The Valt Journal #26

Featuring latest research on Private Credit (Barings, Amundi, PIMCO, M&G); PE (KKR, Carta, PWC); Real estate, Infra, Energy (UBS, Nuveen, JP Morgan); Alternatives as an asset class (KKR, Abrdn)

Hi, welcome to the new edition of The Valt Journal. In every issue, we cover the best and the latest insights into the global private markets. The Valt Journal is a repository of time sensitive and timeless research, delivered to your inbox every 2 weeks, so you don’t have to look anywhere else! Clicking the headlines is all it takes.

Check out TVJ Spotlights 🔦 including 1) Deconstructing opportunities in IG credit (by Neuberger Berman); 2) An evergreen vehicle can be an important tool in private equity asset allocation (by KKR); 3) Solar PV 3.0 (by Nuveen)

Quickly scan the list of all reports in this edition here!

Numbers this edition:

Links: 56

Authors: 30

PRIVATE CREDIT x FIXED INCOME

📝 Emerging market green bonds

IFC-Amundi

The sixth edition of the 'Emerging Market Green Bonds Report' highlights 2023 trends in green, social, sustainability, and sustainability-linked (GSSS) bonds, projecting future developments. The report notes a rebound in GSSS bond issuance driven by easing inflation, climate initiatives, and favorable conditions, with significant growth in sovereign issuance supporting green construction, renewable energy, and water projects. The acceleration in green bond issuance in emerging markets in 2023 was partly driven by sovereigns which tripled their green bond sales. Financial institutions which increased sales of the securities by 52%, remained the biggest issuers of green bonds.

📝 Collectors vs. Selectors: How (& why) direct lending business models are diverging

Barings

The direct lending market has increasingly blurred with the broadly syndicated market due to the rise of mega deals exceeding $500M, driven by factors such as decreased deal flow and M&A volume. This shift has led some managers to become "asset collectors," purchasing parts of other managers' deals to deploy capital efficiently. However, this can reduce control over deal terms and affect portfolio consistency. Additionally, competition with public markets has resulted in less favorable terms and reduced yield premiums, exposing investors to higher risks without commensurate returns. “Private middle market loans have also offered a premium of roughly 200–400 bps over broadly syndicated loans—stemming from the illiquid nature of the market as well as the value that the asset class provides to sponsors via flexible and tailored financing solutions.”

📝 Capitalizing on the global opportunities in fixed-income

PIMCO

High yields and global divergence create attractive opportunities in global fixed-income markets. Experts prefer increased duration and diversification outside the US, particularly into the UK and Australia, due to their favorable debt dynamics. Investment-grade credit and high-quality agency mortgages are expected to offer a compelling return profile within fixed income.

