The Valt Journal #27

Featuring latest research on Private Credit (Barings, M&G, Nuveen, UBS); PE (Bain, Pitchbook, Adams Street); Real estate, Infra, Energy (Robeco, Principal AM, GS); Alts as an asset class (JPM, MS)

Hi, welcome to the new edition of The Valt Journal. In every issue, we cover the best and the latest insights into the global private markets. The Valt Journal is a repository of time sensitive and timeless research, delivered to your inbox every 2 weeks, so you don’t have to look anywhere else! Clicking the headlines is all it takes.

Check out TVJ Spotlights 🔦 including 1) High yield structured credit (by M&G); 2) Portfolio finance: Missing a $100B+ annual opportunity? (by Barings); 3) Private equity midyear report 2024 (by Bain)

🚀 New Launch Alert: The Valt Journal Library 🚀

Our private markets and alternative assets focused live repository featuring a collection of c.5K research reports and articles from 150+ global asset managers and experts across 4 categories and 40+ sub-categories for an efficient, fast and seamless research experience.

Quickly scan the list of all reports in this edition here!

Numbers this edition:

Links: 78

Authors: 37

PRIVATE CREDIT x FIXED INCOME

TVJ Spotlight 🔦

📝 High yield structured credit: Ripe conditions within the European market

M&G Investments

Investors can achieve double-digit returns in Europe due to structural protections and complexity premiums. Opportunities across five interconnected asset sourcing areas within Structured Credit: 1. Significant Risk Transfer (SRT); 2. Consumer specialty finance; 3. Corporate specialty finance; 4. CLOs; 5. Residential mortgage-backed securities (RMBS) and consumer asset-backed securities (Consumer ABS).

📝 Direct lending market update

Stepstone

Direct lending saw strong returns and stable yields (12% returns in 2023), with middle-market companies showing resilience. Despite a slowdown in private equity, there was a resurgence in transactions towards the end of 2023, driven by private equity firms' need to deploy capital. While public markets' optimism may be risky, direct lending offers attractive risk-adjusted returns.

✏️ Charting the course of direct lending in the US and Europe

Man Institute

The US direct lending market is more developed and larger compared to Europe, which remains fragmented and less mature. While Europe shows growth potential, its long-term outlook is unclear due to regional complexities and regulatory challenges and efficient diligence is required. The US market benefits from deeper capital markets and a trend of bank retrenchment, offering higher yields and a more robust ecosystem of experienced managers.

✏️ US direct lending: The portfolio effect

Nuveen

Mid-market activity in 2024 is picking up, driven by existing portfolio company transactions and tuck-in acquisitions, despite high interest rates. Senior lending sees renewed competition and spread tightening, while junior capital focuses on high-quality assets with productive uses for capital. Portfolios are holding up well in a high-rate environment, with low default expectations. Managers with scale, execution capabilities, and strong relationships are best positioned to succeed.

TVJ Spotlight 🔦

📝 Portfolio finance: Missing a $100B+ annual opportunity?

Barings

Private markets are projected to reach $17.6T by 2027. The funding gap due to bank retrenchment presents opportunities for institutional investors through various portfolio finance strategies, such as Private Equity NAV lending, Private Credit Portfolio Finance, and Secondary Portfolio Finance, which offer attractive risk-adjusted returns and investment-grade credit profiles. Core Portfolio Finance provides investors with access to high-quality, diversified private credit investments, potentially yielding higher spreads than public benchmarks.

📝 Portfolio finance for insurers

Barings

Barings explains that portfolio finance involves lending against diverse portfolios of private market assets, offering structural subordination and collateral benefits. This asset class is attractive to insurance portfolios for its defensive characteristics and diversification benefits. Success in portfolio finance requires scale, direct relationships, and a strong track record.

📝 Four reasons to revisit EM corporate short-duration debt

Barings

Four key reasons include: 1. Compelling valuations providing attractive yields compared to developed market counterparts; 2. Lower volatility due to their shorter maturities & attractive risk-adjusted returns; 3. Robust corporate fundamentals; 4. Global & diverse opportunity set.

