The Valt Journal #31

Featuring latest research on Real estate, Infra, Energy (BlackRock, Principal AM, MS); Private Credit (Barings, GS, Nuveen); PE (Hamilton Lane, Carta); Alts as an asset class (Pitchbook, State Street)

Hi, welcome to the new edition of The Valt Journal. In every issue, we cover the best and the latest insights into the global private markets. The Valt Journal is a repository of time sensitive and timeless research, delivered to your inbox every 2 weeks, so you don’t have to look anywhere else! Clicking the headlines is all it takes.

Check out TVJ Spotlights 🔦 including 1) Why middle-market co-investment opportunities make sense now (by Hamilton Lane); 2) Global fund performance report (by Pitchbook); 3) Navigating ILPA’s NAV-based facility guidance (by Pitchbook)

The Valt Journal Library 🚀

Our private markets and alternative assets focused live repository featuring a collection of 1K+ research reports and articles from 150+ global asset managers and experts across 4 categories and 40+ sub-categories for an efficient, fast and seamless research experience.

Quickly scan the list of all reports in this edition here!

Numbers this edition:

Links: 80

Authors: 40

SECTOR FOCUS

Energy Transition x Climate Finance

📝 Capital at risk: nature through an investment lens

BlackRock

Natural capital offers opportunities in both public and private markets in areas like precision agriculture, circular economy solutions, and reforestation. There are $350B of outstanding debt across themes like biodiversity and water conservation. In private markets, large-scale transactions have happened in recent years in regenerative agriculture ($40B market by 2040) and AI & robotics are expected to grow the market to over $150B within a decade.

📝 Carbon management: A candid conversation among investors

BlackRock

Carbon management involves capturing, transporting, and storing or reusing CO2 to reduce emissions, particularly in hard-to-decarbonize industries. There are opportunities in carbon capture, removal, and utilization technologies. Purchases in the durable carbon dioxide removal credits (CDR) market have grown by 7x+. From 2020 to 2023, the space has seen a growth of 5x+. The CDR price index has increased to US$444 per tonne. This indicates that while the market is growing, the costs associated with managing carbon are also increasing, which could pose challenges for scalability and widespread adoption.

📝 Circular economy: reincorporating waste into productive end uses

Nuveen

Waste reduction and circular material use are essential for minimizing natural resource extraction, cutting emissions, and protecting ecosystems. Investments in the circular economy offer unique, ROI-driven opportunities across diverse markets. However, asset selection is crucial to ensure viable unit economics, manageable risks, and experienced management teams in order to scale sustainably.

✏️ Nuclear power’s renaissance

Morgan Stanley

Nuclear power global capacity is expected to double by 2050. Government subsidies and green bonds is fueling investment across the nuclear value chain, including uranium mining, power generation, and waste handling. Innovations like small modular reactors and increasing demand from sectors like AI are further boosting nuclear's growth. “Investments in new capacity will total $470B in China, $250B in the US and $197B in the EU by 2050.”

✏️ Emerging markets, global impact: Driving sustainable growth

Goldman Sachs

EM capital markets offer significant opportunities in areas like renewable energy, biodiversity conservation, and climate resilience, though a large capital gap remains. In 2022, clean energy investments in EMs reached c.$770B. Asia shows notable potential for private sector investment - China’s annual investment could reach $1T by 2030, India's power sector alone presents a $650B opportunity, while Vietnam may need $8-$10 billion annually.

Real Estate x Infrastructure

📝 2024 Mid-year real estate outlook

Principal Asset Management

The report highlights a gradual and uneven recovery in the real estate market, driven by cautious capital markets and continued economic flux. While property returns are improving, the US market remains in negative territory, with AI fueling demand for data centers as a key growth sector. Valuations are expected to stabilize by the year's end, though liquidity and deals remain limited.

📝 A high-quality component of a fixed-income asset allocation strategy

Principal Asset Management

Core commercial and multifamily mortgage loan investments offer attractive credit risk profiles, appealing relative value, high current income returns, and diversification within fixed-income portfolios. These investments also provide call protection and limited correlation with other fixed-income alternatives, making them appealing in volatile economic environments. Successful navigation of this asset class requires a well-qualified asset manager.

