The Valt Journal #29

Featuring latest research on Alts as an asset class (MS, LGIM, UBS); Private Credit (Nuveen, JPM, State Street); PE (HarbourVest, Pitchbook); Real estate, Infra, Energy (Amundi, Abrdn, BlackRock)

Hi, welcome to the new edition of The Valt Journal. In every issue, we cover the best and the latest insights into the global private markets. The Valt Journal is a repository of time sensitive and timeless research, delivered to your inbox every 2 weeks, so you don’t have to look anywhere else! Clicking the headlines is all it takes.

Check out TVJ Spotlights 🔦 including 1) Systematic liquid alternatives (by Morgan Stanley); 2) Investing in India’s energy future (by Amundi); 3) Global real estate outlook mid-year 2024 (by M&G)

🚀 The Valt Journal Library 🚀

Our private markets and alternative assets focused live repository featuring a collection of c.5K research reports and articles from 150+ global asset managers and experts across 4 categories and 40+ sub-categories for an efficient, fast and seamless research experience.

Quickly scan the list of all reports in this edition here!

Numbers this edition:

Links: 78

Authors: 35

PRIVATE MARKETS AND ALTERNATIVE ASSETS

TVJ Spotlight 🔦

📝 Systematic liquid alternatives

Morgan Stanley

The failure of traditional diversification has highlighted the need for new tools, with liquid alternatives like alternative risk premia (ARP) offering a solution. ARP, which includes market factors previously considered part of alpha, provides low-cost, liquid, and low-correlation diversification options. Including ARP in a 60% equity/40% bond portfolio could improve risk-adjusted returns and complement traditional investments, addressing gaps in hedge fund strategies.

📝 Private markets mid-year outlook: Uncertainty, discipline and megatrends

LGIM

Interest rate uncertainty has led to restrained transaction volumes across private markets, with high levels of dry powder necessitating a disciplined approach to transaction underwriting. Marked valuation corrections offer attractive entry points in real estate and venture capital. Despite recent slowdowns, the long-term interest in private markets, particularly among non-institutional investors, remains strong. A scenario-based approach to revenues and interest rates is crucial for resilience against macro and geopolitical uncertainties.