📝 Senior secured loans: 101

Barings

Senior secured loans in the broadly syndicated market offer attractive yield potential with protection against credit and interest rate risk, providing multiple layers of credit protection, asset-backing, and covenant restrictions. These loans, issued by below-investment-grade companies, feature low relative volatility, greater price transparency, and liquidity compared to private credit, making them a compelling choice for investors seeking stable returns and diversification in a higher-yielding, lower-risk asset class.

📝 The advantages of being a lead lender

Adams Street

Lead lenders in private credit enjoy significant advantages, such as privileged data access, influence over capital structure, covenants, loan terms, and earlier engagement in the underwriting process compared to participant lenders. These benefits can lead to superior risk-adjusted returns and incremental fees.

📝 Yield advantage

PIMCO

PIMCO suggests a re-evaluation of the traditional 60/40 asset allocation, highlighting opportunities in fixed-income and asset-based lending. “Today’s yields and a stabilizing inflation outlook are enabling bonds to reassert their fundamental advantages in portfolios: providing potential for attractive income, downside resilience, and stability through reduced correlation with equities.”

📝 Investment grade credit – focus on the idiosyncratic

Capital Group

Tightening credit spreads make investment grade opportunities increasingly company-specific. “As credit spreads have tightened, the opportunity set within IG has shifted toward the idiosyncratic. This might be because of dispersion within a sector, region or individual issuers. For such bonds, less familiarity with the issuer among investors can often result in them offering an additional spread to their equivalent domestic issuance.”

✏️ Yielding answers: Are cash investors being complacent?

UBS

In 2023, money market yields attracted significant asset flows due to high short-term rates driven by central bank policies to control inflation. As central banks normalize policies, the allure of money market yields is expected to fade, prompting a shift to longer-duration assets.

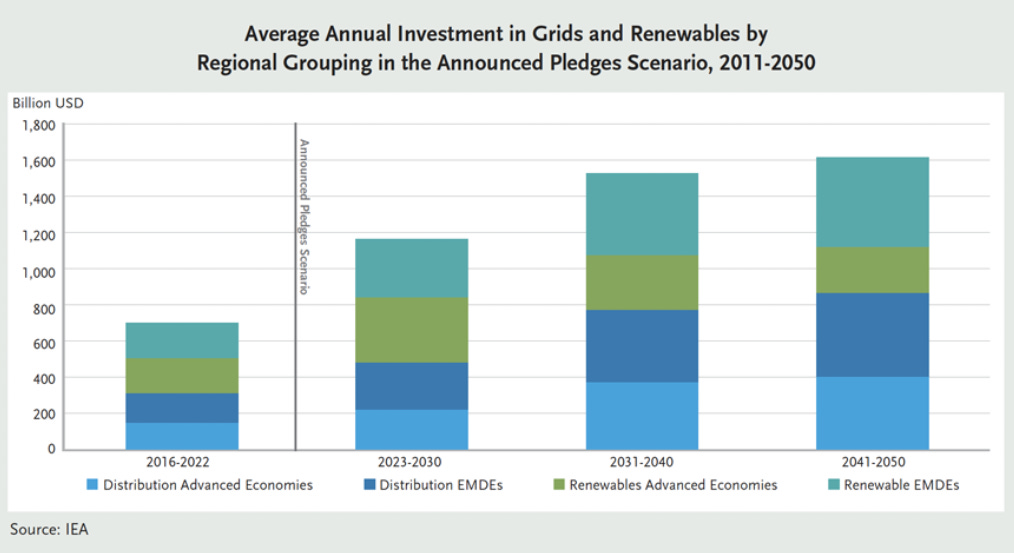

✏️ Infrastructure debt in a sweet spot for 2024

UBS

Infrastructure debt investors can expect more opportunities with attractive risk-adjusted returns in 2024 due to elevated base rates and improved credit fundamentals. Infrastructure debt fundraising remained resilient (overall funds raised in 2023 fell by over 50%). With strong fundamentals and opportunities in sectors like decarbonization and digitalization, infrastructure debt is well-positioned for growth driven by an annual investment gap of $3T+ till 2050 to achieve net zero goals.