TVJ Spotlight 🔦

✏️ Deconstructing opportunities in IG credit

Neuberger Berman

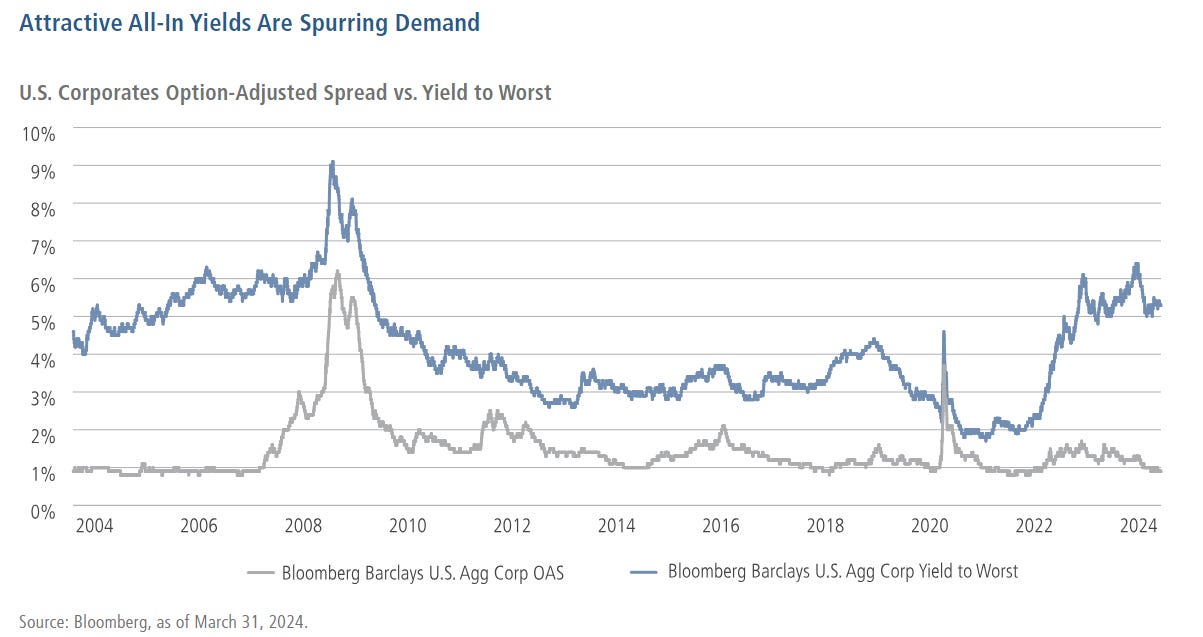

Amid historically narrow spreads in the US investment-grade corporate bond market, solid credit fundamentals and economic resilience have maintained tight trading ranges. Despite increased supply from M&A-related financings, strong demand has absorbed it well. The current environment presents opportunities for skilled sector and credit research to capitalize on potential market dislocations, though an increase in idiosyncratic risk is expected. Investors need to be cautious yet opportunistic, given the healthy but slightly deteriorating credit fundamentals and rising leverage.

✏️ SRTs: Is there really an endgame in sight?

KKR

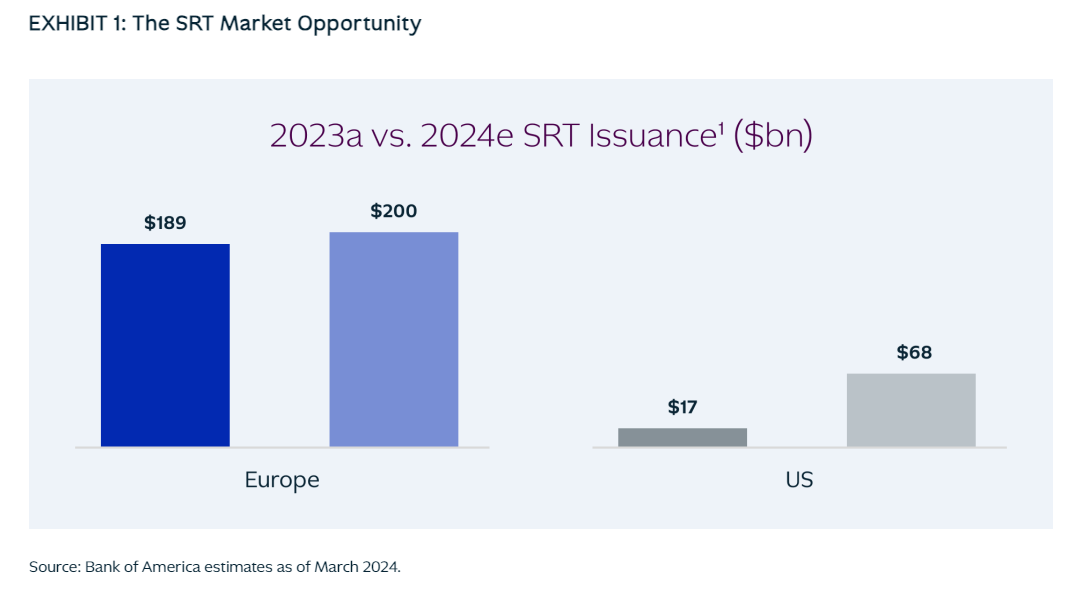

The market for significant risk transfer transactions (SRTs) is growing, with US banks increasingly using SRTs to minimize exposure and manage risk-weighted assets. While Europe has a more established market, the US is catching up, driven by regulatory changes and market shifts. SRTs offer attractive investment opportunities in diverse asset portfolios, such as corporate loans, residential mortgages, and auto loans, allowing investors to select tranches based on their risk-return profiles and benefit from consistent cash flows and high-quality assets.

✏️ Fixed income: What’s the issue with the new issue premium?

M&G Investments

In the first quarter of 2024, surging demand for investment grade (IG) corporate bonds led to negative new issue premiums (NIP), meaning new bonds were more expensive than existing ones. This demand, driven by investors seeking to lock in high yields before potential central bank rate cuts, highlights the significant capital influx into bond markets. Active managers can add value by identifying attractive new issuance opportunities amid this dynamic market.