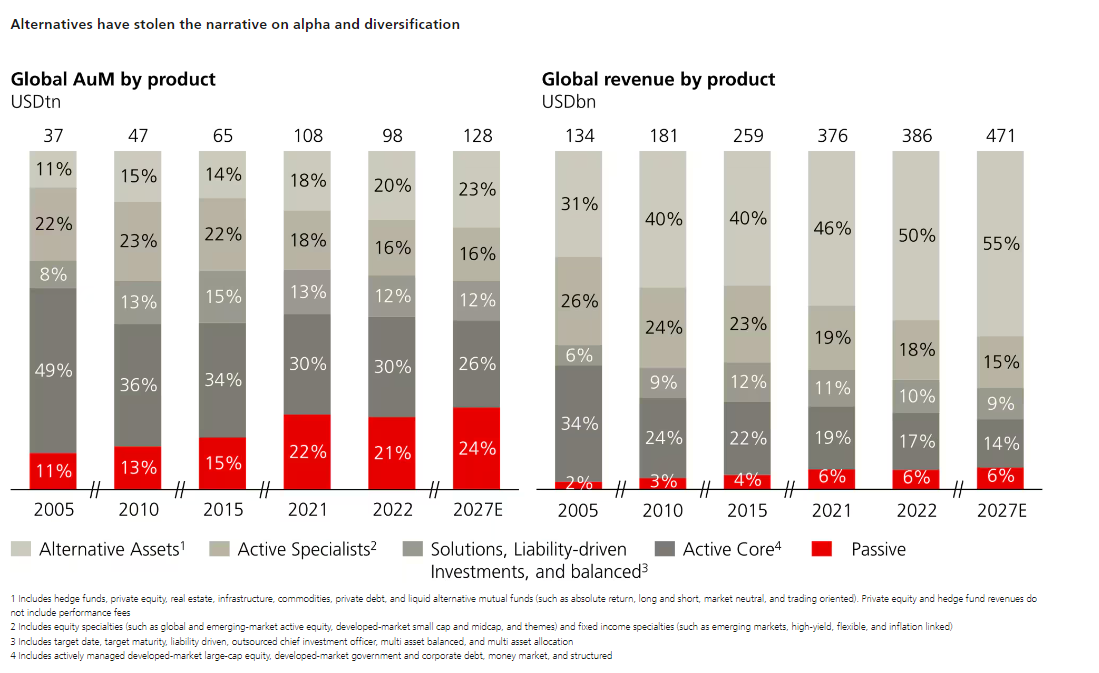

✏️ The inflection point - democratization of alternative investments

UBS

Strategic inflection points demand immediate adaptation, as threats to business models are imminent. Embracing technology to create efficiencies, scale operations, and enhance the investment process is crucial. With retail clients' complex demands and the democratization of alternative investments, asset managers must quickly adapt to fee compression, rising costs, and increasing client expectations.

📝 Human-robot interactions in investment decisions

Amundi

Amundi explores the impact of introducing a robo-advisor on a large set of Employee Saving Plans. Unlike fully automated services, this robo-advisor proposes investment and rebalancing strategies but allows investors to choose whether to follow them. Findings show that the robo-service increases investor attention and trading activities. Investors respond to the robo-advisor's alerts by adjusting their portfolios to stay closer to target allocations, leading to larger portfolio returns. The potential financial cost of allowing investors to retain control is minimal, as automatic rebalancing by the robot would result in only slightly higher returns.

✏️ Do ESG factors help or hurt private fund returns?

Institutional Investor

A recent Preqin report revealed that ESG factors do not significantly impact investment returns. Analyzing over 11,000 funds, including 200 ESG funds, Preqin found no statistically significant difference in performance between ESG funds and all private capital funds, with ESG funds averaging a 13.5% return versus 15.0% for all funds. However, ESG funds showed lower variance in returns, potentially due to better downside risk management. Despite mixed research findings and differing opinions on ESG's necessity, many asset managers continue to use ESG factors to identify and manage risks, hoping they will appeal to limited partners and improve performance.

✏️ The evolution of operating models

State Street

Institutional investment firms are reassessing their operating systems due to core market changes, focusing on emerging technology, transitioning investment functions in-house, managing scale, regulatory compliance, and enhancing data management. Key drivers include automation, AI, cloud technology, and the need for robust data management strategies to support efficient scaling and compliance.

✏️ Could derivatives help enhance your portfolio?

JP Morgan

Derivatives can be a cost-effective way to protect your portfolio by capping gains to reduce potential losses. These financial instruments, including options, futures, and swaps, help hedge against risks, potentially enhance returns, and generate income. Despite their complexity and risks, with the right guidance, derivatives can offer valuable diversification and protection for investors' portfolios.

✏️ The big picture: Journeying into exotic markets diary of a quant

Man Institute

The author explores the evolution from trading accessible instruments like FX and futures to systematic investing in alternative and exotic markets. These markets, though harder to access, offer unique risk factors and diversification benefits. The journey involved significant operational groundwork and adaptability, leading to successes in trading instruments like CDS and crypto, while encountering some dead ends. The continuous exploration of new markets, such as battery metals and climate-related contracts reflects commitment to portfolio diversification and innovation.

📜 Periodicals »

📝 Mid-Year Outlook 2024 (HSBC)

📝 Private market insights June 2024 (UBS)

📝 Global market insights Q3 2024 (JP Morgan)

✏️ Global investment views July 2024 (Amundi)

🎥 AI in investment markets: A discussion among humans (State Street)

🎥 Retail versus institutional flows: Relationships and implications (State Street)

🎥 Institutionalizing niche sectors (Juniper Square)

PRIVATE CREDIT x FIXED INCOME

📝 Not all private credit is created equal: what to consider in an uncertain environment

Nuveen

A disciplined approach to selecting borrowers in the core-traditional middle market can provide better risk-adjusted returns in private credit. Focusing on conservatively structured financings, strong private equity relationships, and thorough credit management is essential. Managers with deep expertise and experience, particularly those predating the 2008 financial crisis, can better navigate economic uncertainties and offer higher-quality investment opportunities.