✏️Asset-backed securities: Resilience in uncertain times

Axa Investment

In a challenging economic environment with slowing growth, high rates, and volatile markets, Asset-Backed Securities (ABS) offer attractive yields, higher spreads, and resilience. ABS provides unique access to consumer assets, diversification, and defensive performance. Their floating rate nature, short duration, and regular principal repayments make ABS a strong addition to institutional portfolios seeking stability and yield.

✏️ Capitalizing on a new era of non-bank lending

Varde

Varde Partners identifies the current market environment as a key phase for non-bank lending in commercial real estate, driven by higher capital costs, a refinancing wave, and the pullback of regional banks. Their focus remains on multifamily, student housing, and hospitality sectors, anticipating significant lending opportunities amid the convergence of macroeconomic forces and shifting market dynamics.

✏️ Higher expected returns with systematic fixed-income

Dimensional

A systematic approach to fixed-income investing can enhance returns by targeting bonds with higher expected returns based on duration, credit quality, and currency of issuance. This method addresses specific investor needs, such as inflation protection and sustainability, and can outperform both active and passive strategies by using market information. Historical data shows that a systematic approach results in higher returns compared to market-value-weighted benchmarks, with notable outperformance in both US and global portfolios.

✏️ Spring into higher yields

Goldman Sachs

With high supply persisting and tax liabilities driving broader selling, the yield environment has improved since late 2023. However, seasonal supply-demand imbalances and potential higher taxes could lower yields soon, making the current period a strong entry point for investors before anticipated Fed rate cuts.

✏️ EU rate cuts: significant opportunities for fixed income

Abrdn

The ECB initiated interest rate cuts in June, lowering rates to 3.75% following improved inflation dynamics. This transition from hikes to cuts is expected to benefit European fixed income, presenting opportunities for income and capital gains. ECB's policy shift and the performance of short-maturity investment-grade corporate and government bonds offer promising returns, especially with high starting yields and attractive spreads.

✏️ Regional Q&A: European credit with Jim Vanek

Apollo

Europe's healthier banking system and anticipated rate cuts present opportunities for hybrid financing solutions, while in the US, a higher-for-longer rate environment creates attractive lending conditions. "Hybrid financings – including things like preferred equity and convertible solutions – can be an effective tool to deleverage balance sheets in a non-dilutive manner and bridge companies through to a different rate environment, or provide liquidity to owners in an environment where exiting via a sale or IPO may not be desirable."

✏️ Are US and European bonds about to break ranks?

Neuberger Berman

Despite significant differences in economic growth, inflation, and interest rate policies, US and European bond markets have shown unusually high correlations in 2024, presenting potential opportunities for relative-value and dispersion trades. This could make trading relative value and increased dispersion between European and US yield curves attractive in the latter half of the year.

✏️ European banking credit: financially sound?

LGIM

Strong banking fundamentals, driven by higher interest rates, improved balance sheets, and credit rating upgrades, have boosted profitability. However, quality varies significantly within the sector, prompting a preference for well-diversified, well-capitalized banks, particularly in Italy and Spain.

✏️ The lost art of credit analysis in buy and maintain management

M&G Investments

As the credit cycle matures, insurance companies must adapt their risk management strategies for core fixed-income portfolios. Traditional "buy and maintain" approaches, which have thrived in stable conditions, are now being tested by economic uncertainties and deteriorating corporate credit quality. Active portfolio management, supported by rigorous credit analysis, is essential to navigate the increased risk of downgrades and defaults, ensuring long-term investment resilience and stability.

✏️ Climate transition bonds: Seven sustainable investing takeaways

Abrdn

Key learnings in the note include the prevalence of greenwashing, the complexity behind sustainable investment labels, and the need to thoroughly evaluate 'green' bonds beyond their labels. Investors can apply a different approach by targeting high-emission sectors and companies with credible decarbonization plans, rather than just focusing on low-emission companies, to make a real impact on climate change.

