The Valt Journal #25

Featuring latest research on Private Credit (Castlelake, Stepstone, TPG); PE (Adams Street, Apollo); Real estate, Infra, Energy (GS, Principal AM, Abrdn); Alternatives as an asset class (KKR, Amundi)

Hi, welcome to the new edition of The Valt Journal. In every issue, we cover the best and the latest insights into the global private markets. The Valt Journal is a repository of time sensitive and timeless research, delivered to your inbox every 2 weeks, so you don’t have to look anywhere else! Clicking the headlines is all it takes.

Check out TVJ Spotlights 🔦 including 1) A primer on asset-based private credit (by Castlelake); 2) PE secondaries: Evolving landscape can expand opportunities (by Apollo); 3) Powering up Europe (by Goldman Sachs); 4) Global wealth investment playbook (by KKR)

Quickly scan the list of all reports in this edition here!

Numbers this edition:

Links: 66

Authors: 34

PRIVATE CREDIT x FIXED INCOME

TVJ Spotlight 🔦

📝 A primer on asset-based private credit

Castlelake

Private credit mainly includes direct lending to companies, either sponsor-backed or non-sponsor-backed, with repayment driven by the borrower’s cashflows. Additionally, asset-based private credit focuses on loans secured by specific cashflow-generating assets, similar to asset-backed securities. The private credit market, currently valued at $1.4T, is expected to grow to approximately $2.3T by 2027, driven by the retreat of traditional banking and increased interest from institutional investors following stricter regulatory and capital requirements imposed post-Global Financial Crisis. “Asset-based private credit can offer investors attractive risk-adjusted returns while providing downside protection and low market correlation. The differing characteristics of direct lending and asset-based lending investments can diversify overall risk in an investor’s private credit portfolio, supporting the argument that allocations to both direct lending and asset-based lending can be complementary.”

📝 Deployment and sourcing channels in direct lending

Stepstone

In 2023, direct lending faced a 43% drop in deployment due to high interest rates affecting private equity valuations and M&A activities. As a result, investors increasingly utilized primaries, co-investments, and secondaries to manage capital deployment effectively. While activity initially mimicked the lows of early Covid-19 in 2020, it rebounded in the second half of the year, setting a positive tone for potential increases in 2024 amid rising private equity dry powder and pressure to deploy capital efficiently.

📝 Credit market outlook 2024

Carlyle

Following the recent Fed moves, markets experienced a significant rebound as recession fears diminished and the anticipation of rate cuts grew. Record levels of loan and bond issuance occurred in early 2024, with exceptionally tight credit spreads, reflecting a shift from bank-financed loans to increased private credit market share. Amidst these shifts, banks are recalibrating their strategies, increasingly focusing on relationship-sensitive lending and collaborating with private funds, even as private credit continues to displace traditional banking in many areas. “Refinancing has been the main driver of 2024 issuance, accounting for 64% of leveraged loans and 88% of high-yield bonds. And a non-trivial share of that refinancing involves borrowers opportunistically swapping out private credit in favor of cheaper syndicated loans.”

📝 EM local debt: Is the EM-US disconnect an overlooked opportunity?

Barings

Emerging markets are currently showing a notable disconnect from the US in terms of inflation rates and economic growth, with EM inflation rates decelerating to meet central bank targets while US inflation remains high. This decoupling, exacerbated by the proactive interest rate hikes by EM central banks ahead of the US, has resulted in EM achieving more favorable real interest rates. Additionally, rising international reserves in EMs suggest robust inflows that enhance the attractiveness of EM local debt and currencies for investors, particularly in the context of the recent selloff in EM local debt.

📝 Is private credit a bubble?