✏️ Turkish Delights: A deep bond market bursting with opportunity

Nuveen

Turkish investment opportunities in emerging markets debt are attractive due to a diverse range of assets, including blue-chip corporates and sovereign debt. Favorable macroeconomic policy changes have led to increased optimism about local and hard currency debt, despite some valuations being high. The focus remains on select Turkish corporates and banks, known for their strong management and financial resilience. However, political stability and continued policy orthodoxy are essential for sustaining these positive trends.

✏️ EU rate cuts are coming, with significant opportunities for fixed income

Abrdn

The ECB is expected to begin cutting interest rates in June due to improved inflation dynamics, benefiting European fixed income by driving yields lower and prices higher. This shift offers significant opportunities, especially in short-maturity investment-grade corporate and government bonds. Despite some risks, these bonds are expected to perform well, with high starting yields and the potential for strong returns as rates decline. The key factors to monitor are inflation, growth, and ECB policy decisions.

✏️ Navigating the challenges: EU securitisation regulation and its effects on investors and markets

PIMCO

The EU securitisation market has been significantly transformed by regulatory changes over the past 15 years. While these changes were necessary to address issues from the GFC, such as high leverage and risky lending, they have also reduced issuance and investment opportunities. To maintain quality and promote growth, further regulatory adjustments are needed. “Securitisation deals are commonly sold in tranches, offering varying degrees of credit risk and return and facilitating a more efficient transfer of risk. This means that more risk-averse, high-quality-focused market participants have the opportunity to invest in loss-remote but lower-returning senior tranches, while more opportunistic and sophisticated investors have the opportunity to invest in higher-returning, first-loss, and subordinated tranches.” [Paywall]

✏️ Where are mortgage rates headed?

JP Morgan

The pandemic housing boom was driven by low supply, high demand, and rock-bottom interest rates, but rising mortgage rates and home prices have since made home ownership less attainable. While a modest decline in mortgage rates from 7% to 6-6.5% is expected over the next 12-24 months, rates are unlikely to drop below 5%. Treasury rates and the mortgage spread impact mortgage rates, and even if long-term Treasury yields decline, high demand for housing will keep home prices elevated, limiting improvements in housing affordability.

📜 Periodicals »

📝 Fixed income perspectives Q2 2024 (Principal Asset Management)

📝 Weekly fixed income musings (Goldman Sachs)

📝 Weekly commentary - Shedding light on private credit (Northern Trust)

✏️ Unconstrained fixed income views: May 2024 (Schroders)

✏️ Emerging market debt: Review and outlook April 2024 (Abrdn)

🎙Fixed income explained podcast - The credit special (Abrdn)

🎥 Insurance-linked securities and cat bonds, an asset class on its own (Axa)

🎥 Future of Finance 2024: Future areas of growth in private credit (Fortune)

PRIVATE EQUITY

TVJ Spotlight 🔦

✏️ An evergreen vehicle can be an important tool in private equity asset allocation

KKR

KKR explores private equity investing, focusing on basics, market issues, and benefits, especially in a higher-rate environment. Evergreen private equity fund structures offer advantages, such as faster allocation and efficient capital management for individual investors. Unlike traditional drawdown funds, evergreen vehicles allow immediate investment and continuous capital recycling, maintaining market exposure and minimizing reinvestment risk.

✏️ How private equity operating partner roles are changing

PWC

Private equity firms are increasingly relying on operating partners or teams to assist portfolio companies (portcos) through value creation plans from pre-diligence to exit. This role, which now spans the entire deal life cycle, has gained prominence as traditional financial engineering's impact has diminished, with operational improvements now contributing 47% to value creation. High valuations and interest rates have led PE firms to focus more on substantial operational transformations and adapt to new market conditions, as limited partners demand sophisticated operational expertise. Many firms are restructuring their teams to meet these evolving demands and create value for investors.

✏️ Top PE funds see mediocre returns as exits slow

Institutional Investor

A new academic analysis shows that many top private equity LBO funds have barely outperformed the stock market, with returns only 5% higher than the S&P 500. These funds, often holding unsold portfolio assets marked to market, face long liquidation periods averaging over 12 years. Despite their higher leverage and associated risks, their returns have not significantly exceeded public market equivalents. Asset selection criteria and manager skills are critical.