✏️ Funding development in today’s market

ICG

The real estate development landscape has changed significantly in the past 18 months, creating new opportunities for debt investors in UK and Europe. Rising interest rates have impacted development viability in the UK, making alternative capital sources more relevant for developers.

📜 Periodicals »

📝 Weekly fixed income musings (Goldman Sachs)

✏️ Weekly CIO commentary: Looking for yield in all the right places (Nuveen)

✏️ High yield monthly update (Nomura)

🎥 Navigating dynamic high-yield markets (Barings)

🎙 Explosion in esoteric ABS issuance (TCW)

PRIVATE EQUITY

TVJ Spotlight 🔦

📝 Private equity midyear report 2024

Bain

PE activity in deals, exits, and funds closed showed signs of stabilization in early 2024, but momentum remains low. LPs are pushing for increased distributions and are focused on favored funds, while GPs face challenges in achieving attractive outcomes. Although deal pipelines are beginning to refill, low distributed to paid-in capital (DPI) levels and macroeconomic uncertainties continue to impact fundraising and transaction activities.

📝 Embracing down rounds: A potential path to long-term equity value

Adams Street

Managing a down round can be more advantageous than cutting cash burn to maintain long-term revenue and equity growth. For companies with solid business models, the benefits of sustained revenue growth can outweigh the dilution from a down round. Provisions can help mitigate the dilutive effects on existing shareholders. In 2023, 14.2% of US financings were down rounds, the highest since 2017. Down rounds can secure necessary capital for growth, countering the negative perceptions and enabling better long-term equity value creation.

📝 Middle market private equity—Greed versus fear

FS Investments

Investors are turning to middle-market private equity to balance the high valuations and risk complacency in public markets. The discussion highlights how low interest rates, globalization, and tech sector dominance have skewed market valuations, creating a landscape where greed outweighs fear. This environment has led to extreme upside volatility and a false sense of security among investors, emphasizing the need for a more balanced approach.

📝 Motivated sellers create buyers’ market

Neuberger Berman

The reversal of liquidity dynamics in private equity since 2021 has driven increased secondaries volumes, particularly LP portfolio sales, as private equity allocations in institutional portfolios have grown. This has led to motivated selling and more opportunities for buyers. In the GP-led market, there's a focus on creating liquidity through continuation funds, allowing LPs to either monetize or stay invested. Despite high motivation for liquidity, LP volumes were down due to a bid/ask spread, leading to selective buying in the secondaries market.

📝 A piece of the action

JP Morgan

As PE ownership rules in sports leagues expand, this review covers team valuations, profitability, emerging sports categories, streaming revenues, the decline of regional sports networks, and more. Traditionally limited to the wealthy, sports ownership is now more accessible to private equity funds, with minority stakes becoming increasingly popular.

📝 High-performance computing

Pitchbook

High-performance computing (HPC) utilizes powerful processors, networks, and storage systems to solve complex computational problems, essential for scientific research, engineering, and various industries. Modern HPC technologies include multicore CPUs, GPUs, specialized accelerators, high-speed networking, robust storage solutions, optimized software, and cloud-based HPC, which has democratized access to these powerful resources. 400+ investors have invested $4B+ into 280+ companies across 370 deals.

📝 Emerging tech indicator

Pitchbook

The Emerging Tech Indicator (ETI) tracks pre-seed, seed, and early-stage investments by top VC firms, providing insights into promising technologies and investment trends. In Q1 2024, ETI deal activity totaled $3.2B across 132 deals, with AI & ML and biotech leading investments. Despite a drop from peak levels in Q1 2022, ETI deals constituted 11% of all early-stage VC funding. Investment values and deal sizes remain volatile, reflecting recent market corrections.

