The Valt Journal #22

Featuring latest research on Private Credit (Blackrock, TPG, KKR, Amundi); PE (Bain, HSBC); Real estate, Infra, Energy (BCG, Wellington, Abrdn); Alternatives as an asset class (Nuveen, Allvue, Preqin)

Hi, welcome to the new edition of The Valt Journal. In every issue, we cover the best and the latest insights into the global private markets. The Valt Journal is a repository of time sensitive and timeless research, delivered to your inbox every 2 weeks, so you don’t have to look anywhere else! Clicking the headlines is all it takes.

Check out TVJ Spotlights 🔦 including 1) CLO liabilities: Carry, diversification, and mitigating default risk for credit portfolios (by KKR); 2) How private credit can drive the net zero transition (by LGIM); 3) Infrastructure secondaries: Riding the tailwinds (by HarbourVest)

PRIVATE CREDIT x FIXED INCOME

TVJ Spotlight 🔦

📝 Private debt: Exploring the nuances

BlackRock

BlackRock’s primer projects the global private debt market to grow to $3.5T by 2028 from $1.7T in 2023, spurred by diverse investment strategies like direct lending which forms 46% of the private debt market. Despite the potential easing in monetary policies, the high capital cost environment will remain, emphasizing the significance of strategic investment choices and market evolution in a competitive landscape. Dispersion across the broader private debt market will continue to play an important role, majorly driven by three elements: a. Strategy: capital structure seniority, investment goals and situational complexity; b. Portfolio: areas of lending focus, including sector selection and company size; and c. Vintage: broader macroeconomic environment, risk asset valuations, and overall opportunity set.

TVJ Spotlight 🔦

📝 Awakening: The rise of private debt

FS Investments

Modern private debt market, now valued at $1.6T, spurred by banks retracting from non-core lending post-GFC, benefits investors, borrowers, and the broader economy by offering tailored capital solutions and diversifying investment opportunities with superior risk adjusted returns.

TVJ Spotlight 🔦

📝 Asset-based credit in 2024: The fundamental story

TPG

The summary discusses banks' ongoing de-risking, which creates opportunities for investors in specialty private credit, particularly in offloading non-corporate debts like real estate and consumer debts. Loan sales present opportunities to pick up distressed assets at attractive prices, with the office sector available at deep discounts with better visibility ahead. Restricted loan origination will lead to tighter credit availability but better performances of consumer debt vintages. The paper underscores the importance of expertise in underwriting these assets and anticipates the trend's persistence.

📝 Global fixed income views

JPMorgan

JPMorgan’s current economic outlook favors ‘sub trend growth’ as the most likely scenario at a 70% probability, reflecting signs of a soft landing and broadening economic expansion. Persistent inflation and potential election-related volatility remain key risks. Their investment focus prioritizes credit, with a preference for high-yield bonds, leveraged loans, and select debt instruments in both developed and emerging markets.

✏️ Decision time

Morgan Stanley

February saw global yields rise as markets dialed back expectations for near-term rate cuts, with the Fed's easing anticipated later in the year, bolstering the dollar. The resilience in credit markets, with tightened spreads in high yield and investment grade sectors, underscores a strategic focus on quality bonds and prudent credit investments amidst an evolving rate landscape. Analysts predict a shift in securitized credit performance. After a strong 2024 driven by spread tightening, spreads are expected to stabilize near agency MBS levels. This suggests future returns will come from interest payments rather than narrowing spreads. While residential mortgage credit remains favorable, with analysts comfortable taking on some risk in that sector, lower-rated consumer and commercial real estate securities are viewed with caution due to potential borrower stress from current interest rates. Agency MBS valuations are considered fair historically, but further spread tightening is seen as unlikely in the near term.

✏️ Shocking bonds: Evaluating advisor fixed income portfolios

PIMCO

The outlook for bonds is positive, with the highest starting yields in over a decade and expected Federal Reserve easing. Despite previous volatility and cautious advisors, current yields offer a strong entry point and resilience against rate increases, with multisector bonds potentially yielding a healthy 6% return if rates stabilize, and even higher returns across sectors if rates fall.