✏️ Lack of exits, lower VC valuations are driving a late-stage lull

Carta

In Q1 2024, VC deal activity at Series D and later stages slowed down significantly, with only 39 late-stage rounds closed, the second-lowest since early 2019. Raising capital has been challenging due to the high operating costs of late-stage startups. The median round sizes also dropped, with Series D rounds averaging $22M and Series E+ rounds averaging $45M, down from $49M and $59M, respectively, in the previous quarter.

🎥 Attractive deal dynamics in the GP-led secondaries market (TPG)

SECTOR FOCUS

Energy Transition x Climate Finance

📝 Energy transition Q2 2024 update: Levelized cost of electricity from renewables

Nuveen

A recent white paper indicates that the cost of power from key renewable technologies—solar PV, onshore wind, and offshore wind—may start to decline after 2024, with significant reductions expected by 2030. By 2050, the levelized cost of electricity (LCOE) for solar PV could drop by 55%, while fixed and floating offshore wind could see reductions of 39% and 84%, respectively.

✏️ Why choose semi-liquid funds for investing in renewable infrastructure?

Schroders

For years, large institutional investors benefited from illiquid assets, but now private investors can access high-quality opportunities like energy transition-related infrastructure, offering higher returns and diversification. New structures, like semi-liquid funds, provide easier access and liquidity, balancing long-term investments with periodic redemption options. These funds support sustainable energy initiatives, ensuring investors can participate in the growing energy transition market while managing their exposure and maintaining portfolio flexibility.

TVJ Spotlight 🔦

✏️ Solar PV 3.0 – the next wave of innovation in the solar industry

Nuveen

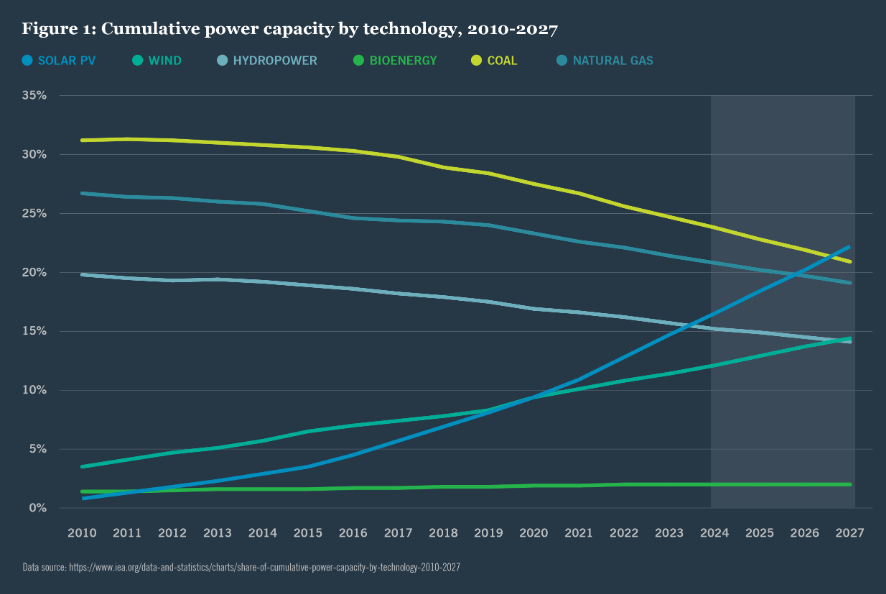

Solar photovoltaic (PV) technology, initially developed for space exploration, has evolved significantly, becoming a mainstream energy source due to reduced costs and improved efficiency. The upcoming phase, solar PV 3.0, will see further capacity growth and reconfigured power networks to support renewables, aiding in achieving 2050 net zero carbon goals. Key developments include solving energy supply intermittency with battery storage, increasing distributed solar power generation, enhancing solar asset efficiency through repowering, and producing green hydrogen as an alternative energy source.

📝 Clean energy report

Pitchbook

In Q1 2024, VC deal value for clean energy technologies reached $3.5B, down from the 2023 quarterly average of $4.1B. The deal count dropped sharply by 32.8% compared to Q4 2023. Early-stage deals dominated the quarter, raising significant funds across segments like grid infrastructure and renewable energy. [Paywall]

📝 Global climate investing survey 2024

Robeco

The 4th Global Climate Investing Survey reveals that investors are increasingly focused on decarbonizing portfolios and transitioning to a low-carbon economy with careful deliberation and scrutiny. While sustainable investing enthusiasm wanes in North America, the Asia-Pacific region now matches Europe in recognizing its importance. Robeco emphasizes that companies embracing sustainability and the energy transition will be future leaders, with c.$125T needed to achieve net zero by 2050. Robeco's 25 years of expertise in sustainable investing supports clients in finding opportunities and driving meaningful change across all sectors.