📝 Challenges and opportunities in today’s commercial real estate market

PIMCO

The CRE market is facing a slower recovery due to high interest rates and geopolitical risks, but there are significant opportunities for those with capital and expertise. Key sectors to focus on include data centers and logistics, driven by trends like digitalization, decarbonization, and demographic shifts. Financing solutions, from senior debt to preferred equity, are becoming more important in navigating this complex landscape.

📝 A compelling opportunity in REITs

Morgan Stanley

REITs have underperformed the US equity market over the past five years due to COVID-19 and rising interest rates, resulting in significant undervaluation. With expected interest rates cuts in 2H 2024, and REITs historically performing well during such periods, they present a good opportunity as valuation discount vs equities could lead to outperformance.

📝 After trough NAV discount comes trough NAV

Morgan Stanley

European listed real estate appears to be nearing a trough in NAV discounts, which historically signals a market recovery within six to nine months. Since October 2023, European real estate stocks have rallied, supported by rate cuts, reduced leverage, and a slowdown in development activity, suggesting resilience in rental and capital values. While risks remain, several positive market signals indicate a further sector recovery.

📝 US real estate: Ready, set, go?

Barings

In the property market, transaction volumes have declined for eight consecutive quarters, but investors are preparing to deploy capital as borrowing costs may lower, despite rising distress levels in real estate debt, particularly in the office sector. Real estate debt distress across major property types reached $94B as of the second quarter of this year. Office comprised the largest share of outstanding distress at $41B, however, distress is pending across other property sectors.

📝 European real estate: Let the recovery commence

Barings

Property market recovery will vary by sector, with office and some European markets lagging. Prime office rents are rising despite vacancies, while logistics and physical retail sectors may rebound as macroeconomic conditions improve. European house prices have proved remarkably resilient to the interest rates shock, partly due to tight labor markets and rising nominal wages, but also a shift to fixed-rate mortgage payments.

✏️ Pricing resets offer considerable upside potential

JP Morgan

The rapid rise in interest rates has significantly reset property valuations across sectors, creating opportunities to invest in high-quality assets at discounted prices. CRE investors now face a potential buying opportunity as market fundamentals remain strong, particularly in single-family rentals, last-mile logistics, and development options.

✏️ Diversification: A key to playing the global real estate recovery

KKR

Diversifying across geographies, property types, and capital stacks can enhance risk adjusted returns, as real estate performance varies significantly by region and sector in the current cycle. With deal activity increasing and global opportunities emerging, diversified and well-capitalized investors are well-positioned to capitalize on the recovery.

✏️ Global real estate market outlook Q3 2024

Abrdn

The strength of European real estate cashflows and their growth potential is attracting capital back to core assets. Prime yields jumped 140 bps from a low of 4.3% in June 2022 to 5.7%, on average, in June 2024. Higher yields and the potential for income growth, in the wake of the strong correction in values, now present a compelling entry point for investors.

✏️ Future minerals: why utility and scarcity make a winning union

Abrdn

Copper and other "future minerals" like lithium, aluminium, and nickel are essential for the energy transition, driven by demand in electric vehicles (EVs) and electricity grids. Long-term demand growth due to green energy adoption may lead to a commodities super cycle. Investing in companies across the value chain, from mining to product manufacturing, offers better opportunities than commodities themselves.

AI x Tech

📝 State of enterprise tech report

Insight Partners

Despite external challenges, enterprises continue to innovate, investing in infrastructure, AI, and enhancing employee and customer experiences. This report provides a benchmarking guide for understanding budget shifts, current investments, and key priorities. “3 key reasons to move your applications to the cloud. First, it allows you to innovate faster on behalf of your customers. Second, it can provide greater security, resiliency and flexibility. Finally, cloud done right can be highly cost-effective.”

✏️ Investing where AI, energy and politics intersect

Goldman Sachs

AI, the clean-energy transition, and geopolitics are deeply interconnected forces shaping the global economy. AI's rising energy demand will drive significant advancements in renewable power and infrastructure. Meanwhile, geopolitical tensions, particularly between the US and China, are accelerating deglobalization and impacting clean-tech development. Investors need to understand these interdependencies to navigate emerging risks and opportunities effectively.

