The Valt Journal #28

Featuring latest research on Alts as an asset class (State Street, GIC, LGT); Private Credit (Barings, KKR, Neuberger); PE (PWC, Pitchbook); Real estate, Infra, Energy (UBS, Abrdn, IEA)

Hi, welcome to the new edition of The Valt Journal. In every issue, we cover the best and the latest insights into the global private markets. The Valt Journal is a repository of time sensitive and timeless research, delivered to your inbox every 2 weeks, so you don’t have to look anywhere else! Clicking the headlines is all it takes.

Check out TVJ Spotlights 🔦 including 1) Building a hedge fund allocation (by GIC x JP Morgan); 2) Specialty finance (by Neuberger Berman); 3) Global EV outlook 2024 (by IEA)

🚀 The Valt Journal Library 🚀

Our private markets and alternative assets focused live repository featuring a collection of c.5K research reports and articles from 150+ global asset managers and experts across 4 categories and 40+ sub-categories for an efficient, fast and seamless research experience.

Quickly scan the list of all reports in this edition here!

Numbers this edition:

Links: 74

Authors: 34

PRIVATE MARKETS AND ALTERNATIVE ASSETS

📝 2024 Digital assets study: Is transformation within reach?

State Street

State Street’s 2024 Digital Assets Study reveals that nearly half of institutions are ready to trade digital assets on and off distributed ledgers. Firms expect significant revenue growth and cost reductions from tokenized assets, potentially reversing rising costs in investment management. A regulatory assessment highlights three key trends in institutional investment in digital assets: increased allocations to digital assets, rising interest in permissioned digital networks, and the coexistence of digital and traditional assets.

TVJ Spotlight 🔦

📝 Building a hedge fund allocation: Integrating top-down and bottom-up perspectives

GIC x JP Morgan

This paper outlines a hedge fund allocation framework combining top-down and bottom-up approaches, aimed at diversifying traditional portfolios and enhancing alpha generation. It categorizes hedge funds into four groups based on their risk/return profiles and attributes sought by investors: Loss Mitigation, Equity Diversifier, Equity Complement, and Equity Substitute. The framework also discusses portfolio construction strategies and the potential use of leverage to improve returns without compromising the portfolio's Sharpe ratio.

📝 LGT Capital Partners insights 25 years of investing in alternatives

LGT Capital

As LGT Capital Partners celebrates its 25th anniversary, this publication shares insights and lessons learned from investing in private markets and liquid alternatives. LGT focuses on sourcing top-tier managers with larger performance dispersion and higher performance, skill & expertise persistence along with repeatable investment playbooks.

📝 Capital structures remain key to recovery

Twin Brook Capital Partners

Capital structures and credit terms in the middle market vary significantly, with lower mid-market deals generally having more conservative leverage, better lender protections, and higher pricing compared to the upper mid-market. This conservative approach in the lower mid-market often results in higher recoveries and more time to address financial distress, whereas the upper mid-market experiences more aggressive terms and higher default rates.

📝 A core allocation to CTAs might be as wise as going tactical

Amundi

Tracking CTA (Commodity Trading Advisor) exposures can provide a useful snapshot of risks but is unreliable for allocation decisions due to frequent changes in positions, focus on mainstream markets, and asynchronous trends across assets. Currently, CTAs are moderately long in equities, slightly short in sovereign bonds, and maintain high long exposure in credit.

✏️Alternatives: Embracing the alternative advantage

JP Morgan

In the first half of 2024, traditional asset allocations struggled to provide stable portfolios due to persistent inflation and market volatility. Opportunities abound in specialized real estate sectors, transportation, infrastructure, and middle-market private equity.

✏️ Navigating new realities in asset management

OTPP

The business environment is rapidly evolving due to disruptive technologies, geopolitical changes, climate change, and economic factors. OTPP emphasizes the importance of innovation, in-house asset management, and global diversification in navigating these shifts. There is a need for a critical mindset, strategic imperfections, and leveraging AI and data to enhance investment strategies. Maintaining the right talent through an apprenticeship model and competitive compensation is crucial for adapting to the changing landscape.