📝 Credit markets in focus in 2024

Amundi

Credit markets, resilient in 2023, promise stronger returns in 2024 bolstered by expected rate cuts. “2023 saw euro (EUR) HY default rates remain low and below the long-term median, closing the year at 3.5% on an issuer basis and only 1.3% on a par-weighted basis according to Moody’s data. In the US, the upward trend pushed default rates to 5.5%, but these defaults were almost entirely represented by the lowest-rated CCC names, which reached 9%, while both B and BB-rated names remained flat. There are many reasons to explain this benign cycle, especially for higher-quality issuers.” Attractive Eurozone investment grade valuations and robust high-yield fundamentals combine with a growing green bond market to offer diverse, impactful investment prospects. Amundi expects “slightly higher defaults through 2024, albeit to levels close to long-term averages and mainly affecting low-rated names and SMEs.”

✏️ Agency MBS key questions for 2024

Wellington Management

Agency mortgage-backed securities saw dramatic shifts in 2023 but present significant value into 2024 due to improved valuations, technicals, and fundamentals. Anticipated Fed rate cuts and the easing of quantitative tightening are expected to redirect money market funds towards MBS, with banks likely to increase MBS purchases in response to lower short-term yields.

✏️ European private credit: A permanent place in the toolkit

KKR

Private credit's role in European financing transactions surged from 27% in 2020 to 56% by 2023, driven by the closure of syndicated markets, which are now reopening. Despite the potential shift back to cheaper syndicated markets, private credit remains vital for its financing certainty and flexible structures, marking its permanence alongside public credit markets.

✏️ CLO liabilities: Carry, diversification, and mitigating default risk for credit portfolios

KKR

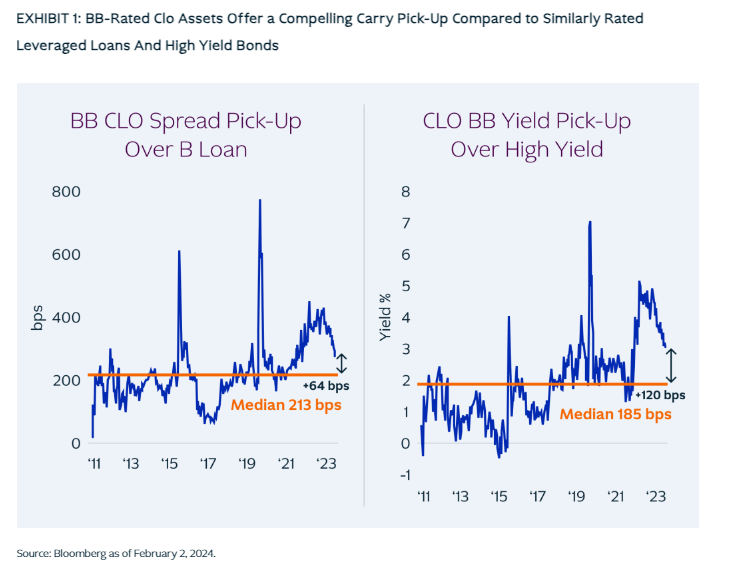

Market consensus anticipates interest rate cuts from the US Fed and ECB, prompting a shift towards portfolio duration. To hedge against potential delays or lesser cuts, a barbell strategy combining high-yield bonds and leveraged loans, alongside adding CLO debt for its attractive carry, protection against defaults and diversification benefits, is recommended. CLO debt has very low correlations with US Treasuries and only moderate correlations with high yield bonds, particularly the higher-rated bonds. While the correlations between CLOs and leveraged loans are slightly more elevated, they are lower than those between high yield bonds and leveraged loans

✏️ The disintermediation of lending

UBS

The banking sector's recent stresses have hastened the move from traditional bank lending to private debt, with institutional investors filling the gap and private debt on track to hit $2T by 2027. This shift, coupled with bank regulations, opens opportunities in sectors like commercial real estate, though it requires caution due to unconventional underwriting and increased leverage. “While the US leads in the private debt market, Europe and Asia also show promise, albeit with regional differences in banking focus and regulatory frameworks.”

📝 The roundup - Key takeaways from Oaktree’s quarterly letters

Oaktree

Despite continued market optimism for near-term interest rate cuts, Oaktree highlights a "lifta-thon" in leveraged credit markets, cautioning investors against complacency as high-yield bond spreads hit a two-year low. They argue interest rates are unlikely to drop as quickly or significantly as expected, suggesting a focus on opportunistic credit and rescue financings, which offer high yields and strong risk/reward profiles amid ongoing balance sheet challenges for many companies. Oaktree favors asset-based finance as “ABF investors are typically able to recoup a substantial portion of their capital in a timely fashion, even in the absence of a refinancing.”

✏️ Is there opportunity for high yield in today’s new economic era?