FS Investments

The private credit market has expanded from a minor sector to a multi-trillion-dollar industry, raising concerns about potential bubbles due to its rapid growth and high valuations. However, unlike historical credit bubbles characterized by excessive private sector debt relative to GDP, the growth in private credit today is attributed more to shifts in credit market composition than to an increase in overall indebtedness. Analysis shows that, from 2012 to 2023, despite a significant expansion in the size of the US private credit market, the total private sector debt to GDP ratio remained nearly constant, suggesting that fears of a private credit bubble may be overstated.

📝 Corporate hybrids take the world stage

Neuberger Berman

European issuers have led the global corporate hybrid securities market by finding an optimal balance between investor and issuer needs, whereas the US market has been more fragmented due to differences in Moody's rating methodologies. Changes in these methodologies are now making US hybrids more appealing, and signs of standardization towards European models are emerging, including structures with long-dated maturities and step-ups. This trend towards global standardization presents both immediate relative value and diversification opportunities for seasoned investors, with asset managers well-placed to capitalize due to their strong global research and investment capabilities.

📝 The impact of debt

Oaktree

This note discusses the nuanced view of debt management - it emphasizes the risks and potential rewards of debt, particularly how businesses with minimal or no debt, like Japan's centuries-old "shinise" companies, manage to survive through severe adversities. Further insights on debt highlight that while debt increases financial capacity, it also restricts resilience to economic volatilities, urging a careful balance to mitigate risks of ruin and maximize longevity and stability.

✏️ Is the growth in private credit cannibalizing the high-yield market?

JP Morgan

Private credit AUM in US has surged from $40B in 2000 to $1.2T in 2023, with significant growth, particularly after 2019. Concurrently, the US high yield market has contracted by c.25% since mid-2021. Factors contributing to private credit's growth include banks retreating from loan issuance due to stricter regulations and a shift in financing strategies, with non-banks now providing about 75% of corporate loan financing. Meanwhile, high yield market shrinkage is largely due to upgrades of nearly $300B worth of bonds to investment grade since 2021, contrasting with only $40B downgraded to high yield.

✏️ High yield bonds & loans: Adapting to changing markets

Barings

Baring experts discuss the current trends and outlooks in high yield bonds and leveraged loans, emphasizing their attractiveness despite potential risks from market conditions and geopolitics. They highlight the necessity of thorough credit analysis and the benefit of large, skilled teams to navigate these below investment grade asset classes successfully. Their discussion also explores the impact of economic conditions and Fed policies on these asset classes. “The reason we're bullish on loans is you have that high contractual income, you have a strong economic backdrop. Corporate balance sheets are in good shape and it's really one of our favorite asset classes and we're max overweight in our multi- asset credit funds as a result.”

✏️ Convertible bonds: the little-known investment that offers extra income

Schroders

Convertible bonds blend stability and growth, providing market protection and capturing upside trends. These hybrid securities, combining elements of bonds and equities, offer flexibility and resilience in various market conditions. With features like conversion options and bond floors, they protect capital while offering growth potential, making them appealing for portfolios seeking both income and appreciation with a lower sensitivity to interest rate fluctuations.

📜 Periodicals »

📝 Fixed income outlook 2Q 2024 - Where are the opportunities in fixed income (Goldman Sachs)

📝 Capital markets perspectives 2Q 2024 (TPG Angelo Gordon)

📝 Performing credit quarterly 1Q 2024 (Oaktree)

📝 Permira credit market update Q1 2024 (Permira)

✏️ High yield monthly update (Nomura)

🎙Extra credit: Catastrophe bonds - A diversifier like no other (Man Institute)

🎙 Volatility ahead? Featuring Howard Marks, Armen Panossian, and David Rosenberg (Oaktree)

🎥 We are going into a credit picker’s market Oaktree)

🎥 Yield matters: A fresh look at core bonds (PIMCO)

🎥 10-minute masterclass — Global infrastructure debt (Barings)

