The Valt Journal #24

Featuring latest research on Private Credit (HSBC, UBS, Barings); PE (StepStone, MS); Real estate, Infra, Energy (BlackRock, GS, Principal AM); Alternatives as an asset class (HarbourVest, UBS, KKR)

Hi, welcome to the new edition of The Valt Journal. In every issue, we cover the best and the latest insights into the global private markets. The Valt Journal is a repository of time sensitive and timeless research, delivered to your inbox every 2 weeks, so you don’t have to look anywhere else! Clicking the headlines is all it takes.

Check out TVJ Spotlights 🔦 including 1) Revolving Credit Facility - potentially emerging asset class in private credit (by HSBC); 2) Living sector and European hotel sector reports (by Principal Asset Management); 3) Evergreen funds: Accessing private markets alpha (by HarbourVest)

Numbers this edition:

Links: 62

Authors: 34

PRIVATE CREDIT x FIXED INCOME

TVJ Spotlight 🔦

📝 Revolving Credit Facility (RCF) - potentially emerging asset class in private credit

HSBC Asset Management

Institutional investors have access to bank-originated assets like Revolving Credit Facilities (RCFs) and Net Asset Value (NAV) financing, which provide portfolio diversification and potential for enhanced returns. RCFs are particularly notable for their stable performance across economic cycles, low-interest rate risk exposure, and substantial growth potential in the private credit sector, supported by consistent refinancing and favorable market and regulatory changes.

📝 Bottom-up opportunities in IG credit

Capital Group

Investment-grade corporate bonds currently offer high yields, presenting a unique chance for attractive long-term income and returns, especially as policy rates may have peaked with potential cuts on the horizon. Despite rich index valuations due to recent spread tightening, opportunities abound for active managers to leverage increased demand, steady supply, and notable dispersion across geographic and sectoral lines.

📝 The growing opportunity in private placements

Barings

Institutional investors, including insurance companies and pension funds, are increasingly drawn to private placements due to higher yields, an illiquidity premium over public markets, and benefits such as enhanced diversification and asset-liability matching. Private placements, sold only to qualified institutional buyers, offer advantages like confidentiality, and flexibility in debt issuance, and typically feature longer maturities and fixed rates, making them attractive for long-term liability management.

📝 Opportunistic credit & distressed debt

Barings x Private Debt Investor

A capital solutions strategy is seen as an opportunistic, all-weather approach aiming to deliver attractive risk-adjusted returns across various market conditions, often yielding a premium over traditional direct lending by focusing on unique, bespoke financing opportunities outside the typical scope of direct lenders. This strategy benefits from flexibility to adapt across market cycles, targets underserved deals to enhance returns, and integrates deep expertise in structuring complex financings that may involve mixed capital forms and navigating borrower-specific challenges.

📝 Diverging markets, diversified portfolios

PIMCO

As major global economies begin to diverge, central banks will follow varied paths in interest rate cuts, with US potentially maintaining stronger momentum and higher inflation rates. Bonds, particularly in developed markets outside US, present attractive investment opportunities due to their yield and potential to handle various economic conditions. The environment stresses the need for global diversification, risk management, and the strategic use of intermediate bond maturities to balance portfolio risks and returns.

✏️ Private credit: The growth story in direct lending continues

UBS

The private credit market has rapidly expanded from a niche alternative investment to a major player, with assets expected to reach $3.5T by 2028 from $1.5T currently. This growth has been fueled by the global financial crisis, which created a lending vacuum that non-bank lenders have successfully filled, further accelerated by recent crises like the collapse of Silicon Valley Bank. “Drawn to its potential diversification benefits, investors are therefore now approaching their allocations with a ‘Core and Satellite’ framework: ‘core’ being middle market direct lending (that is, relatively large loans to companies that are owned private equity sponsors); and ‘satellite’ encompassing a wide range of other private credit strategies.”

✏️ Unveiling niche opportunities in private credit

UBS

As banks retreat from the lending market, the number of private credit funds has soared to 1,080, targeting a capital increase. “While attention has predominantly focused on upper-middle-market direct lending, lesser-known sub-strategies and segments warrant consideration as a supply and demand mismatch persists in these parts of the market. Other strategies include: the non-sponsor-backed lending; asset-backed lending (which may involve financial assets and/or hard assets as collateral); mezzanine lending; special situations or hybrid opportunities; and distressed investing.”