✏️ AI governance for private companies

Wellington Management

The rise of generative AI is transforming industries, with many companies adopting the technology for efficiency gains. However, only 21% have AI risk management policies in place, underscoring the need for responsible governance. Companies must address risks such as customer harm, data privacy, and environmental impact while adhering to emerging regulations like the EU AI Act to harness gen AI's potential responsibly.

✏️ What can instant payments and blockchain do for your bank?

Pwc

The demand for instant payments is growing rapidly, offering benefits like faster transactions, improved efficiency, and better cash flow management. Blockchain-based real-time payments are gaining traction, providing secure and efficient payment methods. Banks and corporations adopting instant payments can capitalize on operational efficiencies, cost reduction, and new revenue streams while meeting evolving customer demands in a competitive digital landscape.

🎥 The growing European software landscape (TPG)

🎥 The creator economy and the evolution of content (TPG)

🎙 Infrastructure debt: a critical part of the capital solution (Nuveen)

PRIVATE CREDIT x FIXED INCOME

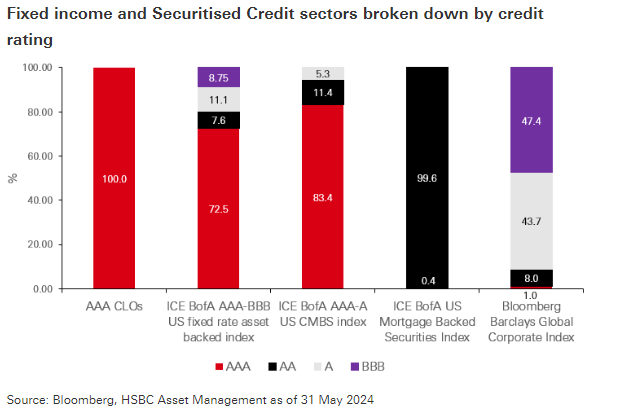

📝 Utilising securitised credit within your asset allocation

HSBC

Securitised Credit offers significant diversification and yield enhancement benefits for multi-asset portfolios due to its floating rate structure and low correlation to traditional fixed income and equities. It provides credit exposure tailored to risk/return preferences and has shown resilience with lower volatility and higher Sharpe ratios vs corporate bonds. Sectors like CLOs, CMBS, and Prime RMBS can strengthen a portfolio’s credit profile while maintaining competitive returns.

📝 Understanding style drift in perpetual BDCs

Barings

The democratization of private credit has been fueled by investment fund structures like Business Development Companies (BDC), offering various access points for investors. Public BDCs offer liquidity but higher volatility, private BDCs have lower volatility but limited liquidity, and perpetual BDCs provide semi-liquid exposure to private credit with cash dividends.

📝 Leveraged loan and CLO: new issuance surge

TCW

2Q 2024 saw strong demand for levered credit and record-setting broadly syndicated bank loan issuance. While defaults have risen, private credit solutions have gained traction, offering flexibility for borrowers facing idiosyncratic challenges. YTD CLOs are returning c.4.4% outperforming Investment Grade credit (-0.46%) and High Yield credit (+1.47%).

📝 Income strategy update: high-yielding, high-quality global opportunities

PIMCO

Bond yields are high, inflation is moderating, and interest rates are coming down, creating a favourable scenario for bond investors. Managers should focus on high-quality assets, including agency mortgage-backed securities and non-agency mortgages, positioned to capture attractive yields while navigating market volatility and potential downturns.

📝 Municipal market: Bonds are acting like bonds again

Nuveen

With the Fed signalling rate reductions, longer-duration municipal bonds are becoming more favourable, offering tax-exempt income, potential capital appreciation, and reduced downside risk as the yield curve steepens. “Municipal bond gross supply is expected to be at c.$450B in 2024, up meaningfully from $330B in 2023. However, with c.$400B of bonds maturing in 2024 and significant coupon payments, supply will likely be net neutral.”

📝 Investors will capture more of the lending market

Apollo Global

Apollo CEO discusses the significant shift towards private credit markets, which are increasingly replacing traditional bank loans, driven by investors seeking higher returns and lower liquidity. Apollo considers private credit to be a $40T market with major focus on investment-grade loans, particularly in sectors like digital infrastructure and energy transition.

📝 Are private credit markets too good to be true — Or just factually true?

FS Investments

Despite concerns from investors about whether private credit is saturated with too much capital due to the large sums raised by investment firms and its growing accessibility, the perception of saturation may not fully reflect the opportunities available in this space.