PRIVATE EQUITY

📝 Private equity as an asset class: A medium term outlook

AlpInvest x Carlyle

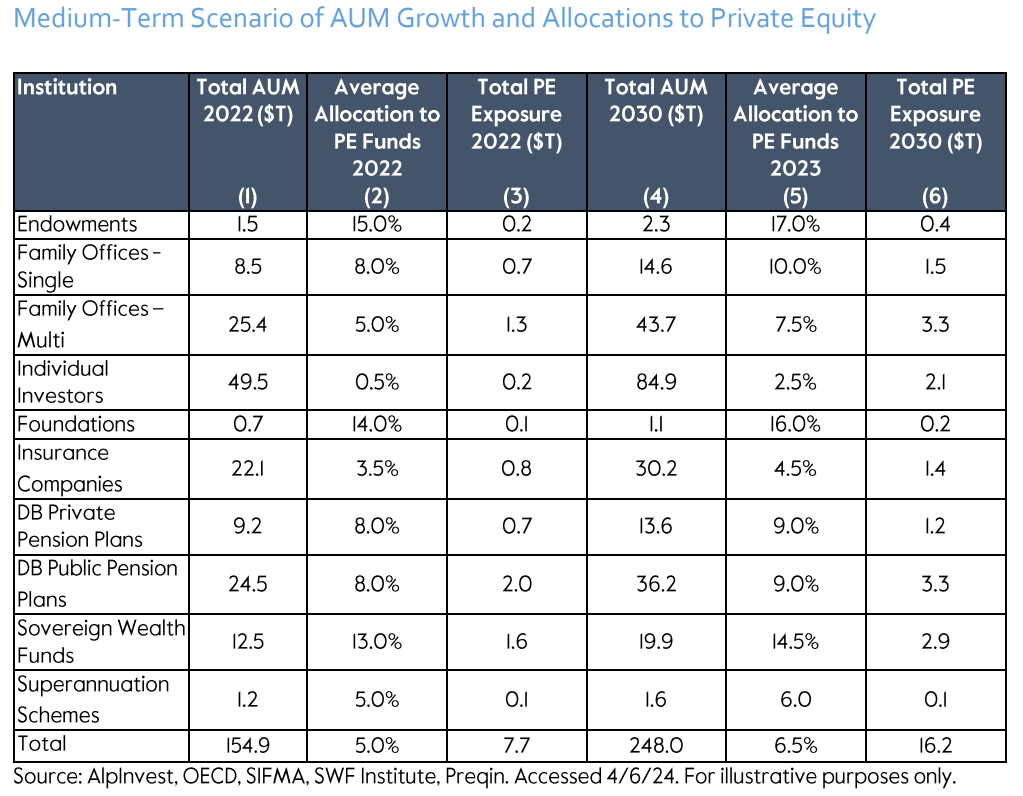

Private equity has historically outperformed public equities and offers diversification benefits. Global buyout funds have generated a 25% outperformance over the past two decades vs public equities. PE is a growing asset class with $7.9T in assets under management globally in mid-2023, 15x larger vs 2000. PE investments are becoming more accessible to individual investors through feeder funds and fintech platforms. The share of individual investors in private equity AUM could rise by 4x by 2030. This growth, led by individual investors, could potentially double private equity AUM to $16 trillion by 2030.