✏️ Growing investment opportunities amid bank deleveraging trend

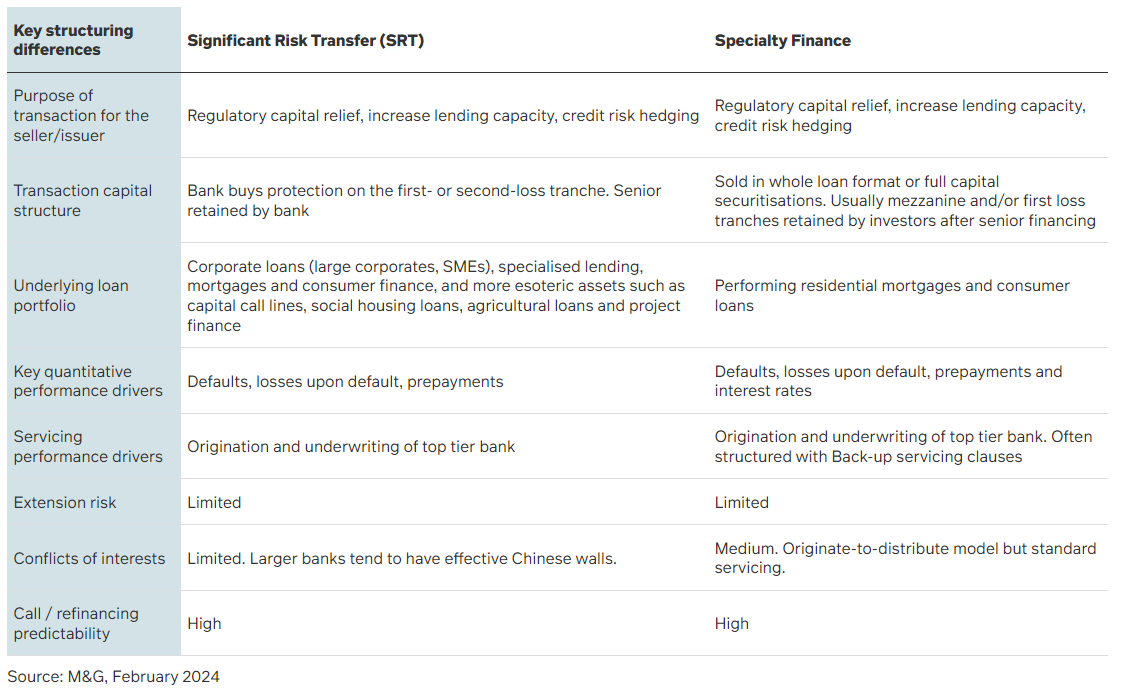

M&G Investments

European banks are accelerating the use of risk-sharing transactions and asset sales to meet upcoming Basel IV capital requirements, creating a prime opportunity for investors to access difficult-to-reach segments of bank balance sheets with potentially high returns. As regulations tighten, particularly with the Basel "Endgame" set for 2025, banks are optimizing balance sheets to handle major changes in risk-weighted asset calculations, boosting the appeal of these investment opportunities.

✏️ CLOs: Standing out in a strong market

Barings

Collateralized Loan Obligations are gaining traction in the credit market due to their floating-rate nature and potential for high yields, especially as fears of a near-term recession diminish and US Federal Reserve rate cuts are expected later. With returns ranging from 1.84% for AAA-rated CLOs to 11.12% for single-B-rated CLOs in the first quarter, the demand for these assets is robust, outpacing supply primarily due to strong investor confidence and less new issuance than anticipated.

✏️ High yield: What the market may be missing

Barings

High-yield bonds and senior secured loans have shown strong performance and appear poised for continued success, bolstered by a supportive economic backdrop and favorable capital market conditions despite potential rate cuts. These markets benefit from solid issuer fundamentals, high coupon rates for loans, and advantageous bond duration and callability, suggesting significant potential for future total returns.

✏️ The solution to the bank lending pull-back may be in the mirror

Apollo

Apollo Global highlighted the potential for superannuation funds to play a crucial role in filling the lending gaps left by regulated banks, suggesting that these funds are the "banks of tomorrow." Private credit could be a $40T market, covering diverse assets while maintaining a cooperative relationship with traditional banks and focusing on investment-grade opportunities rather than higher-risk ventures.

✏️ Private credit makes money for managers. For their LPs? Not so much

Institutional Investor

New research suggests that private credit funds while offering attractive risk-adjusted returns that benefit GPs, do not deliver significant alpha for LPs. This study challenges the uniqueness of private credit compared to traditional banking, showing that when adjusting for both debt and equity risks, private credit returns are virtually low.