📝 Changing the narrative on sustainable fund flows

TCW

Despite headlines about net outflows from sustainable funds, the global sustainable fund market saw net inflows of c.$900M in Q1 2024. Equity-focused sustainable funds faced c.$12B in outflows, while sustainable fixed-income funds attracted more investments than their non-sustainable counterparts. Definitions of sustainable funds vary, influencing mixed messaging, and regional differences highlight diverse investor appetites, with Europe seeing significant inflows and the US experiencing notable outflows. Sustainable fixed-income funds, particularly in passive strategies, have shown strong growth.

📝 The roundup: Top takeaways from Oaktree conference 2024

Oaktree

The investment environment significantly impacts investment success, especially over shorter time horizons. Commercial banks are reducing asset financing activities due to increased regulations and rising interest rates, creating opportunities for alternative lenders in the $5T asset-backed finance market. This shift is seen as a secular change, not a cyclical one, offering long-term prospects for private credit growth. Key opportunity areas include asset-backed finance, markets like Europe and India, real estate, special situations etc.

📝 Buy and maintain: an alternate approach to fixed-income investing

Nuveen

Nuveen’s buy and maintain investing approach blends active investing's benefits, such as diversification and stringent credit risk management, with passive investing's advantages, like low turnover and cost-effective fees. This long-term strategy involves holding high-quality bonds until maturity, focusing on consistent yield and minimizing risks.

✏️ The rise of private credit: A new frontier for investors

State Street

Private credit assets under management have tripled since 2012, reaching $1.5T and are expected to grow to $2.3T by 2027, attracting insurers and both institutional and individual investors. However, asset managers and investors face challenges such as data management, transparency, volatile financing rates, tightened regulations, and a changing macroeconomic environment.

✏️ Private credit: Everything old is new again

UBS

Private credit has gained prominence due to a structural shift in capital markets. Loans and direct lending are particularly attractive at the moment while CLOs are lucrative on a relative value basis. AAA-rated CLO debt tranches (also called mezzanine tranches) are delivering comparable spreads and returns as similarly rated investment grade corporate debt. Senior loans have a much steadier and resilient return profile.

✏️ Finding value in high-value bonds and credit markets

Northern Trust

High-yield bonds present opportunities due to low volatility, increased performance dispersion, and attractive yields, especially for CCC-rated bonds. Private credit, benefiting from private equity support, offers long-term prospects but requires careful risk assessment and experienced management. Both high-yield bonds and private credit are attractive in the current market but demand an understanding of risk tolerance and market dynamics.

✏️Alternative credit outlook: Risk appetite is back, but performance won’t be evenly distributed

AXA

Market sentiment is cautiously optimistic with expectations of higher-for-longer rates. Value corrections have created attractive entry points in real asset sectors needing significant financing. Geopolitical events will impact risk appetite, but structural trends and bank disintermediation continue to create opportunities. Risk assets had a strong first half of 2024, driven by resilient corporate profits and solid consumer spending, with markets expecting a soft landing for the US economy, which should drive a continued risk asset rally in the latter half of the year.

📝 Inflation-linked bonds: A “real” diversifier for long-term investors

LGT Capital

Inflation-linked bonds (linkers) protect investors against inflation risks by tying payouts to an official inflation index, preserving purchasing power even during high inflation. They offer diversification benefits and are effective for long-term fixed-income portfolios, such as those of pension funds and insurers, by offsetting inflation-indexed liabilities. Key features include continuous inflation compensation and maintaining the purchasing power of invested capital.

✏️ Frontier-market sovereign debt: Distressed to impress

Abrdn

The recent sovereign debt restructurings in Zambia, Ghana, and Sri Lanka have created investment opportunities and provided key lessons for investors. Many lower-rated emerging markets lost access to international bond financing since 2020, leading to defaults influenced by COVID-19, geopolitical conflicts, and rising US Treasury yields. Successful investments in distressed bonds require analytical experience, legal expertise, and patience.

✏️ IG credit: Finding value in a more stable environment

Barings

Record-high yields and supportive fundamentals create opportunities in investment-grade (IG) credit. With yields at c.5.5%, nearly double the 10-year average, and strong demand from insurers and investors, the environment remains favorable. Stabilizing leverage and interest coverage in the industrial and financial sectors, along with selective opportunities in new issuers and sector-specific trades, further bolster the outlook for IG credit.