TVJ Spotlight 🔦

📝 PE secondaries: Evolving landscape can expand opportunities

Apollo

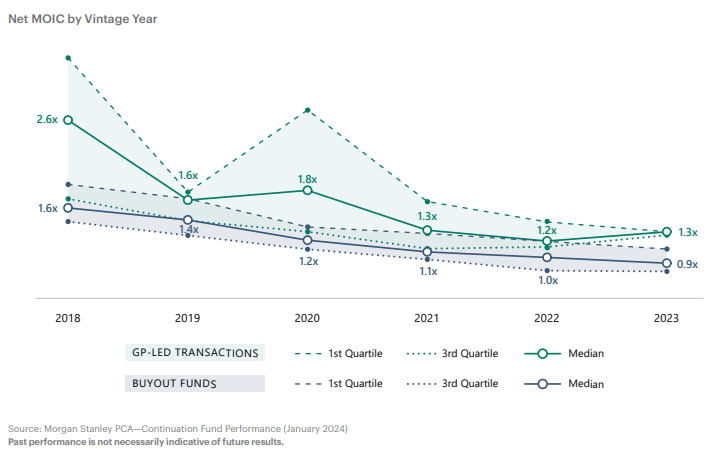

Secondaries have become essential in sophisticated private markets investment strategies, particularly driven by GP-led secondaries and maturation in private markets. The secondary market, growing due to increased use for proactive portfolio management and expected growth in GP-led transactions, is anticipated to potentially double or triple in size over the next five years. This growth is supported by the unique attributes and strategic innovations of secondaries, offering strong performance and resilience during market dislocations, and providing investors with attractive risk-adjusted returns and immediate diversification.

📝 Volatility buoys co-investing and secondaries

Adams Street

Despite high valuations in the face of increased volatility and tighter credit conditions, co-investment and secondary market opportunities remain strong. There is a strategic focus on GPs with proven value-creation plans, which helps maintain confidence in current valuations and long-term returns. On the other hand, the secondaries market presents significant opportunities for buyers who understand GP valuation policies well, allowing them to purchase at what they perceive as significant discounts. The challenging fundraising environment has led to an increase in secondaries sales, providing liquidity and rebalancing opportunities for LPs, with $100B raised in 2023 for secondaries (c.3x vs the previous year's total).

📝 Secondaries roundtable: Private markets’ most undercapitalized asset class

Neuberger Berman

Industry leaders explore the expansion possibilities and prospects within the secondaries market, also addressing concerns about the scarcity of liquid capital. "Market expansion is not constrained by the availability of GPs seeking partners or LPs needing liquidity options, but rather by the insufficiency of capital formation. Single-asset continuation vehicles are now accepted as a valid exit route for GPs, and that will continue to be the case. But the growth of this market is dependent on the availability of capital and the level of appetite for this type of deal. There is no reason why single-asset continuation vehicles shouldn’t represent 10-20% of annual deal volume in private equity. There are a lot more potential deals than those that are actually coming to market.”

📝 Disciplined selection is key to co-investments amid higher interest rates

Adams Street

In a high-interest rate environment, the performance gap between the top and bottom quartile PE managers is expected to widen, emphasizing the importance of selecting skilled GPs. Co-investment managers must now focus on investing with sector-specialist managers who have strong track records in value creation rather than relying on financial engineering. They should opt for market leaders in robust sectors, ensuring meticulous underwriting and prudent diversification to navigate the challenges of the current economic climate effectively. “A key attraction of a co-investment program is that it offers access to a well-diversified basket of high-quality private companies with a typically lower all-in-cost. The structural fee advantage of a typical co-investment program is a boost to the net IRR by 200-300 bps.”

📝 Fight the urge

Stepstone

There's a persistent myth in the investment community that prioritizing diversity, equity, and inclusion compromises quality, specifically financial returns. However, data suggests that diverse-owned managers often match or outperform their non-diverse counterparts, despite facing greater challenges in raising capital and achieving follow-on funding. While diverse managers, especially those new or emerging, frequently struggle with access to traditional funding sources and face implicit biases, they still present a significant, though underutilized, opportunity for generating high returns in the private equity sector.

📝 Private equity: Primed for evolution

Goldman Sachs

This report discusses recent trends and activities in the annuitization and corporate pension sectors. Notably, there has been a significant increase in annuitization volume in Q4 2023, with total sales for the year reported at $125B, a 25% increase over 2022. In the corporate pension sphere, plans are shifting more towards fixed-income investments, and the expected return on asset assumptions has risen, averaging 6.3%, influenced by higher interest rates. PE seems to be attractive for pension firms as it “mostly delivered strong returns in the last decade, driven by operational improvements, multiple expansion, and leverage impacts. We believe these strong returns can continue, but the sources of value creation may change. With more costly leverage and limited multiple expansion, operational value creation may take center stage.”