📜 Periodicals »

📝 Fixed income outlook 2Q 2024

Goldman Sachs

A cautious normalization is expected given the global conditions, with central banks likely cutting rates soon to support growth and stabilize markets. Precise, data-driven decision-making is required to handle potential risks and leverage opportunities in fixed-income and currency markets. “The risk premium on bonds issued by certain banks is appealing, given their robust capital and liquidity positions, as well as diversified business models. More broadly, major banks, which constitute 25% of the USD investment grade market, exhibit financial strength to withstand potential loan losses, including those associated with the secularly challenged office commercial real estate (CRE) sector. The BBB rated segment of the investment grade market also presents opportunities for income and total returns. In addition, we are positioned for a steepening credit curve considering attractive carry and roll potential.”

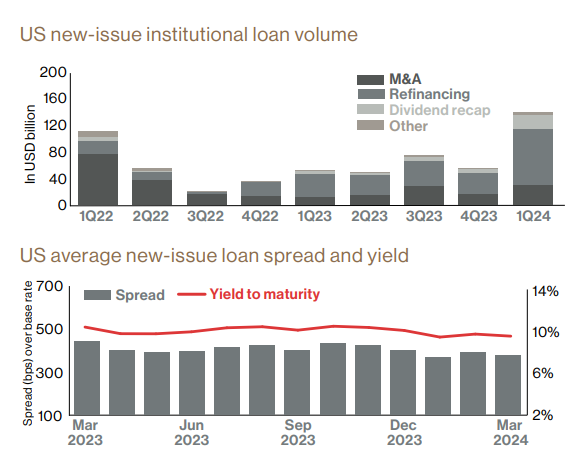

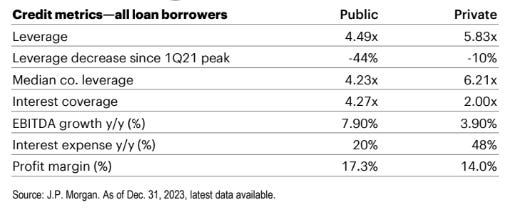

📝 Quarterly liquid loan market Q1 2024

Partners Group

The US leveraged loan market exhibited strong performance in the first quarter, driven by high investor demand and new budget allocations. This period saw record activity in new loan issuance, refinancings, and collateralized loan obligations (CLO) issuance, setting a fast-paced trend for future market expectations.

📝 Corporate credit outlook Q2 2024: Drafting down the straightaway

FS Investments

High-yield bonds offer compelling opportunities for investors, especially as economic resilience could lead to further tightening of spreads, while their robust fundamentals and price convexity may protect against potential defaults even if the economy falters. Conversely, loans face greater risks in a persistent high-rate environment driven by inflation, with more limited upside due to the possibility of borrowers repricing existing loans and thus capping gains from spread tightening.

📝 Fixed income perspectives Q2 2024

Capital Group

Strong economic data in the US has led to increased Treasury yields as expectations for Fed rate cuts in 2024 are reconsidered. Investors are adjusting portfolios to balance risks across various macroeconomic scenarios and maintain favorable fixed-income valuations. Three areas of conviction: 1. Positioning for a steeper yield curve remains a high conviction view given valuations; 2. Mortgages continue to be attractive, particularly relative to other sectors, even as valuations have tightened and are less compelling than last year; 3. Modest and diversified exposure to select credit sectors - valuations for investment-grade corporates are more attractive vs high yield and emerging markets debt.

📝 Looking ahead at 2Q 2024: A pause before a pivot

Principal Asset Management

While IG spreads are tight, demand remains robust, and yields continue to be very attractive. Substantial income produced by the high yield asset class should continue to be attractive for investors. Bank demand, lower cash rates, attractive spreads suggest that the MBS sector is primed for performance for the balance of 2024. Attractive value in single asset single borrower (SASB) loans, offer exposure to specific property types in lower leveraged, higher-quality commercial real estate. Though new loan volume origination for private middle market direct lending has been somewhat below the expectations, the volume that is being realized continues to present attractive value.

📝 Global investment views April 2024: The late-cycle environment continues to play out

Amundi

The US economy's resilience, driven by consumer spending and wealth effects, along with strong earnings expectations, has fueled a recent surge in equities and yields, although concerns about the sustainability of these market movements and the credibility of earnings forecasts persist. Additionally, a forecasted mid-year economic slowdown and various global factors like US elections, monetary policy, and emerging markets' resilience will critically influence future market directions. “We remain prudent and look for opportunities selectively in Asia where earnings growth is more evident. Investors should maintain hedges and a diversified stance. With a close to neutral stance on DM equities, we acknowledge the minute nuances across the globe. We are neutral on the US and upgraded Europe to neutral mainly for risk mitigation purposes, but are slightly positive on Japan. In EM, we remain constructive through India, Indonesia, South Korea.”