✏️ Bank on it: Credit opportunities within financials

Man Institute

Over a year later after the US and Europe regional bank collapse, significant differences between European and US banks have emerged, largely due to regulatory variations. European banks have stricter capital requirements and are more resilient due to their experience with volatile rates and higher capital levels. This resilience has improved the investability of European banks, leading to higher returns on equity (c.12% vs 11% for US counterparts) and benefiting bondholders. The paper also explores credit risk sharing (CRS) and broader financial credit opportunities.

✏️ Public and private credit: Where investors should focus

Mawer

Private credit AUM has surged to $2-3T over the past decade. While private and public credit are often viewed separately, they share many similarities. Although long-term allocations to both are beneficial, investor interest has overly favored private credit. Diversified public credit, especially through an unconstrained strategy, provides attractive returns, transparency, and liquidity, and can serve as a stable anchor in a diversified portfolio.

✏️ Filling the void

UBS

The wave of bank consolidations led to a significant reduction in the number of US banks and indirectly facilitated the rise of private credit in 1990s, as banks shifted focus from small to large corporate borrowers. The gradual repeal of the Glass-Steagall Act and the development of leveraged finance and junk bonds in the 1980s also played crucial roles in reshaping the banking landscape and fostering the growth of private credit. “Private credit still has a lot of room to capture market share from other sectors, such as syndicated loans, high yield, asset backed securities and real estate. The key is for institutional investors to get comfortable with the different sub-asset classes within private credit.”

📜 Periodicals »

📝 Quarterly credit outlook: Plus change (Robeco)

📝 Emerging markets: Second half outlook (TCW)

📝 Global fixed income views Q3 2024 (JP Morgan)

📝 Weekly fixed income musings (Goldman Sachs)

📝 Weekly economic commentary: Mid-year themes (Northern Trust)

✏️ High yield monthly update (Nomura)

✏️ Weekly fixed income market commentary: Treasury yields rise, reversing the June rally (Nuveen)

✏️ Second quarter 2024 investment review (JP Morgan)

🎥 Specialty finance: An expanding world of opportunity (PIMCO)

🎥 Gain an active edge in the bond market (PIMCO)

🎙 In private credit, It’s peak popularity — and peak worries (Institutional Investor)

✏️ First cut—State of private markets: Q2 2024 (Carta)

PRIVATE EQUITY

📝 The importance of diversification

HSBC

Private equity investors face a slowdown in exit markets, leading to reduced distributions and negative cash flows from capital calls. This highlights the need for diversification across investment cycles and industries to mitigate risks. Despite current challenges, managers are actively using tools like continuation funds, NAV loans, and secondary market activity to manage exposure, with expectations of market recovery as interest rates potentially fall.

✏️ A big role for small and middle-market private equity investments

JP Morgan

The smaller end of the buyout market (companies with revenues of $10-$300M) offers several attractive features: a larger opportunity set (147K+ companies - 96% of all privately held companies), 15%-20% lower purchase multiples, and less leverage (20% less acquisition leverage on average). These factors create clear value-creation opportunities through operational improvements and add-on acquisitions. In 2023, the global value of PE exits fell 71% from 2021, with large buyout funds facing an 80% decline in IPO exits, contrasting with the more resilient small and middle-market exits.

✏️ Accessing private markets through primary fund investing: The path to capital appreciation and IRR

HarbourVest

Primary fund investments are used by leading institutional investors and are increasingly popular among family offices, HNIs, and retail investors for private market portfolios. These investments involve LPs providing capital, and GPs investing in a diversified portfolio of 10-30 companies per fund. Primary strategies offer early access to private companies in venture capital, growth equity, and buyouts, providing complementary diversification across strategies, geographies, and time periods, with the potential for capital appreciation and alpha.

📝 Carbon & emissions tech overview

Pitchbook

In 2023, VC deal activity in the carbon & emissions tech sector hit a record c.$18B across 1,130+ deals, driven by the addition of low-carbon manufacturing & industrial processes. Despite challenging market conditions, the sector remained resilient. Exit activity peaked at $3.8B in 2021 but fell to $1.9B in 2023. Key investment categories in Q1 2024 included lithium battery recycling and direct air capture, with significant investments in these areas. The median pre-money valuations for carbon tech companies have remained stable from 2021 to 2024.