✏️Alternative investments: Asset allocation strategies in a changing environment

UBS

Over the past two decades, investors have increasingly turned to alternative investments like hedge funds, private equity, and real estate to diversify portfolios and achieve consistent returns. Initially driven by low yields in traditional markets, the role of alternatives has become even more crucial in today's volatile economic environment, providing diversification and mitigating risks where traditional assets like stocks and bonds may falter.

✏️Many advisors turn to alts to differentiate themselves

FS Investments

According to a CAIS-Mercer survey, advisors are focusing on private equity, private debt, and real estate in 2024 to enhance portfolio returns, increase diversification, and draw additional income for clients. Advisors believe that allocating to alternative investments not only benefits clients but also provides a competitive edge, helping them attract and retain clients.

✏️ Investing in “3D”: Forces shaping alternatives opportunities in 2024

Wellington Management

Three key trends to shape investment strategies: divergence in global economic cycles, technological disruption, and increased dispersion in company results. These trends create opportunities for active management, particularly in global macro investing, extension strategies, and long/short plays on sectors and regions. Investors should also consider opportunistic and tactical ideas to capitalize on market dislocations.

📜 Periodicals »

📝 Wealth outlook 2024: Midyear edition (Citi Wealth)

📝 Opportunity knocks: Midyear outlook for 2024 (KKR)

✏️ Asset and wealth management: US Deals 2024 midyear outlook (PWC)

✏️ The continued search for liquidity: 2024 midyear outlook (HarbourVest)

PRIVATE CREDIT x FIXED INCOME

TVJ Spotlight 🔦

📝 Specialty finance: High-yielding, short-duration and uncorrelated private credit

Neuberger Berman

Specialty finance, or private asset-backed lending, can diversify traditional private debt portfolios by offering high-yield, shorter-duration investments with bespoke structuring for downside protection. This asset class, enabled by new technologies and disintermediated finance markets, differs from traditional private corporate debt and has seen limited institutional competition, requiring specialized teams for effective transaction sourcing and structuring.

📝 KKR credit & markets

KKR

The past few years in global credit markets have been marked by significant volatility and unpredictability, requiring investors to remain disciplined and nimble. “We are in a ‘non-obvious market’ characterized by growing asset level dispersion fueled by an overt focus on spread versus absolute yield, technicals that are increasingly disconnected from fundamentals coupled with the overhang of rapidly developing geopolitical matters. This market requires investors to go beneath the surface to identify compelling relative value and act swiftly"

📝 Private debt in focus

BlackRock

The outlook for private debt investments remains favorable, with the covenant default rate dropping from 4.5% to 3.4% over recent quarters. Despite high inflation and uncertain interest rate cuts from the Fed and ECB, private debt continues to be resilient due to favorable lending structures and proactive management. This edition highlights how specific challenged investments were optimized for yields and returns across direct lending, real estate and infra.

📝 Unlocking private credit: A different kind of lending

KKR

This guide covers the basics of private credit, focusing on direct lending to corporations and asset-based finance (ABF), where loans are secured by collateral. Different types of ABF include: 1. Consumer/ Mortgage Finance (pools of mortgages, credit card debt, auto loans); 2. Hard Assets (aircraft leasing, green energy, rail cars, home rentals); 3. Commercial Finance (Equipment leases for SMEs, accounts receivable payments); 4. Contractual Cash Flows (Intellectual property, royalties (e.g. music rights), financial contracts)

📝 EM sovereign debt: Spreads are tight… So what?

Barings

Despite the perception that emerging market (EM) sovereign debt spreads are too tight, they still overcompensate for default risk and offer attractive premiums. Current high US Treasury yields reduce market risk, implying that lower spreads are needed to compensate for this risk. Consequently, there is potential for spread compression and capital appreciation, making EM sovereign debt a compelling investment opportunity even at these tight spread levels.