✏️ Will exit activity improve in private equity?

JP Morgan

Private equity demonstrated resilience through the Fed's rate hikes, declining only 2% in 2022 but recovering to 3.2% above its 2021 end-year level, outperforming US small-cap stocks significantly. Despite a decline in PE multiples due to higher interest rates and costly debt financing, the sector maintained stability thanks to robust US economic and corporate profit growth. However, PE deal and exit activities have lagged due to economic uncertainty and a shift towards alternatives, with muted IPO and mergers and acquisitions activity. Looking forward, the secondary market is becoming increasingly vital for providing liquidity, as PE exits remain subdued and central bank easing is expected to be modest.

🎙 Exit strategies with Thoma Bravo’s Holden Spaht (Bain)

SECTOR FOCUS

Energy Transition x Climate Finance

TVJ Spotlight 🔦

📝 Powering up Europe: AI data centers and electrification to drive +c.40%-50% growth in electricity consumption

Goldman Sachs

Europe's power demand has declined by approximately 10% over the past fifteen years due to various shocks and slow electrification. However, the rapid expansion of data centers and increasing electrification could potentially boost demand by 40%-50% over the next decade, significantly impacting corporate profits in the industry. Europe could invest over €800B in wind and solar over 2024-33. The report also talks about REPowerEU plan, which is ambitious clean energy transition plan proposed by the EU in 2022.

✏️ Are economic clusters ready for the green transition?

BCG

Governments are employing two strategies to facilitate economic clusters' adaptation to the green transition: safeguarding existing clusters by helping them evolve and optimize resilience, and sparking new opportunities by leveraging emerging green advantages. This approach, emphasized by initiatives from global organizations like the WEF, aims to minimize disruption, foster economic growth, and advance decarbonization across interconnected regional and national economies.

📝 Carbon market integrity principles

Nuveen

Nuveen supports the use of market-based approaches like carbon pricing and voluntary carbon markets as essential tools to complement direct emissions reductions and help meet the Paris Agreement goals. While carbon markets are not a replacement for necessary emissions cuts, they play a vital role in facilitating financing for natural climate solutions and achieving scalable climate targets. Active commitment is required to enhance the integrity, credibility, and transparency of these markets, actively developing projects that adhere to high standards and contribute meaningfully to climate mitigation.

📝 Striking a sustainable balance

Nuveen

Nuveen experts discuss the dynamic evolution and significant growth potential in the energy transition in the infra sector. Despite challenges like rising interest rates and supply chain issues, they see ongoing opportunities driven by geopolitical shifts and high energy prices. These factors compel investment in sustainable energy projects, including those in innovative sectors like battery storage and renewable fuels, underpinned by evolving investment structures and the critical role of regulatory support. Key themes also include onshoring of infrastructure supply chain and innovation in revenue offtake.

✏️ Financing energy transition – Are small modular reactors poised to bridge the gap?

Natixis

Amidst the push for global decarbonization, nuclear power, especially small modular reactors (SMRs), emerges as a solution. With electricity demand expected to more than double by 2050, low-carbon sources like nuclear will need to increase by 6.5 times. Nuclear's constant energy production and ability to complement intermittent renewables make it crucial in achieving net-zero emissions. The International Energy Agency estimates that current nuclear capacity must more than double by 2050 to meet these goals.

✏️ The green arc of steel’s transition

Impax Asset Management

New technologies and increased use of recycled steel are needed to reduce the steel industry's environmental impact. Hydrogen-based direct reduction (DRI) is a promising method for producing primary steel with much lower emissions. Electric arc furnaces (EAF) which rely on scrap steel can also significantly reduce emissions, especially if they use renewable electricity. Governments and companies are increasingly setting ambitious climate targets and implementing policies to support the transition to greener steel production. This creates investment opportunities for companies that can develop and implement these new technologies.