✏️ The state of climatetech: 2024 and beyond

Insight Partners

Global temperatures are at an all-time high, and $82B is allocated for climate tech. Climate change poses significant risks for enterprises, leading Fortune 500 companies to use software for managing climate risks, such as agricultural weather, property weather, carbon investments, grid strain, and emissions reporting. Experts talk about the urgency of decarbonization, the role of AI, proactive corporate emissions targets, and the need to enhance grid resilience using technology to meet rising renewable energy demands.

✏️ Private equity value creation series: Sustainable investing trends

Goldman Sachs

Sustainable investing is complex, with growing regulatory requirements leading to reporting fatigue. Companies are focusing on impact management and measurement, especially the social aspects of ESG. Tools like Novata and Watershed aid in data collection and reporting. Goldman Sachs' Value Accelerator and Sustainability teams support companies in navigating regulations, streamlining data collection, and integrating ESG factors into their strategies. Impact measurement remains challenging, with varied metrics and evolving standards, particularly in assessing carbon benefits and determining responsibility for reductions.

📝 Key takeaways from PIMCO’s sustainable investing report 2023

PIMCO

The sustainable investing landscape is evolving with global regulation, climate transition risks, and capital flows to underserved markets driving new opportunities in thematic bonds, transition finance, and private credit. Managers need to expand their analytical capabilities and frameworks across fixed income, structured products, and real estate, focusing on climate risk, carbon analytics, and ESG scoring. “Despite a decrease in absolute issuance of ESG-labeled bonds in 2022 and 2023, the proportion of ESG labels within corporate fixed income indices continues to grow, partly due to a higher rate of traditional bonds exiting these indices.”

📝 Animal Farm: agriculture from an investor’s perspective

JP Morgan

Food inflation remains high despite declining commodity prices, driven by factors like labor, production costs, and grocery store profit margins. Agricultural investments, seed bio-engineering, and geopolitical impacts on food prices are also key topics. “Over the medium term, positive farm driversinclude crop demand from renewable diesel/aviation fuel demand, and rising demand for US agricultural exports. Drags include premiums for “green” fertilizer (green hydrogen > green ammonia > green nitrogen fertilizer), a shift from diesel to more costly electrified farm equipment and increased ESG tracking/reporting standards imposed by wholesale customers.”

✏️ Agriculture and Energy: A historic intersection

Institutional Investor

Corn and soybean oil are crucial for ethanol and biomass-based diesel production, respectively. The growing energy application of soybean oil has increased interest in Soybean Oil futures, enhancing market liquidity. Historically, agriculture and energy have been intertwined, with biofuel production now significantly influencing agricultural demand. In 2023/2024, nearly half of the US soybean oil consumption and 35% of corn production are projected to be used for biofuel, underscoring the importance of feedstock biofuels in modern agriculture.

✏️ Financing the transition to a carbon-neutral economy

Bain

Pioneering banks will reap substantial rewards as they help companies and consumers shift the economy away from heavy carbon-emitting activities. Banks are expected to invest $600B p.a. through 2030, with the opportunities clearly expected to emerge in US and Europe. Banks are also expected to generate c.$45B of incremental revenues annually through 2030 from financing the energy transition, majorly via corporate loans.

Real Estate x Infrastructure

📝 A missing piece in your portfolio

Principal Asset Management

Investing in essential service providers can diversify portfolios and reduce risk across market cycles. Integrating listed infrastructure into a traditional 60/40 portfolio by substituting 10% of equities can offer similar returns with lower risk. Listed infrastructure has historically outperformed during major equity market drawdowns, demonstrating its defensive qualities, as seen in the 2022 drawdown.

✏️ A bright outlook for European real estate

KKR

Markets have re-priced substantially, but fundamentals remain strong, particularly in logistics, residential, student housing, and hospitality sectors. With yields stabilizing in European markets, the worst of the re-pricing may be over. Now is seen as an opportune time to allocate investments before positive sentiment is fully priced in, as buying opportunities are increasing.