📝 The compelling opportunity in mid-market credit

Adams Street

Private credit is currently attractive due to high yields and lower risk profiles amidst market uncertainties. Base rates are expected to stay high, benefiting private credit yields. Lead lenders gain significant advantages in underwriting and influence over loan structures. “Lead lender status also typically allows to exercise direct influence over the capital structure design, negotiate the covenants using one’s own loan documents and get paid incremental economics.”

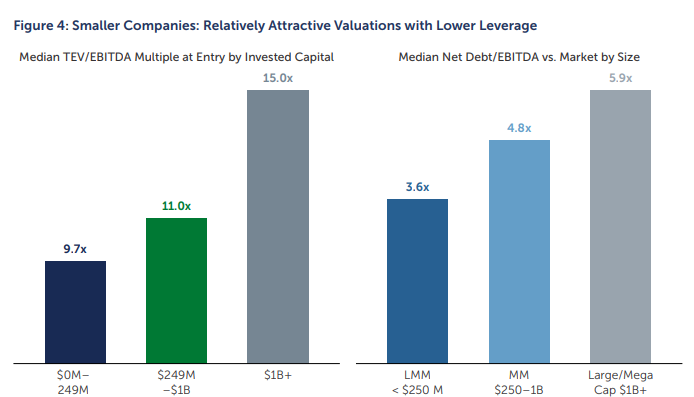

📝 Direct lending: Poised for upside

TPG

Direct lending to lower-middle-market companies (EBITDA of $25M or less) offers attractive opportunities for institutional investors due to their conservative credit structures and higher recovery rates with valuation at 4x EBITDA vs 5-6x EBITDA for upper tier. However, the evolving market conditions highlight the need for experienced direct-lending managers to navigate the complexities. Despite a slowdown in M&A activity in recent years, there is pent-up demand from PE firms, which is expected to drive M&A activity through 2025 and 2026.

📝 Barings: Bigger is not always better in private credit

Barings

Discussions highlight that mid-market companies ($10m to $50m EBITDA) may offer robust investment opportunities due to less competition and better deal structures compared to larger companies. Pricing pressure is more acute in the US market, which is more competitive, while the European market offers more insulation and potential for favorable financing terms.

📝 US market commentary: CLO Q&A

Monroe Capital

Monroe Capital credit expert discusses constraints in the issuance of new private credit CLOs due to slowed LBO and M&A activity, the complexity of placing AAA tranches, and the firm's focus on software and technology sectors for CLO investments. Key metrics for investors include evaluating the manager's track record and portfolio management capabilities.

✏️ Private credit: Europe vs the US

M&G Investments

Investor interest in private credit is expected to double in value over the next five years, with Europe likely outpacing the US in growth. The European market, though less mature and competitive than the US, offers higher yields, better interest cover, and lower default rates. This growth potential, coupled with Europe's diverse and creditor-friendly legal frameworks, provides attractive opportunities for asset managers with local expertise.

✏️ The growth of asset-backed lending in Europe: A journey set to continue

M&G Investments

The rise of asset-backed lending (ABL) in Europe is driven by bank retrenchment, regulatory pressures, technological advancements, and banks' balance sheet optimization. Key opportunities for ABL investors include consumer finance, CLOs, specialty finance, and providing capital through Significant Risk Transfer (SRT) deals. ABL offers strong diversification, access to unique assets, and potentially higher returns, making the European ABL market attractive for investors.

✏️ Fixed income: A slow dance downward

JP Morgan

The bond market experienced strong performance at the end of 2023. which has increased current income from bonds despite volatility. Long-term interest rates are expected to stabilize between 4.00%-4.75% before gradually declining. Short-term rates may see limited cuts this year and into 2025. The yield curve remains inverted but may turn positive by the end of 2025. Investors are advised to use a barbell approach to duration, balancing short-term yields with some long-term bonds as a hedge.