📝 Fixed income weekly: Musings

Goldman Sachs

This weekly insight offers a comprehensive overview of the global economy and fixed-income markets, including recent trends in growth, inflation, and labor markets, as well as insights into monetary and fiscal policies. It also explains how these macroeconomic conditions influence investment strategies in the fixed-income sector.

🎥 Alternative insights video series: Real asset recap and outlook (Goldman Sachs)

🎙 Duration: Friend or Foe? (Morgan Stanley)

🎙 Insights on the mid-market lending outlook (TPG)

🎥 APAC Private Credit (Barings)

PRIVATE EQUITY

TVJ Spotlight 🔦

📝 Pound the table for small buyouts

StepStone

Despite market uncertainties, small-market buyouts (SBOs) offer significant investment appeal due to their resilience, providing liquidity, consistent returns, and stable valuations, making them an enticing diversification opportunity that counterbalances the excessive focus on large-cap funds. “The performance of recent exits has also been strong. In aggregate, realized small-buyout deals have generated a gross TVM of 3.0x.”

📝 Re-writing the playbook on alignment

Morgan Stanley

Morgan Stanley observes a surge in interest for GP-led secondary transactions amidst an undercapitalized market. The economic environment necessitates discounts in these deals, challenging traditional price expectations. Simply reinvesting does not ensure alignment with GPs anymore, as the dynamic has shifted towards understanding GPs' motivations, particularly regarding their financial strategies to facilitate fund-raising. The best investment opportunities lie in single-asset deals in stable regions like the US and Western Europe, and in sectors like commercial services that benefit from buy-and-build strategies.

✏️ Opportunity in the undercapitalized world of private equity secondaries

Neuberger Berman

The private equity secondary market, particularly for GP-led continuation funds, faces a significant capital shortage despite an increase in transaction volume, presenting a sustained opportunity for seasoned investors. This capital scarcity, exacerbated by the lack of traditional M&A and IPO exits prompting LPs and GPs to seek secondary market solutions, is coupled with the growth of GP-led ecosystems as viable avenues for managing and growing high-quality assets amidst challenging exit environments.

📜 Periodicals »

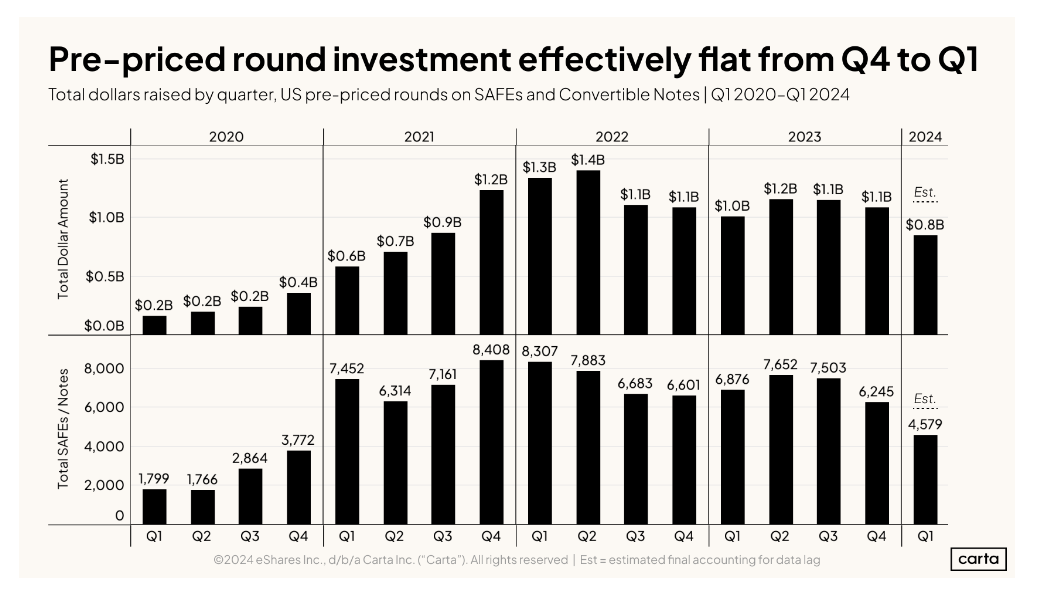

✏️ State of pre-seed: Q1 2024

Carta

Pre-seed fundraising increasingly relies on SAFEs (Simple Agreements for Future Equity) and convertible notes instead of standard-priced venture rounds, with a lot of such agreements being signed on platforms like Carta, channeling billions of funds into early startups. This shift reflects a lack of consensus on what defines a pre-seed round, highlighting a trend towards more flexible, early-stage funding mechanisms. SAFEs are now the preferred investment instrument for all rounds under $3M.