Wellington Management

High-yield investors face a challenging environment, yet higher all-in yields and a quality-focused high-yield universe present emerging opportunities, especially in Europe. Active security selection and sector discernment are key as private credit growth and macroeconomic uncertainties redefine investment landscapes.

✏️ Credit maturity wall: Not as difficult a climb as it may seem

Principal Asset Management

Fears of a spike in defaults due to higher refinancing costs from the Fed's recent rate hikes are mitigated by a resilient economy and a credit space skewed towards higher-quality issuers, suggesting that most companies will manage the debt maturity challenge, with rate cuts and strong balance sheets aiding this process. However, lower-quality segments may still struggle, highlighting the need for careful management.

📝 Unveiling the value of EM debt

Amundi

Emerging Markets Debt is recommended as a core portfolio allocation due to its favorable macroeconomic outlook, significant growth, and transformation, offering attractive yields and diversification benefits. The asset class has matured, showing resilience and providing a variety of opportunities with its expansion in market size, number of issuers, and especially in local currency debt, underscoring the importance of thorough research and active management in this dynamic landscape.

✏️ Why we think you can’t rely on mean reversion for credit investing

Abrdn

Mean reversion is a strategy used in bond funds to buy undervalued bonds and sell overvalued ones based on historical data. While analysis by Abrdn shows mean reversion can be effective, it's not foolproof, since it might not consider issuer fundamentals, which is why mean reversion shouldn't be the sole strategy. Skilled analysts who consider issuer fundamentals alongside historical data are key to making sound investment decisions.

✏️ High yield floating rate notes: Prospects in the next stage of the cycle

M&G Investments

Global high-yield floating rate notes performed strongly in 2023 amid economic uncertainty, inflation, and interest rate hikes, fostering cautious optimism for a potential soft landing in 2024 despite geopolitical concerns. With inflation declining and interest rates stabilizing, strategic allocation to defensive market segments is advised to navigate the anticipated ongoing rate volatility.

TVJ Spotlight 🔦

📝 How private credit can drive the net zero transition

LGIM

The transition to net zero will necessitate trillions in investment across various sectors and geographies, predominantly in private markets. Private credit, already active in financing transition assets, offers investors a chance to invest at scale, diversify risk, and secure potentially attractive returns by filling funding gaps in the expanding and evolving landscape of the net zero transition.

✏️ Evaluating labelled bonds: a robust framework is key

Wellington Management

The sustainable debt market, with over $4T outstanding, captured 16% of 2023's total global issuance as pressure for sustainable finance grows. Despite a dip from 2021's peak, sustainable debt's share of the fixed-income market is rising, with sovereigns leading but corporates, particularly financials, gaining ground.

🎥 Today’s historic opportunity in actively managed bonds (PIMCO)

🎙 The long-term megatrend of European private asset-backed finance (M&G Investments)

🎙 Algorithmic Advantage – Systematic investing in credit (Man Institute)

PRIVATE EQUITY

TVJ Spotlight 🔦

✏️ How private equity can thrive with elevated interest rates

KKR

Despite concerns that higher interest rates may dampen private equity returns, four key reasons—historically average rates, lower leverage levels, the ability to leverage inflationary shocks, and a focus on value creation—suggest private equity can continue to deliver compelling returns in an environment of elevated rates.

📝 Pondering performance

UBS

The secondary market is witnessing robust demand for liquidity and higher quality deals, with a clear market bifurcation favoring transactions that demonstrate strong operational value creation, sector focus, and alignment of interest among all parties. GP-led secondaries are distinguished from co-investments by their unique dynamics and the substantial capital contribution by GPs, signaling strong conviction and alignment. As per UBS, “a lack of full exits means it is too soon to say how well this latest generation of GP-led secondaries will fare, but the ingredients for success are all in place.”

✏️ Follow the money: The real story behind buyouts’ big year

Bain

In a challenging fundraising environment, buyout funds stood out by attracting $448B, an 18% increase year-over-year, despite the overall private capital hitting its lowest since 2018. While the average fund size reached a record $1.2B, the number of funds closing saw a significant decline. The top 20 funds captured over 50% of the buyout capital raised. Key success factors include: setting a growth ambition with a clear view on where capital is likely to come from; understanding LPs need for a differentiated value proposition; using data to segment LPs and create campaign strategies; along with building a team with the right capabilities to deliver results.

TVJ Spotlight 🔦

📝 Technology: a high conviction private equity playbook

HSBC Asset Management

HSBC advocates for investments in technology private equity, offering insights into market context, key industry sub-sectors, trends, outlook, and their approach to selecting high-conviction managers. B2B software, cybersecurity, and IT services offer compelling opportunities for private equity GPs to benefit from high ROI, mission critical products with recurring revenues, low customer concentration, good unit economics combined with growth and profitability potential.