📜 Periodicals »

📝 Fixed income quarterly outlook: Fiscal hurricane season (Robeco)

📝 Weekly fixed income musings (Goldman Sachs)

✏️ Emerging market debt review and outlook: May 2024 (Abrdn)

✏️ Unconstrained fixed income views: June 2024 (Schroders)

🎥 Why the term premium matters for bond investors (PIMCO)

🎥 How can your cash work harder? (PIMCO)

🎥 10 Minute Masterclass—Senior secured loans (Barings)

🎙 FireSide: Answering the burning questions around private debt (FS Investments)

🎙 How much longer can companies go on paying 12-14% on debt? (Institutional Investor)

PRIVATE EQUITY

📝 Picking up the pace

KKR

KKR’s interest in infrastructure investment remains strong, driven by its performance in volatile, high-inflation periods. They remain focused on delivering attractive risk-adjusted returns and capital preservation. Renewable energy also continues to be a sector of focus with the recent valuation adjustment. Electricity demand in the US could rise by 20% by 2030, partly due to advances in AI - thus driving the need for investment in renewables.

✏️ Creating value for private equity in a complex deals market

PWC

Private equity deal activity in 2024 remains sluggish due to mismatched asset value expectations between buyers and sellers and persistent high interest rates. Investors are focusing on value creation and innovative dealmaking, including bilateral deals and AI integration, to navigate the challenging environment. Opportunities lie in complex deals such as carve-outs and take-privates, with success dependent on driving organic value creation.

✏️ 8 emerging venture capital trends

Wellington Management

The venture capital market is showing signs of recovery in 2024 after a slow 2023. Key emerging trends include a surge in capital efficiency, with many high-valued startups facing down rounds, a shift in LPs' focus to Distributed to Paid-In (DPI) ratios due to liquidity challenges, and high valuations in the AI sector outpacing revenue generation. Additionally, SaaS companies, insulated by large cash reserves, are seeing more reasonable valuations as these reserves deplete, creating new opportunities for investors.

✏️ A bifurcated world for venture

Juniper Square

Effective communication with LPs is crucial, especially amid AI-driven market disruptions and valuation uncertainties. LPs face challenges in choosing GPs, balancing the desire for consistent returns versus potential high gains. Experts suggest that we are at the start of a new super-cycle, emphasizing the importance of accessing top deals and considering the future dominance of technology in the economy.

✏️ Private equity has historically outperformed public markets

FS Investments

Despite strong headline returns for US stocks in 2024, the gains are concentrated in a few large-cap tech firms, with the "Magnificent 7" stocks driving 61% of the S&P 500's year-to-date return. Small- and mid-cap stocks have struggled, highlighting the potential in private markets, where private equity (18%+ returns) has outperformed the S&P 500 (c.10% returns) over five years. Increasingly, new investment vehicles are making private equity more accessible to individual investors.

✏️ How PE investors can build resilience and drive growth in today’s market

OTPP

With cheap leverage and lower interest rates gone, investors are focusing on creating returns rather than chasing them. Active joint problem-solving, ensuring the right management and board talent, and leveraging digital technologies like AI are some critical strategies. Integration and collaboration between deal teams and value creation teams are crucial for achieving desired results and addressing current economic headwinds.

📜 Periodicals »

📝 2024 US Venture capital outlook: Midyear update (Pitchbook)

📝 E-commerce: Q1 2024 (Pitchbook)

📝 EMEA healthcare market: Q1 2024 (Pitchbook)

📝 Enterprise SaaS: Q1 2024 (Pitchbook)

🎥 Growth equity as an attractive asset class (Adams Street)

SECTOR FOCUS

Energy Transition x Climate Finance

TVJ Spotlight 🔦

📝 Global EV outlook 2024

International Energy Agency

Electric car sales continue to grow, potentially reaching 17M in 2024, with market shares rising in China, Europe, and the US. Despite challenges like tight margins and high inflation, the sector is buoyed by policy support and decreasing battery prices. The rapid uptake of EVs is expected to significantly reduce oil demand and boost investment in EV supply chains, with global battery manufacturing capacity set to meet increasing demand.