✏️ Public and private credit: Capitalizing on coexistence

Goldman Sachs

The resurgence of public fixed income is driven by higher yields, while private credit markets continue to grow, reaching $2.1T in assets. Public and private credit serve complementary roles in portfolios, with public credit offering liquidity and private credit providing potentially higher returns through tailored lending solutions. Companies increasingly use both markets strategically, optimizing their capital structures to adapt to evolving market conditions.

✏️ The tailwinds behind asset-based finance

Goldman Sachs

The asset-based finance market, estimated at $15T+ by GS, is growing rapidly, offering diversification opportunities beyond traditional corporate lending. It provides investment-grade risk exposure across pools of real estate, consumer, hard, and financial assets, with increasing institutional involvement. ABF offers higher yields, diversification, and flexible term structures, making it attractive to asset allocators like insurers and pension funds.

✏️Asset-based finance – too important to ignore

Axa Investment Managers

The Asset-Backed Finance market is growing rapidly, offering investors diverse exposure, typically with shorter duration and higher control compared to traditional lending. ABF can enhance returns in fixed-income portfolios without increasing risk, acting as an effective diversifier due to its low correlations with other asset classes and providing opportunities for yield enhancement amid tightening bank lending standards.

✏️ Understanding private credit

Goldman Sachs

Private credit offers tailored capital solutions with advantages like certainty, speed of execution, and confidentiality. Over the past decade, the asset class has generated higher yield than most other asset classes, including 3-6% over public high yield and broadly syndicated loans, with overall IRR in the 8-12% range.

✏️ Private credit: From mid-market to real economy financier

Blackstone

Private credit is creating a significant $25T opportunity, particularly in high-grade strategies like asset-based financing and infrastructure. Private credit offers better yields, reduced volatility, and diversification compared to traditional corporate credit, with larger platforms well-positioned to capitalize on the opportunities ahead. “Direct lending generates double-digit yields on c.50% LTV loans with around 300bps of excess yield compared to public loans.”

✏️ Private credit: Lessons from a deal-making expert

UBS

Private credit remains resilient, benefiting from its flexibility and specialized solutions as syndicated markets regain activity. The upper middle market, with its larger, more established businesses, offers strong investment opportunities, while strategic partnerships and origination excellence are crucial for sustained success. As M&A activity rebounds, private credit is poised for continued growth, supported by increased private equity sponsor activity.

✏️ Venture debt financing

Carta

Venture debt is a form of private credit offered to startups alongside equity financing, allowing them to secure additional capital without diluting ownership. It is based on the company's growth potential rather than traditional metrics like revenue or assets. Pros: No ownership dilution, tax deductions, build credit; Cons: You must pay the money back, high interest rates, requires regular income, terms may require certain milestones.

✏️ Emerging into the spotlight: The case for EMD in insurance portfolios

Man Institute

EMD (emerging market debt) offers insurers high-quality, long-duration investments, attractive spreads over US Treasuries, and diversification across a large, growing pool of assets. While EMD presents opportunities, investors should be mindful of liquidity risks, particularly in corporate bonds. EMD can enhance insurance portfolios by offering a spread premium and greater return potential compared to developed market credit.

✏️ US debt sustainability: An uncertain fiscal future

Goldman Sachs

US gross federal debt is projected to surpass $35T by November 2024, continuing its upward trend and potentially reaching $54T by 2034. While the US economy's unique strengths, such as the global reserve currency status of the dollar, offer fiscal flexibility, long-term debt sustainability remains a concern amidst rising interest rates and geopolitical risks.

📜 Periodicals »

📝 Credit market update – 2Q 2024 (Varde)

📝 Performing credit quarterly 2Q 2024 (Oaktree)

📝 2H 2024 Alternative credit insights: Investing for resiliency (Nuveen)

📝 Quarterly liquid credit market commentary 2Q 2024 (Partners Group)

📝 Permira credit market update 2Q 2024 (Permira)

📝 High yield monthly update (Nomura)

📝 Weekly fixed income: Treasury yields retrace their steps, moving higher (Nuveen)

📝 Monthly market roundup: July 2024 (BNY Mellon)

✏️ Emerging market debt July 2024 review and outlook (Abrdn)