✏️ Private Equity: Understanding the macro opportunity

JPMorgan

The decline in the number of companies going public has led to many staying private longer, experiencing substantial growth before considering public listing. Private markets offer diverse opportunities and allow investment in flourishing companies, with 85% of US companies over $100M in revenue remaining private. Private equity managers contribute to the growth of young companies through operational and strategic enhancements.

✏️ The private equity market has stalled — And there’s no easy fix

Institutional Investor

Private equity is grappling with a unique crisis, holding $3.2T in assets without exit plans amid a market downturn, worsened by sharp rate hikes, without anticipated Fed intervention. Bain's report highlights a significant drop in deal and exit values, comparing the current climate to the post-2008 financial crisis yet noting its unprecedented nature.

SECTOR FOCUS

Energy Transition x Climate Finance

✏️ A blueprint for building climate-aware multi-asset portfolios

Wellington Management

A new framework developed by Wellington aims to integrate climate change effects into multi-asset portfolios through strategic asset allocation and climate-aware investment options. This approach emphasizes understanding transition and physical risks, optimizing asset allocation with climate metrics, and implementing specific strategies, culminating in a seven-step blueprint for climate-aware asset owners: 1. Create a comprehensive strategy for transition risks and opportunities; 2. Create a strategy for physical climate risks and opportunities; 3. Integrate top-down approaches; 4. Establish criteria for special cases of active management; 5. Design an engagement strategy; 6. Understand how incorporating climate impacts other portfolio objectives; 7. Create a feedback loop to incorporate the latest science, data, and calculation methodologies.

✏️ Sustainability signals: Gray to green, education, healthcare, financial inclusion

Goldman Sachs

Global investment in the energy transition surged to a record $1.8T despite geopolitical tensions and macroeconomic challenges including rising interest rates and inflationary pressures. Sustainable investment funds saw assets under management globally reach an all-time high of nearly $3.7T. Investment in low-carbon and inclusive economic solutions is on the rise, with a focus on measuring actual change at the company level to identify sustainable winners. Despite challenges, the promising economics of sustainability and supportive factors like potential rate cuts are expected to propel sustainable investing forward. The focus on inclusive growth, heightened in 2023 by the cost-of-living crisis, is driving new technology solutions and creating attractive social-impact opportunities.

✏️ The charging challenge: Investing in the decarbonization of transportation

KKR

Electric and hybrid vehicles, now leading in global energy transition spending at $634B in 2023, are anticipated to dominate investment in this decade with $1.8T annually. Amidst this megatrend, investing in essential tools and services like charging infrastructure, rather than directly in manufacturers, could offer stability and returns, especially for ventures serving emissions-targeted organizations and governments.

TVJ Spotlight 🔦

✏️ Nature is banking’s next opportunity

BCG

Banks face new reporting requirements on nature-related risks and opportunities, offering a lucrative business opportunity. With an estimated $1.2T needed annually for nature-related investments, banks can generate up to $250M in extra revenue. Despite challenges like long timelines and regulatory limitations, leaders should focus on understanding risks, collaborating, and incentivizing private investments.

✏️ Carbon markets: A risk assessment for institutional investors

Man Institute

The paper addresses investor concerns about navigating complex carbon markets by developing a risk assessment framework, and evaluating financial, structural/regulatory, and reputational risks using a traffic light system. It examines major compliance carbon markets in Europe and North America, the voluntary carbon market, and alternative carbon trading methods, providing insights into carbon markets as investment opportunities for institutions. “As it stands the Voluntary Carbon Market, valued at $2B, is fragmented, unstandardised, and largely unregulated.”

✏️ From legislation to consolidation: navigating the future of green finance

Natixis

The report highlights the importance of banks' ESG profiles and climate strategies, the need for regulatory consolidation, standardization of green loan criteria, and the utilization of the EU taxonomy for sustainable activities to promote transparency and comparability in green finance. Additionally, it discusses the necessity for financial institutions to adapt their practices to evolving regulatory landscapes and to develop robust internal ESG frameworks to contribute meaningfully to the journey to net-zero emissions.

📝 US EV sales need a boost

Northern Trust

The gradual and long adoption cycle of air transport and related technology, parallels the current slow adoption of electric vehicles (EVs) amid range anxiety and infrastructure challenges. Despite high owner satisfaction, EV market penetration is hindered by nascent charging networks and consumer skepticism, underscoring the need for expanded infrastructure to support widespread adoption.