✏️ Why investors are eyeing the energy transition

OTPP

Ontario Teachers' Pension Plan is heavily investing in the energy transition, with over $34B allocated to green assets such as clean energy generation and technologies that reduce fossil fuel demand. The investment strategy focuses on both financial returns and positive environmental outcomes, exploring innovative technologies like hydrogen and advanced nuclear energy. Major funds are expanding their renewable energy portfolio, including significant projects like green hydrogen storage facilities and major offshore wind developments.

🎙 Investing in the key players in Asia’s energy transition: Emission impossible?

(Abrdn)

Real Estate x Infrastructure

📝 US multifamily in focus: When fear is a friend

KKR

Rising interest rates and a looming loan maturity wall are putting pressure on US multifamily housing, similar to other sectors of commercial real estate. Despite current challenges, including higher debt levels and a significant influx of new supply, the difficulties are seen as cyclical rather than long-term structural issues. Post-2025, the market is expected to rebound with potential rent growth due to a structural housing shortage and high construction costs. This situation presents a promising opportunity to acquire high-quality properties at costs below their replacement value, especially for well-connected investors with deep market knowledge and readily available capital.

📝 Asian infrastructure - Filling in the Gaps

HSBC

The global infrastructure asset class, totaling $1.3T AUM, is vast, yet fund investments are heavily concentrated in the US and Europe, leaving a notable gap for investments in Asia and opportunities beyond the largest assets. “Focusing on mid-market in Asia means there are additional benefits from quicker decision making processes and the ability to adapt more rapidly to the market changes compared to the often slower-moving large-scale projects in US and Europe.” Major opportunities in renewable energy infrastructure as Asia needs to make significant investments in the space in the next few years.

📝 Increasing opportunity in the net lease space

TPG Angelo Gordon

TPG highlights the evolution and robust growth of the net lease sector over the past 30 years, transitioning from a niche area less understood by institutional investors to a significant strategy in real estate investing. Initially intrigued by sale-leasebacks as a way for companies to efficiently manage capital while retaining asset control, the sector has matured with a better understanding of asset types, particularly valuing industrial properties over flashy corporate headquarters due to lower costs and volatility. Today, the net lease market is thriving, driven by a lack of credit availability, making it a strategic option for corporations seeking alternative financing methods. The current high demand for sale-leasebacks, making them an attractive and capital-efficient solution for companies needing to free up resources.

📝 Green leases

UBS

Green leases have evolved to encompass a broader scope of sustainability goals beyond climate change, integrating aspects like biodiversity and community engagement. These leases have become crucial tools in the real estate sector, which is responsible for about 40% of global emissions, by aligning landlord and tenant efforts to meet environmental targets and improve building operations. With the real estate industry facing regulatory pressures to upgrade buildings for better energy efficiency, green leases help address the split-incentive dilemma between landlords and tenants, promoting collaborative efforts towards sustainability and reducing the building's environmental impact.

✏️ Playing offense: How we approach value creation in infrastructure

KKR

Infrastructure investing, often viewed as a defensive play due to its stable returns and essential real assets, involves much more than managing large assets. It includes actively and sustainably managing real businesses with operations, employees, and revenues to ensure long-term growth and sustainability. These efforts focus not only on maintaining steady cash flows and leveraging long-term contracts but also on optimizing operations and pursuing strategic shifts to unlock hidden value. This active management approach aims to improve business efficiency and sustainability, enhancing investment value and offering significant upside potential to infrastructure equity investors.

✏️ NAV 2.0: A better asset pricing model for private infra

EDHEC

The CAPM framework is inadequate for valuing unlisted infrastructure assets due to its reliance on inappropriate models, data, and ad hoc adjustments, resulting in stale discount rates. EDHEC advocates for a modernized approach leveraging better models and machine learning to accurately estimate asset value in real time, termed NAV 2.0.