📝 APAC healthcare market snapshot

Pitchbook

Asia-Pacific has seen significant healthcare VC investment - Q1 2024 saw $1.1B of deal value across 44 deals ($25M average deal value). China has recently seen $50B+ of investments in Beijing and Shanghai alone. Other top cities include Seoul, Singapore, and Tokyo. Despite China's prolonged downturn, Japan and India show market optimism, and rising geopolitical tensions impact the region.

📝 Key takeaways from medtech MVP venture & partnering

Pitchbook

Reimbursement has become the primary challenge for commercializing medtech devices, surpassing regulatory review. The FDA’s breakthrough program accelerates review periods for certain devices, but its proliferation has lessened exclusivity. M&A activity remains a growth strategy for strategics, with an increase in public medtech company acquisitions due to favorable valuations. IPOs are expected to surge in 2025, despite a less optimistic outlook for the rest of this year. Strategic minority investments present mixed benefits for startups and VCs. Future medtech innovation is likely to be driven by precision medicine, connected devices, and portable therapies.

📝 High-stakes foundation model horse race out of the gate

Pitchbook

Since 2022, Pitchbook has tracked VC megadeals for 14 foundation model research labs, with secondary trading creating liquid markets for companies like OpenAI, Anthropic, Cohere, and xAI. In Q2 2024, valuations for AI unicorns Anthropic, Databricks, and OpenAI increased based on public comparables and secondary transactions. The success of foundation models will depend on reasoning capabilities, with research labs focusing on new approaches to enhance performance.

✏️ The startup industry’s boom in bridge rounds isn’t slowing down yet

Carta

In Q1 2024, bridge rounds accounted for 42% of seed-stage and 43% of Series A investments, marking the highest rates of the decade. Despite a general decline in venture deals, bridge rounds have shown resilience, with Series A bridge rounds only decreasing by 34% compared to a 73% drop in primary rounds since Q4 2021.

✏️ Meeting the capital challenge within impact growth equity

M&G Investments

Private equity investors are increasingly focusing on impact investing, projected to grow from $3T in 2023 to c.$8T in the next decade at a 10% CAGR. However, a reduction in late-stage funding, particularly due to high interest rates and decreased IPO activity, is challenging for impact growth equity. This funding gap is critical, especially for capital-intensive sectors like energy transition. A growth equity impact strategy is required, providing both capital and strategic support to mission-driven companies in climate, health, and inclusive growth sectors.

📜 Periodicals »

📝 Pharmatech: VC and PE trends and industry overview Q1 2024 (Pitchbook)

📝 2024 European private capital outlook: Midyear update (Pitchbook)

📝 Global PE first look Q2 2024 Excel databook (Pitchbook)

📝 NVCA venture monitor first look Q2 2024 Excel databook (Pitchbook)

✏️ First cut—State of private markets: Q2 2024 (Carta)

SECTOR FOCUS

Energy Transition x Climate Finance

TVJ Spotlight 🔦

📝 Investing in India’s energy future: a just transition challenge

Amundi

India is undergoing significant growth, with a notable focus on its energy transition due to its large scale and impact on the economy and environment. As the third-largest CO2 emitter, India relies heavily on fossil fuels but aims to reach Net Zero emissions by 2070, investing in renewable energy and green sectors. The Securities and Exchange Board of India (SEBI) has enhanced ESG regulations to support this transition, emphasizing the need for inclusive and just practices. Despite these efforts, coal remains a major energy source, posing challenges that require global cooperation and investment to overcome.

📝 Nuveen Natural Capital: 2024 sustainability report

Nuveen

Addressing the interconnected challenges of climate change, biodiversity loss, and unsustainable production requires a holistic approach. Nuveen’s Nature-Positive Farming Program in Europe enhances farming practices' resilience and financial sustainability. Leveraging three decades of land-based investing experience, Nuveen aims to invest in global nature-based climate solutions and sustainably manage farmland and timberland, focusing on improving soil, water, biodiversity, climate, and communities across their assets.