✏️ Planting the seed of change: real estate's role in the nature crisis

Abrdn

Since 2020, the focus has been on mitigating climate risks and decarbonizing real estate portfolios while also expanding to broader environmental and social issues like biodiversity, acknowledging the interdependence of nature and climate crises. “Real estate provides the unique opportunity to have a positive impact at the construction phase of a building, particularly in terms of design. This may involve maintaining existing green areas or improving habitats that are in poor condition. But it can also have a positive impact in the post-construction phase, by implementing green infrastructure.”

Real Estate x Infrastructure

TVJ Spotlight 🔦

📝 Private real estate debt: Out with the old and in with the new

Principal Asset Management

The downturn in commercial real estate valuations and the banking sector's reduced direct lending are opening opportunities in real estate debt, emphasizing the need for investors to pivot from legacy strategies with heightened risks due to past valuation declines and high LTVs to newer strategies that leverage the reset credit cycle and increased private lending.

✏️ Opportunities in the US multifamily housing sector

Principal Asset Management

The US multifamily housing sector faces challenges with overdevelopment, lower transaction volume, and declining values, yet offers investment opportunities due to strong underlying macroeconomic fundamentals and steady demand, particularly from younger generations renting longer. Well-capitalized investors could benefit from distress opportunities in this market over the next 12-18 months, aiming for exits as capital values recover in three to five years.

✏️ Infrastructure secondaries: Riding the tailwinds

HarbourVest

Private infrastructure, surpassing $1T in AUM since the 1990s, is seeing a rise in secondaries as GPs seek to extend asset ownership beyond fund lifespans, offering LPs liquidity solutions. This market's growth, coupled with a capital shortage, presents buyers with high-quality investment opportunities at favorable terms, highlighting the strategic value of secondaries in infrastructure portfolios.

✏️ The case for infrastructure

Abrdn

Amidst global macroeconomic challenges, infrastructure investment presents a unique opportunity for stable, long-term returns driven by urbanization, the energy transition, and the digital revolution. With essential services in transportation, communication, utilities, and energy crucial for societal functioning, infrastructure investments are poised for growth, offering diversification and resilience against market volatility.

🎥 Real Estate: the refinancing headache? (Natixis)

Artificial Intelligence x Technology

📝 On the cusp of a productivity boom?

BNY Mellon

Generative AI could ignite a new industrial revolution by automating and enhancing tasks previously untouched by innovation, potentially leading to substantial productivity growth despite historical periods of stagnation. This advancement, akin to major technological shifts like the steam engine and computers, offers optimism for productivity amidst a tighter labor market and higher interest rates. However, as per another BNY study on ‘AI equity impact: Already irrational?’, the impact of AI on productivity and the market is just starting to be realized, with expectations of a significant S&P 500 rally driven by AI adoption, yet not fully priced into current market valuations. While recent gains suggest robust forward returns without extreme valuations, the historical trend of innovations leading to market bubbles signals a high probability of such an outcome with AI. However, AI could still bring impactful transformation in the finance industry and capital markets as a whole.

✏️ AI diary of a quant

Man Institute

AI enhances systematic strategies by processing vast amounts of unstructured data, offering cost-effective alternatives to traditional methods in finance and investment, and streamlining workflow. It can sift through reports, outperform manual efforts and condense information more efficiently, thereby benefiting strategy development and code development alike, increasing productivity, and enabling researchers to focus on complex problem-solving. “To say that AI has remodelled the investment landscape at this point would be premature, but it is clear that its usefulness is only going to increase.”

✏️ Silent enablers of the global tech boom in Asia

Impax Asset Managers

Asian tech firms play a crucial role in supplying industries vital for transitioning to a sustainable economy, driven by long-term factors such as electrification and semiconductor growth. This creates opportunities for niche service and hardware providers in technology product lifecycles. There are three types of critical technology supplier that currently stand out to capitalise on these long-term structural trends: multilayer ceramic capacitors, suppliers to the semiconductor industry (like glass components, testing solutions) and makers of cutting-edge chips.

✏️ How biopharma can make a difference in health equity

BCG

Over 2B people in low- and middle-income countries lack access to essential medicines, with health suffering expected to rise sharply. Despite biopharma's efforts, 70% of R&D for crucial health issues in these countries remains unaddressed, yet these regions offer significant untapped market potential for growth.