📝 Investing in C-PACE (Commercial Property Assessed Clean Energy)

Nuveen

C-PACE (Commercial Property Assessed Clean Energy) is a US state policy-enabled financing mechanism which allows financing to be secured by a senior assessment, giving institutional investors access to invest in clean energy and impact opportunities, and delivers value for stakeholders across the lifespan of the loan. It offers attractive yields, long durations, diversification and definable positive impact. With many investors prioritizing low-carbon targets in portfolios, C-PACE has emerged as an asset class capable of delivering these goals alongside financial returns in commercial real estate.

📝 Climate finance partnership

BlackRock

The Climate Finance Partnership is a fund setup by BlackRock that accelerates capital flow into renewable energy in emerging markets, supporting low-carbon transitions through investments in wind, utility-scale solar, and distributed solar projects. This inaugural Impact Report provides an overview of the CFP approach and details key achievements highlighting the environmental and social impact CFP delivered in line with the fund objectives and providing a blueprint for other investors.

📝 Climate meets nature

UBS

The energy transition is essential for meeting climate goals and protecting nature, with clean energy technologies already helping avoid significant emissions. However, the growth of these technologies can negatively impact nature, highlighting the need for integrating natural capital considerations into investment decisions. The report provides practical steps for managing these impacts, including improving land management, using lifecycle analysis, and embedding circularity in design principles.

📝 Generating next-level returns in renewables

Nuveen

Returns for traditional renewable energy investments are under pressure due to supply chain challenges, inflation, and rising costs. Industry experts emphasize the need for sustainable investment strategies, focusing on system architecture, grid interconnections, and streamlined approval processes rather than subsidies. Battery storage, although critical for mitigating cannibalization risks, faces investment challenges and may benefit from government support.

✏️ Future Minerals: From underground to building blocks of tomorrow

Abrdn

Future minerals, such as copper and lithium, are critical for the energy transition, especially for electrification and EVs. Demand for these minerals is expected to rise significantly, driven by structural changes and government policies. Investors should focus on companies involved in the extraction, supply chain, and products utilizing these minerals to capitalize on the potential multi-decade super cycle. An active investment approach is recommended to manage ESG risks and adapt to market changes.

✏️ Decarbonizing transport

UBS

Decarbonizing the transport sector is crucial, as it accounts for a significant portion of global emissions. Electrified transport investment reached $634B in 2023 (up by 36% yoy), surpassing renewable energy. Surface transport, representing 70% of transport emissions, can be largely decarbonized using existing battery-electric vehicle technology, while marine and aviation sectors face more significant challenges and require innovative solutions like sustainable aviation fuels and battery-electric propulsion for short routes.

✏️ The right (and wrong) questions about sustainable investing and returns

Robeco

Investing sustainably and generating returns is not an "either-or" decision. Instead, it involves optimizing risk-adjusted returns while integrating sustainability preferences. ESG factors enhance investment decisions by acting as early warnings for risks and uncovering opportunities, thus supporting better-informed, comprehensive assessments and valuations.

✏️ Not all net-zero pathways are created equal

UBS

Improving real estate's sustainability is crucial for addressing climate change, as the sector accounts for about 40% of global emissions. Investors are demanding precise disclosures and net-zero pathways to compare investment products' progress in reducing emissions. However, with no industry-wide standards, it's essential to scrutinize the assumptions and data behind these pathways. Key factors include the types of emissions considered, the baseline data used, and future decarbonization measures planned.

✏️ Are we underestimating the impact of climate change?

Schroders

Global surface temperatures rose by 1.45°C above pre-industrial levels in 2023, making it the warmest year on record. Climate scientists predict that worsening conditions could severely impact global GDP, with a 20% decline by 2050 under the worst-case scenario, emphasizing the importance for investors to incorporate climate risks into their asset allocation decisions.