📜 Periodicals »

📝 Real estate sector: Spring 2024 (Principal Asset Management)

📝 US real estate sector report (Principal Asset Management)

📝 European real estate sector report (Principal Asset Management)

📝 The tactical and strategic importance of real assets (Principal Asset Management)

📝 European real estate: An uneven path ahead (Barings)

📝 US real estate: Recovery postponed but not cancelled (Barings)

✏️ Global real estate market outlook Q2 2024 (Abrdn)

✏️ North America real estate market outlook Q2 2024 (Abrdn)

✏️ European real estate market outlook Q2 2024 (Abrdn)

✏️ UK real estate market outlook Q2 2024 (Abrdn)

✏️ Asia-Pacific real estate market outlook Q2 2024 (Abrdn)

Financial Services

📝 No turning back: KKR 2024 insurance survey

KKR

From 2021 to 2024, the investment landscape for insurance CIOs has dramatically shifted from managing $15T in assets with negative interest rates to none today, due to a sharp increase in interest rates globally. This transition has led insurance CIOs to adeptly manage assets through sophisticated allocation and risk management strategies. These CIOs have successfully navigated the volatile market, building resilient, diversified portfolios that are well-positioned to support new business and deliver robust returns, moving away from traditional reliance on Liquid Credit towards embracing alternative investments. “Having become more comfortable with the diversification and return enhancements that non-traditional investments can achieve, many CIOs are looking for opportunities to selectively allocate more to these areas. 64% of CIOs in our survey envision the Alternatives segment of non-traditional asset classes driving overall portfolio returns going forward.”

📝 Four themes emerging in life insurers’ asset allocations

Barings

Life insurers are favoring higher credit quality assets, with allocations to top-rated bonds increasing while reducing exposure to high yield securities. Additionally, they're shifting towards less liquid investments for potential yield enhancement, signaling a delicate balance between seeking returns and managing risk. This strategic shift reflects insurers' ongoing efforts to optimize their portfolios amidst evolving market conditions, aiming to achieve a prudent balance between yield generation and credit risk mitigation.

📝 Asset management in the ascendancy

Nuveen

Infrastructure investments have shown resilience amid macroeconomic turbulence due to their low correlation to GDP and inflation linkage. These investments are benefiting from fixed-rate financing and inflation indexation, helping navigate the challenges of inflation. However, the environment still demands proactive asset management, particularly in sectors like energy, where regulatory pressures are intense, and in renewable energy, where supply chain issues and planning bottlenecks persist. Leaders emphasize the importance of strategic adaptation, local engagement, and a focus on decarbonization across all investments.

✏️ There’s ‘no going back’ for insurance company investment portfolios

Institutional Investor

Insurance companies, accustomed to conservative investment strategies, have adapted well to higher interest rates, finding the current market environment more typical compared to the past 12 years of abnormal conditions. This shift has allowed them to expand their portfolios with larger pools of liquid assets and increase allocations to alternative investments, enhancing their ability to underwrite more policies and meet return goals. This change indicates a permanent shift towards embracing both complexity and illiquidity in their portfolios.

PRIVATE MARKETS AND ALTERNATIVE ASSETS

TVJ Spotlight 🔦

📝 Global wealth investment playbook

KKR

In a new high inflation and rate environment, the Fed may delay rate cuts until 2025, while other central banks may cut rates this year. US large cap equities may see lower returns due to high rates and valuations, making European equities more attractive despite diversification challenges. Alternatives offer diversification, income, and inflation hedging amid rising correlation between stocks and bonds. “Private Infrastructure can provide downside protection with an element of upside potential. Private Credit can be a reliable income boost. Private Equity can materially enhance total returns across rate environments. Real estate remains a key diversifier with more opportunities emerging on the equity side, in addition to credit.”