🎥 Alternative insights video series: Opportunities in private equity (Goldman Sachs)

SECTOR FOCUS

Energy Transition x Climate Finance

TVJ Spotlight 🔦

📝 Transition center of expertise: Renewable power

BlackRock

In 2023, the solar and wind industries achieved record installations despite supply chain and macroeconomic challenges, propelled by declining costs, supportive policies, and energy security needs. New green industrial policies globally, especially in the US and EU, are boosting renewables, although supply chain risks and regulatory hurdles persist. Behind-the-meter energy generation is an opportunity along with offshore renewables. “Renewables are essential in the transition to a low-carbon economy, and often provide sticky, long-term contracted revenues and inflation protection that can bring balance to portfolios. This industry provides investment opportunities across the risk-return spectrum spanning public and private markets, playing an important role in portfolios.”

📝 Weaving India’s future: A tapestry of green and grey energy

Morgan Stanley

India's rapid economic growth, aiming to become the third-largest economy by 2030, continues to provide opportunities in the renewable and green energy space. Three major areas of opportunity: 1. Power transmission and distribution (T&D); 2. Renewables and battery storage; 3. Electric transportation

✏️ Energy security and the implications for the energy sector

Schroders

Recent geopolitical instability and the COVID-19 pandemic have exposed the vulnerabilities of globalized energy supply chains, prompting a shift towards deglobalization and heightened emphasis on energy security. This shift has led governments to prioritize local energy production, diversify energy sources, and advance policies to secure stable, resilient, and sustainable energy systems, with a focus on renewables and technologies like battery storage and hydrogen power to support decarbonization efforts.

✏️ Supply chain overhaul: How shifting demand within US markets and product types is shaping a new era for industrial investment

Morgan Stanley

As the global economy slows and interest rates rise, sectors like industrial real estate, fueled by e-commerce growth and global supply chain overhauls, remain attractive investments. With e-commerce's accelerated growth post-COVID-19 driving demand for diverse industrial spaces, “Morgan Stanley estimates that $850B of China’s c.$5T of manufacturing will shift to other countries with major beneficiaries: US and Europe ($200B each); Japan and Southeast Asia ($100B each); and Mexico and India ($50B each).”

✏️ From legislation to consolidation: navigating the future of green finance

Natixis

Natixis experts highlight the importance of transparent and strategic climate plans, aligning banking operations with net-zero goals, the complexities of regulatory ESG frameworks, and the role of green finance instruments like green bonds and loans, emphasizing the need for standardization and rigorous compliance to support a sustainable financial ecosystem.

Real Estate x Infrastructure

📝 Global real estate outlook: Seizing on the cyclical uplift

BlackRock

The global real estate market is recovering from a downturn, driven by stabilized interest rates, with transaction volumes expected to significantly improve in 2024. Despite some supply concerns, there is a growing demand for industrial real estate due to changes in supply chains, highlighting the need for future-proofing investments. “Real estate fundamentals remain solid with NOI growth at 5.5% yoy (December 2023). NOI growth was 12.8% for industrial and 4.5% for multifamily and both are forecast to have positive income growth going forward, albeit at a slower rate. Supply is a risk for both sectors in the near term but mitigated by continued demand and an expected drop off in deliveries after this year.”