Real Estate x Infrastructure

📝 Ares infrastructure opportunities

Ares

The convergence of digitization and decarbonization is driving over $2T in US energy transition infrastructure and data center investments by 2030. US data center electricity consumption is expected to reach c.380 TWh by 2027, equivalent to 8.5% of total US electricity consumption. Rapid growth in global data creation demands significant new investments in digital infrastructure, increasing power consumption, and boosting renewable energy demand. This growth presents both challenges and opportunities at the intersection of digital infrastructure and the energy transition.

📝 Real estate: Capturing opportunities amidst market volatility and price dislocation

HSBC

Following the 2022/23 market downturn, real estate pricing appears to be stabilizing, creating opportunities for experienced investors to acquire high-quality assets. Opportunities vary by asset quality, sector, and geography, with a preference for prime assets with strong ESG credentials, sectors like logistics and residential, and regions that have repriced quickly or are economically strong.

📝 A paradigm shift: Infrastructure equity 2.0

Barings

Infrastructure equity is evolving from traditional, yield-oriented assets like toll roads and utilities to "Infrastructure Equity 2.0," which includes more distributed and smaller-scale projects such as carbon capture. These newer investments feature conservative capital structures, fixed-rate debt, inflation protection, and contracted cash flows, aiming to drive alpha in investor portfolios while still providing downside protection and stable returns.

📝 Navigating growth in European life science focused real estate

UBS

The growing life sciences industry, driven by demographics and increasing incomes, is creating a rising demand for specialized real estate to support R&D, manufacturing, and other activities. This trend presents attractive investment opportunities in life science real estate for both value-add and core investors, as the industry expands to meet the needs of an aging population and higher spending on healthcare in wealthier nations.

📝 Unlocking infrastructure opportunities

UBS

Private infrastructure investments are increasingly popular due to their stability, inflation resistance, and alignment with global economic trends like decarbonization, digitalization, and demographic change. These assets offer resilient returns, low correlation with listed equities, and benefit from government incentives and long-term contracts, making them attractive for diversifying portfolios amid market volatility. A collection of interviews reveals why the private markets present decent opportunities in infrastructure.

✏️ European residential real estate - time to live a little

Abrdn

European residential assets returned 7.2% per annum between 2001 and 2023, while experiencing the lowest total return volatility of all the real estate sectors. European living real estate market is re-emerging as a prime investment opportunity. The sector is characterized by resilience, inflation-linked cashflows, and consistent risk-adjusted returns, making it increasingly attractive to investors. Key demand drivers, such as home-ownership affordability constraints, urbanization, and demographic changes, continue to support growth, while sustainability and energy efficiency are becoming crucial factors in investment decisions.

✏️ US real estate deals 2024: Midyear outlook

PWC

Real estate professionals are becoming more selective in their strategies due to higher capital costs and interest rates, broadening their focus to include "real assets" like data centers, wellness properties, and senior housing. The anticipated $400-450B in annual commercial real estate loan maturities presents opportunities for investors focused on prime assets and long-term solutions.

✏️ Helping airlines meet growing demand

Carlyle

With global air travel surpassing pre-pandemic levels, airlines face a shortage of airplanes due to halted production during COVID-19. The demand for over 40,000 new commercial jets over the next 20 years requires $8T of financing, creating opportunities in fleet leasing, secondary trading, and niche aviation financing. As the aviation industry's profitability grows, aviation finance is set to play a crucial role in meeting capital demands.

✏️ Deepening global real estate diversification with dynamic logistics

Abrdn

The logistics sector, vital for connecting farmers, manufacturers, distributors, traders, and consumers, has seen significant growth due to the expansion of e-commerce and global trade. With a market size of c.$9T in 2023, expected to reach c.$22T by 2033, the sector is appealing to investors seeking long-term, reliable income. Modern logistics spaces with sustainability features and inflation-linked leases highlight the sector’s attractiveness and potential for diversification in investment portfolios.