✏️ Unconstrained fixed income views: August 2024 (Schroders)

✏️ Q3 Active fixed income outlook: Back to the 1970s? (LGIM)

🎥 Private markets: Early innings for asset-based lending (PIMCO)

🎥 High yield bonds: Assessing the landscape today (Barings)

🎥 Demand for private credit, BDCs not slowing anytime soon (Barings)

🎙 Is private credit a bubble? (FS Investments)

PRIVATE EQUITY

TVJ Spotlight 🔦

✏️ Why middle-market co-investment opportunities make sense now

Hamilton Lane

In a challenging macro environment, middle-market co-investments offer significant opportunities due to broader deal sets, greater value creation potential, and more conservative valuations with lower leverage. These investments benefit from enhanced exit options and shorter hold periods, resulting in attractive returns. Co-investment funds provide diversification across GPs and sectors in a more fee-efficient structure.

✏️ Pension funds are the most active sellers in this hot secondaries market

Institutional Investor

In 1H 2024, secondary market transactions in private funds surged by a record 50%+, reaching c.$68B. Pension funds were the largest sellers (33%). The market saw significant growth, with deal sizes increasing and secondary transactions gaining momentum, particularly among LPs. Buyers are optimistic about continued growth, anticipating a total volume of $131B by year-end, with strong demand for secondary assets across various strategies.

✏️ Mid-year update: Investors still finding their footing on the path forward

Hamilton Lane

Middle-market buyouts and are expected to offer greater potential for value creation. With increased liquidity and stronger exit activity, especially in the latter half of 2024, co-investments provide diversification, lower leverage, and more conservative valuations. The outlook for private equity remains positive, with Europe offering emerging opportunities, despite its past underperformance relative to the US.

✏️ There’s a wall of assets that need to change hands

Goldman Sachs

The current PE market is shifting toward buyers due to prolonged holding periods and lower DPI ratios from deals between 2019 to 2021. This provides better valuations for buyers, more time for due diligence, and enhanced downside protections like earnouts. With unrealized value still held by many large-cap funds, sellers are becoming cautious, leading to innovative deal structures and an increased focus on strategic exits rather than continuation vehicles.

✏️ Why private equity is increasingly interested in Japan

OTPP

OTPP is expanding its investments in Japan due to compelling opportunities in sectors like industrial tech and healthcare. Japan now has a strong private equity market, driven by corporate reforms and a focus on operational improvements. Although Japan's market requires patience, it offers consistent deal flow and attractive returns.

✏️ State of private markets: Q2 2024

Carta

In Q2 2024, the venture ecosystem saw 4% qoq increase in funding rounds and a 12% rise in total VC investments to c.$21B. Median valuations rose across stages, and down rounds decreased to a six-quarter low, signalling a founder-friendly environment. The time between funding rounds remains longer, but investor-friendly terms have declined, indicating a shift toward more balanced deal structures. Valuations are rebounding in Seed and Series D.

✏️ Pre-money vs. post-money SAFEs

Carta

A pre-money SAFE (Simple Agreement for Future Equity) does not fix an investor's ownership percentage until the SAFE converts during a future funding round. Post-money SAFEs locks in a fixed ownership percentage for investors, giving them more clarity but potentially leading to greater dilution for founders. Post-money SAFEs are generally preferred by investors.

✏️ Survey: A pulse check on venture capital

Juniper Square

The US VC industry is currently divided, with AI-focused firms thriving while others face challenges. A survey of 85 VC professionals revealed that 80% expect fundraising in 2024 to be as difficult, if not harder, than in 2023. LP concerns include investor sentiment, LP liquidity, and a lack of exit activity, with LPs pushing for more liquidity. Meanwhile, top-performing firms with strong track records continue to raise funds successfully.

✏️ Value creation in private equity: Making our own luck

KKR

The value creation within portfolio companies is achieved through repeatable processes, focusing on operational improvements, M&A, and strategic positioning. M&A helps companies expand product lines and geographies, while employee ownership and operational involvement, including granular focus, help foster a culture of long-term value creation.

✏️ Understanding private equity performance

Wellington Management

PE investments offer higher cumulative returns compared to public equities but come with trade-offs like lower liquidity. Key metrics used to evaluate PE performance include IRR, MOIC/TVPI, and DPI, each offering unique insights into fund returns. The J-curve effect, where early returns are negative due to fees and delayed realizations, is a common feature of PE funds, especially early-stage venture capital.