TVJ Spotlight 🔦

📝 Living sector series: US single-family rentals

Principal Asset Manangement

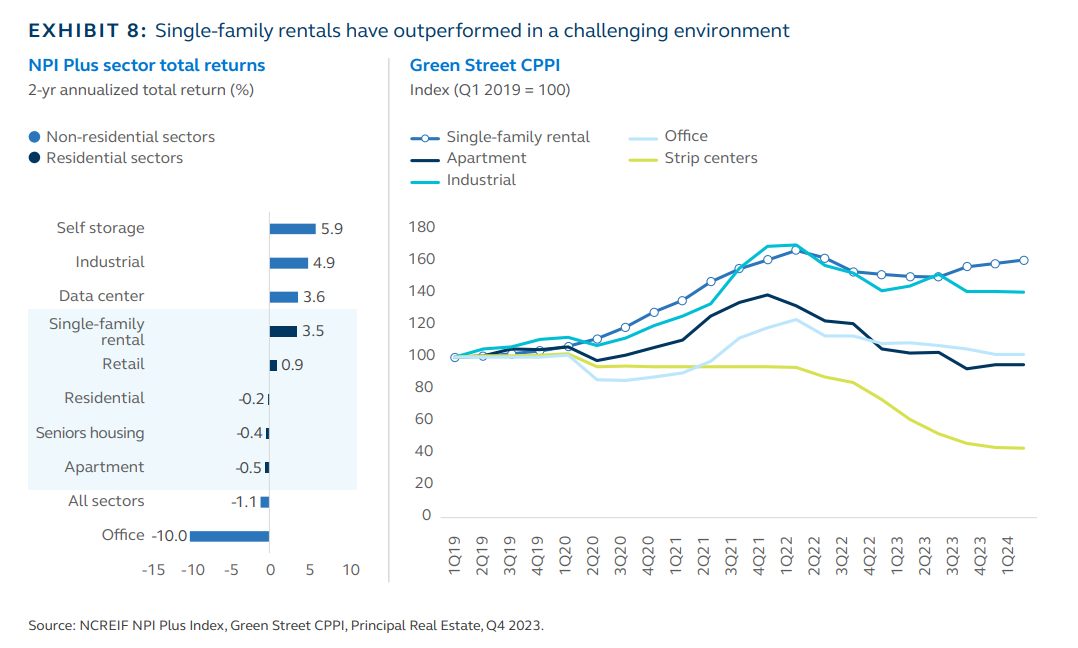

The single-family rental market has emerged as a strong investment strategy within the real estate asset class, particularly after the Global Financial Crisis which reshaped economic and demographic dynamics, affecting homeownership affordability and increasing the attractiveness of rental options. This sector's growth is driven by changes in housing affordability and demographic shifts, presenting sustained opportunities for investors as younger generations struggle financially to purchase homes.

📝 Most new data center capacity is still in primary markets

Principal Asset Manangement

Demand for data center capacity has soared, particularly accelerated by COVID-19, leading to shortages in top markets as supply struggles with disruptions and increased development timelines. Despite these challenges, the fundamentals of connectivity, power, and land availability continue to make top markets attractive, though secondary markets in Europe and changes in market dynamics, like those seen in Northern California and Atlanta, illustrate the fluid nature of top data center locations.

📝 Choosing the optimal operating structure and partner in European hotel sector

Principal Asset Manangement

The success of hotel investments hinges on macroeconomic factors, market location, and demand-driven transformations, but realizing potential returns greatly depends on choosing the right operating structure and partner. This selection involves assessing risk/return, flexibility, market experience, and expertise to optimize value-added investments. Typical operating structures include a lease, a management contract, or a franchise.

📝 European hotel sector: Creating value through demand-driven transformation

Principal Asset Manangement

The rebound of travel post-COVID-19 presents promising investment opportunities in the European hotel sector, particularly in properties that are undervalued or underperforming, despite challenges like high inflation and rising debt costs. Successful investment strategies involve identifying properties with strong locations and potential for operational improvements or rebranding, aimed at capitalizing on evolving consumer preferences and demand dynamics to boost profitability. “The opportunity lies in transforming the property to better suit a particular demographic given changing demand drivers. This could involve brand repositioning, or a targeted capex initiative such as sustainability-focused refurbishment, or an operational change such as implementation of technology.”