PRIVATE MARKETS AND ALTERNATIVE ASSETS

📝 Global institutional investor survey 2024

Nuveen

Key stats and insights from the survey highlight that investors acknowledge a heightened level of uncertainty in the market, prompting a focus on enhancing portfolio resiliency, with varying approaches to achieve this. The normalization of interest rates is leading to asset reallocation, with a shift from equities to fixed income, while investors are also positioning their portfolios to support the transition to a low-carbon economy, often surpassing regulatory requirements.

📝 2024 GP outlook

Allvue

Emerging and enterprise managers are both investing in AI and machine learning for fund operations, with nearly a quarter of all GPs using these technologies, primarily for data collection, portfolio monitoring, and dealmaking. While private debt managers plan to adopt AI within two years, the private equity and venture capital sectors anticipate a more favorable environment in 2024, with VC managers particularly optimistic about improved dealmaking and exit opportunities.

📝 Why LPs are focusing on the most consistent top-performing GPs

Preqin

Private equity is facing a tough environment for both investors (LPs) and fund managers (GPs). Exiting investments to return profits to LPs has become difficult, with global exit value falling significantly in 2023. Falling public markets have also forced LPs to be more cautious with their private equity allocations, leaving GPs with less capital to raise for new funds. Data shows a decline in both the amount of capital LPs are deploying and the total funds raised by GPs compared to recent years.

✏️ 2024 private markets outlook: From headwinds to tailwinds

State Street

Private markets thrive despite economic challenges, with rising demand from investors. A forthcoming study highlights key themes such as increased allocations to infrastructure and private debt, driven by factors like risk mitigation strategies and evolving roles of retail investors. As institutions aim to reduce risk and achieve operational excellence, they look for data accuracy, timeliness and interoperability and are thus considering outsourcing data management and tapping into advanced technologies.

📝 A bigger role for active strategies

BlackRock

Financial markets are experiencing increased volatility and uncertainty, requiring a more dynamic portfolio approach. Active strategies, including dynamic indexing, are favored for delivering above-benchmark returns, especially in the current environment of wider return dispersion. Skilled managers may find more opportunities for active returns, although picking top managers remains challenging and requires extensive research.

📝 Private market insights March 2024

UBS

Capital market conditions remain volatile, with expectations for early interest rate cuts scaling back due to stubborn inflation. Real estate markets have held steady despite delayed rate cuts, with momentum expected to accelerate as cuts become real. Clean energy dominates infrastructure conversations despite pushback, while private equity faces challenges in fundraising and realization markets, with opportunities in secondary sales and life sciences. Non-sponsor direct lending in the lower middle market can yield higher returns with similar or better credit performance compared to sponsor-backed strategies, depending on the manager's expertise and market positioning.

📝 Private markets optimism rises as headwinds ease

Adams Street

Investor confidence in private markets is rising, with optimism for 2024 amidst easing headwinds like deal activity constraints. Concerns revolve around election uncertainty, geopolitical conflicts, and inflation impacting asset classes, while the environment for private markets, particularly credit remains attractive due to higher returns and floating rates. Assessing private market managers focuses on sustainable value creation, emphasizing revenue growth, experienced teams, and consistent performance.

✏️ Three sources of alpha: A conversation with Robert C. Merton

Dimensional

This note explores three sources of alpha: traditional, financial services, and dimensional, highlighting their differences in scalability, persistence, and synergy within factor strategies, aiming to enhance investor evaluation and asset allocation decisions.

✏️ Are allocators too optimistic about 2024?

Institutional Investor

Despite recession warnings from some experts, allocators are optimistic about market direction, attributing confidence to the belief that the Fed can engineer a soft landing. However, concerns persist regarding political risks, with the US presidential election ranking as the top economic concern for 61% of respondents in a recent survey by Commonfund.

✏️ Every allocator should ask these questions before hiring a manager using large language models

Institutional Investor

Generative AI and LLMs are related concepts; LLMs focus on language patterns for predictions and text generation. While managers primarily use LLMs for operational efficiency, some are leveraging them for investment insights, prompting allocators to scrutinize technology integration complexities and ethical implications during due diligence beyond surface-level demonstrations.

🎥 Trends shaping private markets in 2024 (Adams Street)

🎙 How PE secondaries can enhance diversification in volatile times (Apollo)

Thank you for reading The Valt Journal!

Check out our other editions here.

Disclaimer:

The content provided on this platform contains references and links to external sources, including articles, reports, websites, images, or videos. We do not own or claim copyright over the content found in these external sources. The ownership and rights of the content belong to the original creators.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.