✏️ The commercial real estate lending market looks buoyant

Abrdn

Data on commercial real estate lending for UK in 2023 showed a 33% drop in origination volumes, higher defaults, and record low loan-to-value (LTV) levels. However, 2024 has seen a significant recovery, with banks returning to the market, increased competition, and tighter spreads. Real estate equity markets are showing signs of recovery, and the outlook for real estate debt is positive, with a focus on quality assets and cautious sector-specific approaches. Opportunities across industrial & logistics, residential and student accommodation.

✏️ Growing up and out: The impact of aging populations on housing

Morgan Stanley

Over the next decade, population growth in the 70+ and 30-50 age groups will create residential opportunities tailored to their unique living preferences. Single-family rental demand is expected to rise due to affordability gaps between owning and renting, while senior housing sees improved affordability and occupancy gains. Aging demographics will significantly impact real estate, particularly benefiting single-family rentals and senior housing facilities.

✏️ Global real estate

UBS

Adding unlisted real estate to a traditional 60/40 portfolio provides diversification, improved risk-return trade-offs, inflation protection, and potential for long-term capital growth. The shift to higher interest rates increases the expected yield on real estate, making good asset management crucial for achieving competitive returns. Despite economic risks, international and domestic investments in sectors like logistics, health facilities, and senior housing can offer substantial opportunities.

✏️ Is infrastructure overvalued? The biggest allocators don’t think so

Institutional Investor

Institutional investors are increasingly allocating funds to infrastructure, with target allocations rising to 5.5% in 2024. Despite some overvaluation concerns, strong demand, government support, and anticipated rate cuts are expected to sustain the sector's appeal, with a shift towards higher-risk strategies like renewable energy and non-regulated airports.

Artificial Intelligence x Technology

✏️ Opportunities presented by emerging technologies in capital markets

State Street

The integration of emerging technologies such as blockchain, generative AI, and quantum computing is transforming the financial sector. Blockchain enhances transparency and efficiency in transactions, while digital assets offer new investment opportunities. Generative AI improves data analysis and decision-making, and quantum technologies accelerate computations and enhance cybersecurity. These advancements promise to redefine financial markets, improving operational efficiencies and fostering growth and innovation.

✏️ How does AI change drug discovery?

UBS

AI tools like ProGen and AlphaFold are revolutionizing drug discovery by expediting the process and enhancing precision in target identification, molecular simulations, and clinical trials. These technologies enable the design of novel drug molecules and improved understanding of protein structures, potentially reducing the time and cost associated with bringing new pharmaceuticals to market.

Financial Services

✏️ US insurance deals 2024: Midyear outlook

PWC

Despite macroeconomic factors slowing deal volume, insurance dealmaking remained active from mid-November 2023 to April 2024, driven by four megadeals. There were 145 announced insurance transactions worth over $34B, an increase in deal value compared to the previous period. Major deals included Aon plc's $13.6B acquisition of NFP Corp and Arch Insurance's $1.4B acquisition of Allianz's US MidCorp and Entertainment insurance businesses.

✏️ US banking and capital markets deals 2024: Midyear outlook

PWC

Banking and capital markets deal activity saw a modest rebound over the past two quarters, driven by a few sizable deals. However, competitive and cost pressures are expected to drive future mergers or divestments as banks seek to align with long-term goals. Key priorities include achieving scale, adding capabilities through innovative technologies, and adjusting portfolios by divesting non-core assets to focus on core competencies and improve capital efficiency.

✏️ How is homeowners’ insurance impacting the macro data?

JP Morgan

Homeowners' insurance costs rose by over 20% in 2023, driven by increased claims from severe weather events, higher repair costs, more uninsured homeowners, and private insurers withdrawing from high-risk states. This has contributed to "shadow inflation" not reflected in the CPI and may further stagnate the housing market, even if mortgage rates fall. The upward trend in insurance rates is likely to persist, although increases may moderate over time.

Thank you for reading The Valt Journal!

Check out our other editions here.

Disclaimer:

The content provided on this platform contains references and links to external sources, including articles, reports, websites, images, or videos. We do not own or claim copyright over the content found in these external sources. The ownership and rights of the content belong to the original creators.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.