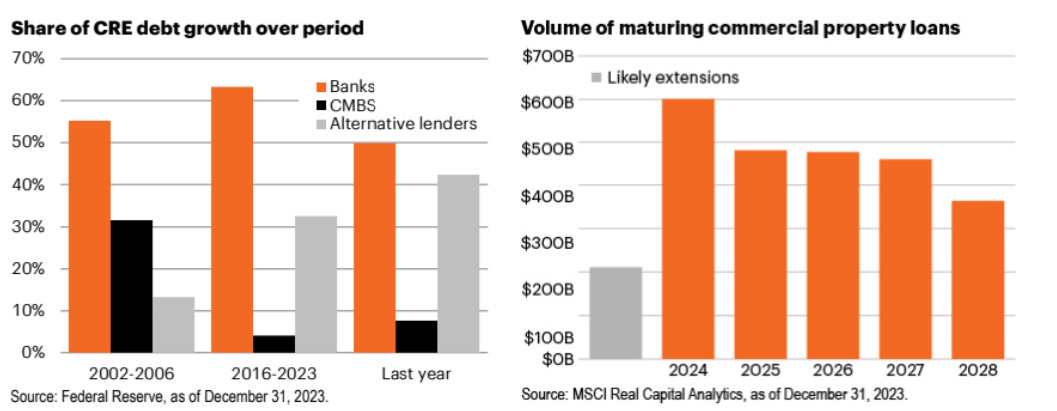

📝 Q2 2024 Commercial real estate outlook: Attitude adjustment

FS Investments

The commercial real estate market has been under pressure for two years due to rising interest rates, leading to fears of a market crash. However, the reality has been more resilient, with property fundamentals remaining strong despite decreased activity and modest declines in property values. As investor sentiment begins to improve and adapt to higher interest rates, the market outlook for 2024 appears cautiously optimistic, though recovery in property values remains uncertain.

✏️ Triple threat: Opportunities in US residential credit for global insurance companies

Man Institute

The US residential private credit market presents a valuable opportunity for global insurance companies, offering a scalable investment with attractive returns and low-risk-based capital charges. This sector provides a stable alternative to commercial real estate amidst fluctuating interest rates and uncertain economic conditions. “We see a compelling opportunity for insurance companies seeking a differentiated source of income with a yield pick-up and exposure to a healthy underlying market. This is coupled with attractive capital treatment and inexpensive FHLB financing for balance sheet investors.”

✏️ How close is the UK office sector to fair value?

LGIM

The blog analyzes the UK office market's value decline, suggesting a c.30% fall in indices with yields potentially undervaluing the assets by 80 bps on average. It argues for a necessary adjustment to reflect fair value, considering both known and unexpected costs, and forecasts a further valuation drop of 10%+ this year, possibly aligning market pricing more closely with true fair value.

✏️ How Japan’s economic reawakening is creating real estate investment opportunities

KKR

Japan is experiencing a significant shift from deflation to inflation, reinvigorating various sectors like tourism and manufacturing, and prompting positive changes in corporate governance. This environment is enhancing the appeal of real assets, creating diverse investment opportunities in commercial real estate, particularly in hospitality and divestitures of non-core assets, although success heavily relies on strong local partnerships.

✏️ Why are infrastructure managers being acquired?

Hamilton Lane

As the private markets' fundraising environment remains challenging, investment firms are diversifying their offerings to become 'one-stop shops' for alternative assets, including infrastructure due to its historical outperformance, resilience, and low volatility. This trend is driving large asset managers to acquire infrastructure teams capable of meeting institutional investor demand for such stable, inflation-resistant investments.

📝 PGIM real estate: Quarterly insights

PGIM

After enduring a tough period, the commercial real estate market is focusing on recovery prospects amid sector-specific challenges in demand and supply. PGIM Real Estate’s latest insights delve into regional trends, with a special focus on office affordability analysis and rental growth projections, which indicate potential stronger-than-expected performance in key markets despite ongoing economic shifts.

🎥 Alternative insights video series: Real asset recap and outlook (Goldman Sachs)

🎥 Morgan Stanley on real estate investing (Morgan Stanley)

🎙 Commercial real estate – Emerging opportunities during the long, hard slog (TCW)

Artificial Intelligence x Technology

📝 Solving the interoperability puzzle

StateStreet

Crypto composability, which allows for the integration of assets across various blockchains, is enhancing the creation of complex applications and financial products. Despite offering extensive opportunities for innovation and financial inclusion, it also poses significant security and regulatory challenges.

✏️ Irony, optimism, and AI

Blackstone

While AI promises to enhance productivity and growth, similar to past technological booms, its true economic contributions and job creation potential are tied to traditional economic dynamics, with significant impacts expected well beyond immediate market speculations.

🎥 How AI is affecting the world order and what it means for business (Goldman Sachs)

PRIVATE MARKETS AND ALTERNATIVE ASSETS

TVJ Spotlight 🔦

✏️ Evergreen funds: Accessing private markets alpha

HarbourVest

Private markets have consistently outperformed public ones, with private equity buyouts yielding a 670 bps average premium over MSCI ACWI Total Return over five-year periods. Evergreen funds offer “instant exposure to a diversified private markets portfolio in a single subscription with lower investment minimums, potential for enhanced liquidity, greater flexibility to meet investment objectives, and less operational complexity compared to traditional private markets investing. Evergreen funds could also be used as a satellite liquidity solution for experienced institutional investors with a mature portfolio of closed-end traditional private equity funds seeking to adjust exposure back to a targeted strategic asset allocation level.”