📝 Real and alternative assets in focus in the strategic asset allocation

Amundi

Amundi's 2024 Capital Market Assumptions highlight the attractiveness of real and alternative assets due to their superior risk/return profiles, emphasizing the need for careful liquidity management. Despite a slight decrease in expected returns over the next decade, these assets offer diversification benefits and can enhance portfolio performance. Hedge Funds remain effective diversifiers with moderate risk, while infrastructure, private debt, private equity, and real estate present varying opportunities and challenges, requiring a nuanced approach in portfolio construction.

📝 Private markets: Tectonic shifts

TPG

The alternatives industry is undergoing significant shifts, with private markets diversifying across asset classes and geographies, deepening LP partnerships, and introducing innovative products. Industry veterans highlight the trend towards greater consolidation of GP-LP relationships and emphasize the importance of trust, transparency, and alignment for successful transactions amid heightened competition.

📝 Sourcing alpha in the new regime

BlackRock

Financial markets are transitioning to a new regime where active strategies are expected to play a larger role, presenting both challenges and opportunities for investors. As macro uncertainty rises and market volatility increases, the ability to reliably identify top-performing managers becomes crucial in generating excess returns and diversification. This shift underscores the importance of skilled managers in navigating the evolving market landscape and mitigating risks associated with underperforming managers amidst greater return dispersion.

📝 When markets diverge, opportunities emerge

PIMCO

The global economic outlook indicates diverging paths for growth, inflation, and central bank policies. Emphasizing quality and diversification, multi-asset portfolios are modestly overweight in equities, particularly US large caps and select emerging markets, to mitigate inflation risk. Additionally, fixed income investments in developed markets outside the US and selected sectors like US agency mortgage-backed securities and securitized credit are favored, given their attractive risk/reward profiles amidst central bank policies.

📝 Hedge fund outlook H2 2024

Amundi

Hedge Funds have performed well, up 4.2% YTD, outperforming diversified global allocations with strong alpha generation. Market dynamics have shifted, with investors retracing overly optimistic inflation and easing expectations while consumption remains robust in the US. Amid uncertainties, HF are poised to benefit from fragmented economies and monetary policies, offering opportunities in relative value arbitrage and short positions. Looking ahead, L/S Equity Neutral, EM Fixed Income, and Merger arbitrage strategies are favored for the second half of 2024.

✏️ What are private market investments and could they benefit DC pension savers?

LGIM

Private market investments offer potential opportunities for DC pension savers, who rely on maximizing returns for their financial futures. While traditionally DC pensions mainly invest in listed assets, private markets offer illiquid assets like private equity, venture capital, and real estate, potentially providing an 'illiquidity premium' over the long term and diversification benefits. Despite higher fees and complexity, investing in private markets could deliver greater overall value and contribute to societal benefits like clean energy and affordable housing. With appropriate risk management, expanding investments into private markets could enhance member outcomes and drive economic growth.

✏️ Everything investors know about hedge funds is based on flawed data

Institutional Investor

For years, hedge fund performance has been underestimated due to the lack of data sharing from funds above $1B in assets. This missing data skews averages, affecting academic research and investment decisions. A study reveals that commercial databases exclude many high-performing institutional quality funds, leading to inaccurate benchmarks. The study identifies 152 managers with at least $1B in assets missing from these databases. The PivotalPath Composite index, including data from these funds, outperformed other commercial databases by 2.4 percent annually, showcasing higher alphas and lower market risk exposure.

🎥 Public vs. Private markets for long-term investing (Apollo)

🎥 Bolstering resiliency in the US financial system with private capital (Apollo)

Thank you for reading The Valt Journal!

Check out our other editions here.

Disclaimer:

The content provided on this platform contains references and links to external sources, including articles, reports, websites, images, or videos. We do not own or claim copyright over the content found in these external sources. The ownership and rights of the content belong to the original creators.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.