✏️ China’s clean technologies: the risks and opportunities of oversupply

Abrdn

China's surge in clean technology manufacturing, including solar, wind, and battery components, is beneficial for global climate efforts but has led to overcapacity issues. This mismatch between supply and demand affects various sectors, creating challenges but also opportunities for companies in clean technologies. Clean technologies have never been as competitive, which could significantly accelerate the pace of decarbonization. This could provide an upside for multiple businesses including power producers, electrification technologies, and the infrastructure that supports decarbonisation.

✏️ A powerful combination of tailwinds powering impact opportunities

JP Morgan

In mid-2024, the impact investing industry is showing signs of recovery after a challenging 2023, with increased activity in fundraising and deal-making. Climate remains the dominant investment theme, but significant opportunities also exist in education and workforce development. Despite a broader slowdown due to inflation and interest rate adjustments, climate investments have demonstrated resilience, and there's a notable influx of talent into climate investing. Additionally, the education sector is experiencing growth driven by demand for non-traditional training and innovative financing models.

📝 Climate impact pledge: Moving the needle on net zero

LGIM

Climate change poses a significant systemic risk to investment portfolios, prompting LGIM to enhance their Climate Impact Pledge (CIP) assessments and engagements with over 5,000 companies. Despite some progress, the transition to net-zero carbon emissions by 2050 must accelerate, necessitating more stringent actions such as vote sanctions and divestments for underperforming companies. LGIM's recent efforts include focusing on emission-intensive sectors and improving methane emissions disclosure and coal usage, highlighting the importance of public policy and better emissions reporting to drive substantial climate action.

✏️ Renewables: A way to participate in the India growth story

HSBC

India's economy, bolstered by resilient growth in sectors like technology, credit, consumer spending, and services, is attracting investors despite global uncertainties. The renewable energy sector, driven by aggressive clean energy targets and supported by government policies, presents significant opportunities for bond investors. However, challenges such as infrastructure limitations and equipment supply volatility remain. The government's focus on eliminating risks and supporting renewable projects is expected to enhance investment appeal in this sector.

🎙 A sustainable future in aviation (Man Institute)

Real Estate x Infrastructure

TVJ Spotlight 🔦

📝 Global real estate outlook mid-year 2024: A new cycle of contrasts

M&G Investments

After challenging years, optimism for global real estate in 2024 is growing, with many markets expected to bottom out and stabilize. Investors are cautiously re-entering, seeing the potential for attractive returns, but must navigate risks such as high leverage and structural challenges in certain assets. The new cycle will focus more on income generation and preservation rather than capital growth, requiring selective investment decisions. Best-in-class office assets could well see a better rental return than older logistics assets in markets where recent double-digit rental growth has led to a large supply response. Below is a snapshot of the various opportunities in the market.

📝 The new infrastructure blueprint

BlackRock

Societies face overlapping challenges including energy security, transitioning to a low-carbon economy, changing demographics, urbanization, and supply chain realignment, all requiring substantial new infrastructure investments. Traditional funding sources are insufficient, necessitating public-private partnerships and corporate collaborations. This transformational moment in infrastructure investing presents significant opportunities for capital deployment in super batteries, data centers, logistics hubs, and more, with increasing annual energy investments expected to reach c.$4.5T by the 2040s.

📝 Annual sustainability report in real estate

Nuveen

Sustainability remained crucial for Nuveen Real Estate team which has a focus on global energy transformation and affordable housing. Regulatory developments demand greater transparency, and 70% of institutional investors report that ESG factors influence their decisions. Government policy and technological innovation are seen as key drivers of the energy transition, while politicization poses a challenge. Nuveen Real Estate aims for net zero carbon by 2040, integrating long-term trends like digitalization and the low carbon economy into its investment strategy to deliver value to clients and society.

📝 Infrastructure’s second lease of life

Pantheon

Pantheon highlights the surge in infrastructure secondaries deal flow driven by LP demand for liquidity and a slowdown in distributions from existing portfolios. There is a supply-demand imbalance due to a shortage of buy-side capital, leading to entry discounts of 5-15% and occasionally up to 20% for high-quality infrastructure portfolios. This imbalance supports sustained discount levels and potential slight widening, not due to portfolio concerns but due to the availability of capital and buyers for infrastructure secondaries.

