to aligning equity investments with long-term sustainable trends.

✏️ The solar coaster: Twists and turns of an evolving investment opportunity set

Nuveen

To achieve decarbonization goals, US must increase its grid capacity by 57% by 2035, necessitating annual clean energy generation additions of 58–115 GW through 2050. This expansion, highlighting a significant investment need of $200B–$500B annually, is complemented by the growth of supporting infrastructure like energy storage and the onshoring of supply chains amidst challenges of rising costs and grid intermittency.

✏️ Asia opportunities amid global slow-growth environment

Abrdn

Investors are gravitating towards "quality" companies with strong fundamentals and exploring value in non-US markets, fixed-income opportunities, and alternative assets, including listed private equity at significant discounts, reflecting a strategic approach to long-term investment.

✏️ Income strips for insurers: A natural fit?

M&G Investments

Amidst higher interest rates prompting UK defined-benefit pension schemes to explore de-risking options, the resulting reduced demand for private assets like income strips opens up attractive opportunities for other institutional investors, especially insurers, given their high quality and inflation-linked returns. These assets, backed by prime real estate, offer an alternative source of credit risk and illiquidity premium.

🎙 All you need to know about 'transition finance' (Robeco)

🎙 Real estate secondaries (Stepstone)

🎥 Real estate: Resilience & reacceleration (Blackstone)

🎥 The evolution of institutional real estate (Juniper Square)

PRIVATE MARKETS AND ALTERNATIVE ASSETS

📝 Three key themes for private markets in 2024

Pantheon International

Key themes include: intensified focus on manager and asset selection due to ongoing financing pressures and increase in performance dispersion; increased dealmaking driven by high levels of dry powder and a recalibration of new deal valuations; compelling secondary market opportunities amidst sustained liquidity demands.

✏️ 2024 alternatives outlook

JP Morgan

Alternatives continue to offer significant benefits for long-term investment strategies, including diversification, volatility reduction, inflation risk mitigation, and the potential to enhance both absolute and risk-adjusted returns. [Paywall]

TVJ Spotlight 🔦

📝 Global wealth investment playbook

KKR

In 2024, an elevated stock-bond correlation is anticipated due to continued performance in fixed income amidst disinflationary trends and higher yields, with public equity growth slowing and cash offering attractive returns amid reinvestment risks. The persistence of ‘tectonic shifts’ and policy dynamics suggests a long-term regime of higher inflation bias and volatile rates, underscoring the importance of private market alternatives.

📝 You can’t control the cycles, but you can control your nerves

Partners Group

Partners Group debunks the notion that private market investments underperform during periods of economic uncertainty and market volatility, which paradoxically may offer the best opportunities for strong returns due to reduced investor activity. Flexible investment strategies and continuity in investing during these times can enhance portfolio performance and stabilize distributions.

📝 The appeal of private assets in 2024

Nuveen

Despite expectations of sustained elevated interest rates and inflation in 2024, private market assets such as infrastructure, private credit, real estate, and natural capital offer promising risk-adjusted returns, diversification, and inflation hedging, bolstered by policies promoting energy security and low-carbon transitions. Experienced managers are poised to expand access to these benefits for private investors through innovative investment vehicles.

📝 Engagement blueprint

Schroders

The Engagement Blueprint by Schroders' provides a guide to generate positive outcomes and long-term financial performance across a firm’s diverse private asset investments.

✏️ Relief for understaffed LPs: The operational benefits of SMAs

HarbourVest

LPs grappling with administrative burdens amid market slowdowns find relief in separately managed accounts (SMAs), which streamline private market investing through customized solutions addressing cash flow, capital calls, and legal, and tax structuring challenges. HarbourVest leaders highlight SMAs as an effective remedy for operational hurdles faced by resource-constrained LPs.

✏️ Private markets insights – February 2024

UBS

Two sub-segments of private credit with high relative and absolute return potentials driven by supply-demand imbalance: 1) short duration homebuilder (acquire and develop bridging mortgages yielding 15-20% unlevered IRRs, recourse land banking loans yielding 12-14%), 2) Reinsurance / Insurance Linked Strategies (Cat bonds offer loss-adjusted net yields of approximately 11%). Real estate: Despite a 16% drop in global transaction volumes in 2023, a 43% increase between Q3 and Q4, led by APAC and Europe, signals potential stabilization, with real estate values expected to begin recovering by mid-2024, except for the Office sector. Infrastructure: 2023 was challenging for private infrastructure, as fundraising fell by 35% and transaction volumes fell by 20%, but 41% of investors are looking to deploy capital into the asset class.

✏️ Private assets for the masses

UBS

Democratization of PE with the rise of semi-liquid structures offering tailored solutions for private investors and a notable increase in ELTIFs, coupled with improvements in the administrative and operational processes, have streamlined investors' experience, highlighting the current opportune moment for diversifying into private equity, especially through secondaries.

✏️ Family offices plan material increase to private markets

FS Investments

A survey of family offices indicates a strategic pivot towards private and alternative investments, reducing cash and public equities allocations in favour of private equity and credit for their yield premium and growth potential with limited market correlation.

✏️ But why do family offices have little interest in alts platforms

Institutional Investor

Alternative assets focused platform like iCapital and competitor CAIS attract little interest from the wealthiest private investors and single-family offices, with a Fidelity survey showing 72% family offices prefer to source from their direct networks vs these platforms.

✏️ Could 2024 be a big year for tokenization within wealth management?

Fintech Global

With the SEC's approval of Bitcoin ETFs and growing interest in tokenizing real-world assets, 2024 is poised to see an influx of institutional capital and further market evolution, suggesting a maturing, more regulated landscape that could attract a wider investor base seeking portfolio diversification and innovation.

Thank you for reading The Valt Journal!

Check out our other editions here.

Disclaimer:

The content provided on this platform contains references and links to external sources, including articles, reports, websites, images, or videos. We do not own or claim copyright over the content found in these external sources. The ownership and rights of the content belong to the original creators.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.