🎥 Deal dynamics & the case for diversification (TPG)

🎙 Driving impactful growth despite the high cost of capital (Morgan Stanley)

🎥 Growth equity as an attractive asset class (Adams Street)

SECTOR FOCUS

Energy Transition x Climate Finance

📝 US offshore wind: Blowing in the right direction

Nuveen

Global offshore wind capacity will reach 328 GW by 2030, contingent on supportive government policies. Offshore wind's share of global wind energy is expected to grow from 8% in 2020 to 34% by 2050. The US offshore wind industry is expanding, which is mobilizing significant investment. However, the industry faces challenges such as supply chain constraints, rising costs, and regulatory hurdles.

📝 Fertile ground

OTPP

Agriculture contributes c.4% to global GDP and plays a larger role in some economies. Agricultural transformation through sustainable, efficient, and innovative practices is essential. Investors can significantly support this sector by deploying capital to address these challenges and drive economic development. Global farmlands grew at 10% CAGR over 20 years.

✏️ Power-to-X: amplifying renewable energy

Nuveen

Investors, companies, and governments are prioritizing renewable energy to meet net zero goals by 2050, with Power-to-X (PtX) processes playing a key role. PtX converts renewable energy into various forms, like hydrogen and synthetic fuels, helping to address the intermittency of wind and solar power and decarbonize hard-to-electrify sectors such as heavy transport and industrial processes. This technology also supports long-term energy storage and increases the potential for clean energy investments.

✏️ Asia makes huge strides in commitment to climate investing

Robeco

APAC investors now lead in climate-focused investment policies, with 79% prioritizing climate change, surpassing Europe (76%) and significantly higher than North America (35%). This shift reflects strong progress in Asia and a backlash in North America against integrating ESG factors due to perceived costs. Commitments to net-zero emissions by 2050 have increased in Asia to 26% while remaining stable in Europe (37%) and declining in North America (13%).

📝 Feeding the world sustainably – challenges and opportunities

Principal Asset Management

With the global population expected to reach 10B by 2050, food demand will grow by 56%, necessitating innovative and sustainable agricultural solutions. Precision agriculture, digitalized irrigation, and enzyme technology are promising approaches to increase efficiency, reduce waste, and create value for investors in sustainable farming practices - 15x+ expected growth in sustainable solutions market during 2019-30 period.

📝 The hidden silver lining of the energy crisis

Principal Asset Management

Inflation has strained household budgets globally, but it has also accelerated the deployment of renewable energy and green technologies to reduce dependence on fossil fuels. An expected 3.5x growth in renewables from 2022 to 2030, presents substantial investment opportunities in green technologies and renewable energy infrastructure.

✏️ A transition opportunity – Investment framework in action

TCW

The transition to a low-carbon economy requires transforming energy systems from fossil fuels to sustainable alternatives, focusing on electrification and decarbonization of combustion. TCW identifies investment opportunities across the transition value chain, emphasizing the role of legacy high-emitting sectors in decarbonization. Significant infrastructure investment will be needed, creating opportunities in transmission, storage, and energy system transformation.

📝 Environmental transition: Capturing opportunity and driving real-world impact

Goldman Sachs

Over 80% of emissions come from sectors representing less than a quarter of the market but about 40% of global GDP. These companies must make radical changes for tangible emission reductions. Investors should focus on transitioning companies undervalued due to perceived risks, offering potential investment opportunities. A climate-transition investment strategy should include sectors beyond energy, considering overall environmental impact.

📝 The training wheels come off

UBS

The EU Emissions Trading System encourages companies to reduce emissions for net zero goals, with the potential removal of free emission allowances impacting various sectors. Steel companies that decarbonize can avoid higher carbon costs and benefit from higher steel prices and potential green premiums. Despite risks, proactive companies offer the best risk-reward for investors.

📝 Natural capital and biodiversity

Principal Asset Management

As the global population is projected to reach 10B by 2050, companies must navigate these crises by innovating and adopting sustainable practices. Key industries like agriculture, finance, and construction need to future-proof their operations through technology and sustainable methods to mitigate risks and capitalize on growth opportunities, enhancing long-term value creation.

✏️ Transition trilemma: a reckoning for decarbonization?