📝 Towards a reordering of asset class profiles

Amundi

Climate policy delays, geopolitical tensions, and the growth of AI are set to reshape asset class returns over the next decade, favoring bonds, and global and Emerging Market equities while challenging traditional equity and bond allocations. The transition to net zero, varying central bank strategies, and the integration of real and alternative assets will be key factors influencing investment strategies and expected returns.

📝 Private market insights – April 2024

UBS

Fundraising and deal activities in infrastructure and private equity show signs of recovery, despite ongoing challenges posed by a potentially prolonged period of high interest rates. Additionally, private credit sectors are exploring niche strategies like NAV lending to navigate liquidity issues and provide robust investment returns.

✏️ UK charities are exploring private markets

Abrdn

Private market investments such as solar farms and tech start-ups, previously overlooked by UK charities and foundations, are gaining interest due to their potential for high returns, impact, and portfolio diversification. These assets align well with the long-term investment horizons of endowments and foundations, despite initial hesitations due to concerns about liquidity, high fees, and the need for specialized expertise.

✏️ Alternatives: Do you want to invest? Here's how to start

JPMorgan

As investors increasingly recognize that traditional stocks and bonds may not suffice to achieve desired returns, they are turning to alternative investments like private equity and hedge funds to enhance and diversify their portfolios. Navigating this complex field, which includes thousands of options, requires clear goals and careful planning to create a balanced investment strategy.

✏️ The new 60:40 portfolio

UBS

The current investment landscape is marked by geopolitical challenges, high-interest rates, and commodity price volatility, diminishing the returns of traditional 60:40 stock-bond portfolios. To counteract this, the democratization and diversification of private markets are emerging as viable alternatives for boosting returns and reducing risk, similar to the impact of ETFs on stock investing in the early 1990s. Enhanced accessibility through regulatory improvements and innovative financial products is enabling private investors to engage more actively with private equity, venture capital, and real assets. Opportunities across the asset classes: infrastructure, real estate and private credit are particularly well suited to offer downside protection due to the yield component along with private equity secondaries.

✏️ Embrace alternatives or potentially be left behind

FS Investments

Despite a volatile market post-2022's broad rally, the US economy remains robust with strong consumer spending and diverse economic growth, while persistent service inflation drives higher interest rates, making fixed-income assets less attractive. This economic environment favors private lending and middle market private equity, which can thrive with the current economic stability and higher interest rates, offering alternatives for investors facing a lack of opportunities in traditional asset classes.

📝 Hedge fund strategies – an introduction

LGT Capital

Hedge funds are versatile investment vehicles that can employ both long and short-term strategies across traditional and alternative asset classes, offering a unique return profile unbound by benchmarks. This flexibility, combined with their ability to tap into diverse and often less efficient markets, allows hedge funds to pursue alpha and manage risks effectively, providing strong diversification benefits and potential for high returns irrespective of market conditions.

✏️ Can hedge funds play the role?

Wellington Management

Selecting hedge funds is critical, especially the ones that align with overall portfolio objectives, using new frameworks designed to navigate today's investment landscape, where traditional asset correlations may falter. Hedge funds, with their diverse strategies including event-driven, equity long/short, relative value, and macro, offer tailored risk and return profiles that can enhance portfolio resilience against market downturns.

✏️ Manager selection is key in private markets

Blackstone

Blackstone advocates for increasing strategic allocation to private assets like private credit, private equities, and real estate in uncertain times due to their unique benefits such as high yields, inflation protection, and diversification. Future discussions will focus on critical implementation decisions like manager selection, which is especially crucial in private markets due to the significant performance disparities between the best and worst managers.

✏️ Insights from KKR’s global wealth investment council

KKR

KKR highlights risks and opportunities in various global markets, including an optimistic outlook for Japan and AI investments, while also focusing on repositioning strategies for a new investment regime and reviewing asset allocations amidst anticipated higher inflation and interest rates.

📝 Valuation multiples: What they miss, why they differ, and the link to fundamentals

Morgan Stanley

This report critiques the reliance on valuation multiples like P/E and EV/EBITDA for pricing stocks, noting their limitations and the divergence they can show in assessing a stock's attractiveness. It suggests a deeper understanding of alternative earnings measures and the fundamental drivers behind these multiples.

Thank you for reading The Valt Journal!

Check out our other editions here.

Disclaimer:

The content provided on this platform contains references and links to external sources, including articles, reports, websites, images, or videos. We do not own or claim copyright over the content found in these external sources. The ownership and rights of the content belong to the original creators.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.