📝 Mastering the last mile

Partners Group

Last mile logistics is crucial for businesses due to urbanization and e-commerce growth, but investors face increasing complexity from evolving occupier needs, technical specifications, and stricter ESG requirements. A focus on understanding occupier needs and local market dynamics provides a competitive advantage in this growing and competitive sector and to pick attractive opportunities.

✏️ Fundraising in infrastructure

UBS

Infrastructure investing is seeing a resurgence of "animal spirits" with increased risk-taking and market activity in early 2024, following a cautious 2023. Positive announcements of successful fund closings have improved sentiment, with the average infrastructure fund size rising significantly. Sector-specific strategies have also become more prevalent, accounting for 30% of funds raised in recent years, compared to 10% in 2019.

✏️ China: Property easing measures are speeding up

Principal Asset Management

China's cautious approach to property policy easing gained traction after the April politburo meeting, resembling successful measures from 2008 and 2015. Recent policies include cutting down payment ratios and mortgage rates, and converting unsold properties to public housing. These measures are expected to stabilize the property market, essential for economic recovery, presenting a compelling investment opportunity in China.

Artificial Intelligence x Technology

📝 Artificial intelligence & machine learning report

Pitchbook

In Q1 2024, AI and ML VC funding reached $21.6B, driven by a few megadeals for companies like Anthropic, Mistral AI, and xAI. This trend of significant investments is continuing into Q2. Early-stage AI companies are seeing higher median valuations than late-stage ones, indicating strong investor interest. Hardware acceleration remains a key exit strategy, highlighted by notable IPOs and acquisitions. The semiconductor sector is expected to continue producing larger outcomes compared to software, with potential high-value acquisitions for AI startups. [Paywall]

📝 Crypto report

Pitchbook

In Q1 2024, crypto fundraising surged, with startups securing $2.4B across 518 deals, a 40.3% increase in invested capital and a 44.7% rise in deal volume from the previous quarter. Infrastructure startups led the funding. Valuations rose significantly across all stages, with early-stage deals earning higher valuations than late-stage ones. Deal sizes also increased for pre-seed/seed and early-stage rounds but decreased for late-stage rounds. [Paywall]

✏️ Investing in a digital tomorrow

UBS

Digital infrastructure, such as data centers, fiber networks, and mobile towers, is crucial for supporting technological innovations like AI, IoT, industrial automation, blockchain, and virtual reality. The sector has grown significantly, driven by increased demand during the COVID-19 pandemic and substantial investments. Despite challenges from supply chain disruptions and interest rate hikes, the sector is maturing and poised for development driven by fundamental growth rather than speculation. This infrastructure will be central to the future digital economy, enabling advancements across various industries.

✏️ Megatrends: Transformative technology

Nuveen

Generative AI is set to transform the global economy and workforce, potentially adding $2.6-$4.4T to annual GDP and automating 60-70% of current employee tasks. This wave of AI-driven automation will significantly impact higher-wage and highly educated workers, while also accelerating labor productivity growth by 0.1-0.6% annually through 2040. AI is driving cross-sector opportunities and impact across areas like real estate, infrastructure, natural capital.

Financial Services

📝 Investing in insurance-linked strategies in a changing climate Q2 2024

LGT Capital

Investors in insurance-linked strategies (ILS) saw strong returns in 2023 due to a higher premium environment and strategic adjustments focusing on risk-remote transactions. Despite significant catastrophe losses exceeding $130B for primary insurers, ILS managers mitigated impacts by concentrating on single, extreme events. Climate change remains a serious concern, but careful portfolio management in ILS can still yield attractive returns amidst increased event activity.

✏️ What’s going on with auto insurance costs?

JP Morgan

April's CPI print matched expectations, but inflation remains high and persistent, particularly in the service sector. "Super core" inflation, driven significantly by a 22.6% annual increase in auto insurance premiums, remains problematic. Factors contributing to rising auto insurance costs include higher vehicle prices, increased claims, more uninsured drivers, and regulatory delays.

Consumer x Healthcare

✏️ Innovation and M&A driving biotech recovery

Wellington Management

We are optimistic about the biotech market's recovery, supported by an improving macroeconomic environment, robust M&A activity, and strong sector fundamentals. Key signals include high levels of innovation, record M&A activity in 2023, investor willingness to fund advancing companies, and successful public market access for private companies. With 55 new FDA drug approvals in 2023 and continued regulatory support, biotech innovation is expected to drive progress and M&A momentum, benefiting both large and smaller companies with promising early-stage assets.