Abrdn

Despite significant progress in renewable energy in Europe, issues like storage and cost pressures slow decarbonization efforts, leading to continued reliance on fossil fuels. Investments, such as in Italy's €4.5B biomethane initiative, highlight how targeted approaches can address these challenges while delivering value and reducing greenhouse gas emissions.

✏️ How will tariffs reshape the electric vehicle market?

BCG

The US electric vehicle market is experiencing significant changes due to new tariffs on imports from China, including increases on EVs, lithium-ion batteries, and critical raw minerals. These tariffs may lead to major shifts in global trade, impact US consumers by raising EV prices, and force US automakers to reassess their strategies. Chinese EV and battery manufacturers may seek growth in other markets, while protectionist policies could reconfigure investment and supply chains in the industry.

Real Estate x Infrastructure

✏️ When infrastructure starts at home

KKR

Decarbonization efforts can be both large-scale and small, with smart meters playing a crucial role. Smart meters provide real-time energy usage data, enabling homeowners and utilities to optimize energy use and reduce carbon emissions. Smart metering systems leverage government mandates and long-term contracts to expand smart meter installation, paving the way for smart grids and further decarbonization technologies like rooftop solar and EV charging solutions.

✏️ It all rests on infrastructure

Neuberger Berman

Infrastructure investment is crucial for economic growth, underpinning megatrends like clean energy transition, supply chain shifts, and technological advancements. Infrastructure provides essential assets, aligning with the trend of big government spending on security and protectionism.

🎥 Identifying real estate opportunities in a higher rate environment (Principal Asset Management)

Artificial Intelligence x Technology

✏️ Investing in AI: Everything, everywhere, and all at once

Robeco

Venture investment in generative AI surged 120% to $20.3B in 2023, reflecting its growing impact across various sectors. While AI is projected to automate up to a quarter of jobs in the US and Europe and add $15.7T to global GDP by 2030, it is crucial to discern genuine opportunities within enterprise software, cybersecurity, industry, robotics, and consumer technology amidst the hype. Despite the broad potential, historically few companies capture the majority of value in transformative technology cycles.

✏️ The tech leapfrog effect is producing EM fintech winners

Robeco

In emerging markets, superior and cheaper innovations are bypassing older technologies, significantly impacting industries like telecommunications, energy, and finance. This rapid technological adoption, especially in finance through mobile telecommunications, enhances access to banking services, reduces costs, and boosts macroeconomic growth by integrating more people into the organized economy. Local entrepreneurship and innovation further accelerate this trend, adapting technologies to market needs.

✏️ Investing in the foundation of the digital world

JP Morgan

Digital infrastructure is crucial for the AI revolution and data-driven economy. With global data traffic projected to grow 25% annually, significant investments in expanding digital infrastructure are underway to meet demand. Investing in digital infrastructure, including fiber optic cables, data centers, cell towers, and wireless communication, offers the potential for stable cash flows, inflation hedging, and portfolio diversification.

📝 Assessing the economic impact of generative AI

State Street

Effective policy and governance are crucial to harness AI's potential to enhance productivity, manage inflation, drive growth, and reduce inequality, as detailed in the analysis of past technological breakthroughs and their outcomes. The ‘Magnificent 7’ stocks have gained over 100% in 2023 vs 24% for overall S&P 500 index. Multiple opportunities exist for private market investors as well but critical selection is required.

✏️ Power-hungry AI applications are demanding a significant expansion in global energy capacity

Schroders

The power consumption of data centers is expected to surge further as AI workloads require much more energy. Meeting this demand poses challenges, including the need for increased power generation capacity and sustainable energy solutions, with major tech companies investing heavily in renewable energy sources. However, issues such as the intermittence of renewables, supply chain bottlenecks, and grid capacity constraints complicate this transition - however these areas could provide opportunities for investors.