✏️ Global real estate outlook – May 2024

UBS

Real estate investment volumes remained subdued globally, with significant price adjustments continuing, especially in the US and UK office sectors. APAC leasing activity was stable, especially in finance and tech sectors, but capital markets saw weak investor sentiment, with a 13% YoY drop in transaction volumes in 1Q24. Cap rates stabilized after significant increases in 2023. US private real estate showed mixed results in 1Q24, with positive returns in retail and industrial sectors offsetting declines in apartments and office buildings. Despite overall one-year negative returns, the expectation for recovery remains for most sectors except office buildings. The European real estate market is recovering but the next few months will be crucial in determining how robust the recovery will be. Total annual commercial transaction volume in Europe amounted to EUR 96B by the end of 1Q24.

✏️Infrastructure for good? It's time to get real with your pension

LGIM

Infrastructure investing, particularly in clean energy, digital telecoms, transportation, and water, is seen as a key strategy. This approach not only targets attractive returns but also aligns with ESG goals, motivating members to invest more in their pensions while contributing to real-world benefits like climate change mitigation and improved societal infrastructure.

Artificial Intelligence x Technology

📝 Beach read: Navigating tomorrow’s game-changing trends

Robeco

The introduction emphasizes the constant nature of societal change driven by evolving trends and structures. Key themes include the transformative impact of technology, robotics, shifting socio-demographics, and the urgent need for climate action, highlighting significant opportunities for investors.

✏️ The gross margin imperative in the age of AI

Lightspeed

This is an exciting time for startups, especially with the impact of AI on software development. Lightspeed emphasizes the importance of gross margins for the long-term viability of new companies. With AI enabling more complex and efficient software capabilities, many disruptive companies are adopting "work as a service" models, charging based on success rather than static pricing. However, this approach can be costly due to the computational demands of large language models (LLMs) and the need for human-in-the-loop workflows to ensure model accuracy.

✏️ Finding certainty in tech's unknown future

OTPP

AI will profoundly transform our lives and work in the coming decades, emphasizing the need for strategic adaptation, innovation, and efficient resource utilization. Clean, reliable, and accessible data will be crucial for AI success, offering a significant competitive edge. As AI technology matures, workflows will evolve around AI to enhance productivity, effectiveness, profits, and overall quality of life.

✏️ Integrating tech into the healthcare value chain

Permira

Tech enablement is transforming healthcare by integrating advanced technologies like AI, machine learning, and robotics to drive efficiency, reduce costs, and improve patient outcomes. Key investment opportunities include specialty pharma, medical devices, and healthtech, with AI enhancing drug development, diagnostic imaging, and surgical procedures. Challenges include regulatory hurdles and data protection, but the potential for AI and precision medicine to revolutionize the sector is significant.

✏️ The hidden advantages for medtech in Europe’s ESG rules

BCG

European medtech companies are facing a surge in ESG regulations, requiring a proactive approach to compliance. They must understand existing and upcoming regulations and deploy a regulatory-watch process to stay agile. Key areas of focus include product design, waste management, and developing strategies to meet new requirements while potentially gaining a competitive edge through ESG initiatives. This approach not only helps avoid noncompliance fines but also positions companies better in procurement, financing, transparency, and attractiveness as employers.

✏️Are you organized to reap value from generative AI?

Bain

Adopting generative AI swiftly requires strategic organizational choices in program sponsorship, governance, staffing, and funding. Bain's analysis of 20 financial firms highlights the importance of C-suite governance for coordination and cross-functional initiatives to engage business units and disseminate successful practices.

Financial Services

✏️ Insurance investors: All change?

Portfolio Institutional

Insurance investors are reassessing their portfolios due to higher treasury yields, risk premium compression, and the need to maximize yield. M&G highlights the shift towards re-evaluating strategic asset allocations, particularly focusing on the core portfolio's fitness for purpose amid tightened investment grade credit spreads and higher government bond yields. Insurers are now prioritizing non-core assets like senior secured private credit to diversify and improve yields, while also considering liquidity needs, liability duration, and capital-raising strategies.

🎥 The cooperative advantage in banking and insurance (Bain)

Thank you for reading The Valt Journal!

Check out our other editions here.

Disclaimer:

The content provided on this platform contains references and links to external sources, including articles, reports, websites, images, or videos. We do not own or claim copyright over the content found in these external sources. The ownership and rights of the content belong to the original creators.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.