✏️ The cash generics opportunity in health care

BCG

Access to affordable medications is a significant challenge in the US. The cash generics market, where patients buy generic drugs out of pocket, could reach $10-$15B by 2030. Two models, direct cash pay at cash-only pharmacies and prescription discount cards, are expanding access and affordability for around 140M US patients. These models also increase pricing transparency and streamline the medication purchase process, contributing to a more sustainable industry.

✏️ The evolution of the consumer staples sector

MFS

Technology and mobile devices have significantly impacted consumer staples, once a stable sector with low competition and high brand loyalty. E-commerce and social media have democratized the market, lowering barriers to entry and increasing consumer choice. As a result, established brands face new competition, requiring investors to focus on company-specific factors and category growth to identify opportunities.

PRIVATE MARKETS AND ALTERNATIVE ASSETS

✏️ Private markets house view H1 2024 summary

Abrdn

The private markets outlook for the first half of 2024 predicts varied impacts across asset classes due to enduring inflation and high interest rates. Private equity faces challenges with smaller deal sizes and increased use of continuation funds. Infrastructure remains resilient, especially in energy-efficient technologies, while real estate anticipates price adjustments, particularly in office and industrial sectors. Private credit sees growing demand, driven by tighter lending markets, and natural resources benefit from energy transition needs. Overall, diversification and working with experienced partners are emphasized for success.

✏️ Can investment management harness the power of AI?

JP Morgan

In Q1 2024, about 45% of S&P 500 companies mentioned AI in earnings calls, with capital expenditures rising significantly to support AI deployment. The financial services industry, among others, is adopting AI for enhancing research processes, optimizing portfolio management, and improving trading efficiency. Major corporates are increasing their technology spend to integrate AI, but must also manage risks such as data security and ensuring proper human oversight. AI adoption across industries is expected to increase in the next six months, reflecting ongoing investments and reorganization efforts.

✏️ The case for emerging markets

UBS

In 2022, despite fears of instability, many emerging markets (EMs) managed the interest rate hikes better than expected by raising rates early and maintaining sustainable debt levels, resulting in controlled inflation and currency gains. Investors are encouraged to reconsider EM allocations due to their strong macroeconomic fundamentals, attractive valuations, and positive growth differentials with advanced economies, presenting opportunities for improved risk-adjusted returns in global portfolios.

✏️ Liquidity tension between LPs and GPs persists

Institutional Investor

Tough market conditions have strained relationships between investment managers and capital allocators. Limited liquidity has balanced the power dynamics between general and limited partners but introduced new challenges. Experts talked about the misunderstandings between LPs' liquidity needs and GPs' portfolio management. Despite these tensions, current market conditions offer significant investment opportunities, particularly in early-stage ventures and private credit markets.

✏️ Investing in India’s ambition

UBS

India is emerging as a geopolitical and economic superpower, offering attractive investment opportunities in its rapidly growing market. Key drivers include an expanding middle class, stable government, improving export competitiveness, and global relocation of manufacturing. Despite its potential, India poses risks for foreign investors, necessitating selectivity and on-the-ground research. Current government, aiming for a third term, seeks to elevate India to the third-largest economy and a developed nation by 2047. With strong economic growth and a booming middle class, India presents a compelling long-term investment case.

✏️ Understanding TVPI (Total Value to Paid-In)

Carta

Total value to paid-in (TVPI) is a metric used by private equity and venture fund managers to evaluate a fund's performance, expressed as a multiple of the total capital paid into the fund. It sums realized investments (distributions already made to investors) and unrealized investments (current value of holdings) and divides by the total paid-in capital. TVPI is most relevant during a fund's life, becoming equal to distributions to paid-in capital (DPI) upon the fund's liquidation.

🎥 Positioning portfolios across global asset classes (PIMCO)

🎙 Building Resilience: Selecting the right assets for an alternatives portfolio (Apollo)

🎙 Fishing in less crowded ponds: Identifying opportunities in emerging markets (Mawer)

Thank you for reading The Valt Journal!

Check out our other editions here.

Disclaimer:

The content provided on this platform contains references and links to external sources, including articles, reports, websites, images, or videos. We do not own or claim copyright over the content found in these external sources. The ownership and rights of the content belong to the original creators.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.