✏️ Built to last? Identifying durable health care start-ups

Wellington Management

Key findings from a study of 48 non-biotech healthcare companies indicate that companies with technological breakthroughs, strong moats, value creation focus, consistent execution, and high revenue quality tend to be durable. In contrast, nondurable companies often exhibit poor cash efficiency, high growth but subscale at IPO, underestimated competition, insufficient pain points, overemphasis on TAM, and poor business integrity.

Financial Services

📝 Payments sector report

Advent

Investors like Advent have invested over $7.8B in 18 payments and fintech companies since 2008, transforming payments divisions into global champions and supporting businesses through complex carveouts and evolving business models. The sector continues to develop rapidly, driven by technological change, customer demand, and regulatory efforts, with a shift towards integrated and connected commerce solutions.

📝 P&C Insurers: Moving up in credit quality

Barings

In 2023, property and casualty (P&C) insurers adjusted their asset allocations to focus more on higher-rated bonds, reducing high-yield holdings. They also adopted a barbell strategy in bond maturities, balancing short-term and long-term investments. US Treasury and equity allocations increased, while private equity and CLOs decreased. Insurers are adopting more conservative investment strategies due to rising loss and combined ratios, despite modest growth in illiquid asset classes like private corporate bonds and mortgage loans.

✏️ Driving retirement outcomes

Goldman Sachs

The Annuity Industry Survey explores how insurance carriers are navigating current conditions to support their clients' retirement goals through adaptability, resilience, and innovation. The survey, based on insights from 150 US industry participants, identifies market trends and emerging themes in four key areas: macro outlook, product vehicles and implementation, shifting industry trends, and retirement income strategies.

PRIVATE MARKETS AND ALTERNATIVE ASSETS

✏️ Alternative asset managers primed for growth

Robeco

Despite concerns over alternative asset managers (AAMs) due to rising interest rates, there is optimism for their future. Short-term fundraising is expected to improve with capital market recovery, and long-term growth is driven by global demographics increasing demand for diverse, high-yield investments. The sector's resilience is highlighted by recent successful IPOs and positive outlooks from industry leaders. With a significant savings gap anticipated by 2050, AAMs are well-positioned to benefit from increased demand for asset management solutions, offering a promising investment opportunity.

✏️ How AI could help alternative asset managers overcome operational challenges

State Street

Experts highlight opportunities for operational improvements through AI in private markets, focusing on data management and technology upgrades. AI's potential for enhancing efficiency and transparency was noted, with applications ranging from automating corporate secretarial tasks to improving investor communications.

✏️ Tapping private market insights for public market investments

Man Institute

Private market insights, enhanced by natural language processing (NLP), can serve as leading indicators for public market investments. As private markets grow, contributing significantly to the US economy, advances in NLP techniques allow systematic extraction of private company data from various sources.

✏️ How can investors diversify portfolios if when equities zig, bonds zig too?

JP Morgan

Investors can still rely on core bonds for recession diversification, but inflation and deficit concerns necessitate alternative solutions. Private markets, including real assets and hedge funds, offer diversification benefits with low to negative correlation to public markets.

📜 Periodicals »

📝 Midyear outlook 2024: A strong economy in a fragile world (JP Morgan)

📝 Private market insights – May 2024 (UBS)

📝 The BEAT for June – Key themes and top trade ideas (Morgan Stanley)

📝 Private markets global survey insights 2024 (Hamilton Lane)

📝 Weekly economic commentary (Northern Trust)

✏️ Our multi-asset investment views - May 2024 (Schroders)

✏️ The early view May 2024 - Why we welcome the era of higher rates (Man Institute)

🎥Private Markets: Q1 2024 preliminary valuation summary & analysis (Neuberger Berman)

🎙Podcast: In tune with the markets – Power to the people (Robeco)

🎥 Navigating an evolving landscape (Principal Asset Management)

🎥 Beyond the metropolis: Unlocking opportunities in smaller markets (Juniper Square)

Thank you for reading The Valt Journal!

Check out our other editions here.

Disclaimer:

The content provided on this platform contains references and links to external sources, including articles, reports, websites, images, or videos. We do not own or claim copyright over the content found in these external sources. The ownership and rights of the content belong to the original creators.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.