🎙Evolution of private equity and alternative markets (TPG)

PRIVATE MARKETS AND ALTERNATIVE ASSETS

TVJ Spotlight 🔦

📝 Global fund performance report (with preliminary Q1 2024 data)

Pitchbook

The Global Fund Performance Report shows an improving outlook for private markets after a subdued 2023. Private equity saw a rebound with a one-year IRR of 10.5%, following a decline in 2022. Venture capital, despite six consecutive quarters of negative one-year IRRs, began showing signs of recovery in Q4. Private debt funds had a strong year, returning an estimated 9.2%, driven by floating-rate loans.

TVJ Spotlight 🔦

📝 Navigating ILPA’s NAV-based facility guidance

Pitchbook

The Institutional Limited Partners Association (ILPA) has released new guidelines for LPs and GPs regarding the use of NAV-based loans, addressing the challenges posed by the current fundraising environment, distribution slowdowns, and future allocations. These best practices, aim to improve transparency, legal clarity, and negotiations between LPs and GPs.

📝 Fintech M&A review: Middle-market valuation analysis

PitchBook

PitchBook's latest note highlights a slowdown in fintech private equity buyouts, with Q2 seeing an estimated 12 deals, down 57% qoq. Analysts remain optimistic due to overall healthy dealmaking over the past year. Corporate M&A activity remains flat, and recovery may take time. The report also includes a detailed set of valuation comparisons for the middle market, based on acquisition price and employee count.

📝 Insurance perspectives: Alternatives in focus

TPG

The partnership between insurance companies and alternative asset managers is evolving, driven by the alignment of insurance companies' long-term liabilities and alternative managers' long-term investment outlook. This collaboration is expanding into areas like private credit, real estate, and infrastructure, as insurance companies seek to enhance yields amid rising competition.

📝 5 things to know from KKR’s 2024 mid-year outlook

KKR

KKR sees compelling investment opportunities in 2024, driven by trends like AI, energy transition, and Japan's economic revival. They recommend shifting away from traditional 60/40 portfolios towards private assets like infrastructure, private equity, and credit to improve diversification, hedge inflation, and enhance returns. They also suggest considering reinsurance and real estate credit for their stability and attractive yields.

📝 The enduring appeal: How top companies command high valuations

Adams Street

Premium valuations for growth-stage companies are driven by their ability to demonstrate efficient growth through key metrics like revenue growth, market size, and sales efficiency. Despite recent challenges, investors continue to prioritize sustainable revenue growth over immediate free cash flow, as the software industry’s proven model suggests high gross margins and operating leverage can lead to larger profits long term.

✏️ Alternative investments: Increased accessibility for investors

Morgan Stanley

Alternative investments are now accessible to individual investors due to the "democratization" of alternative investment vehicles. Financial advisors need to understand the value of these investments, as they may help strengthen client portfolios by addressing the need for income, inflation protection, diversification, and stability. Key alternative strategies include hedge funds, private credit, private equity, real estate, and infrastructure.

✏️ Redesigning operating models for private markets

State Street

Investment firms are increasingly allocating to private markets, but managing the associated unstructured data poses significant challenges. New operating models are needed to support these assets, emphasizing the importance of a "whole-of-fund" view. Intelligent data platforms are being explored to automate processes, integrate diverse assets, and scale as firms grow, offering flexibility and improved compliance.

✏️ Institutions are deferring hedge fund investments until 2025

Institutional Investor

Institutional investors remain interested in hedge funds but are holding back allocations until next year, according to a survey of 185 institutions. While diversification and low correlation to other asset classes are appealing, confidence in hedge fund allocations has waned, leading to increased redemptions and a wait-and-see approach, with many deferring new investments until 2025 or later.

✏️ How multi-manager platforms find strength in numbers

Morgan Stanley

Multi-manager platforms attract investor interest by offering diversified strategies, strong risk management, and consistent returns with lower volatility compared to traditional hedge funds. They excel in generating uncorrelated alpha and managing complex market risks, making them a compelling option for investors seeking diversification and stability.

✏️Asymmetric returns: Managing downside for greater upside

FS Investments

While the Sharpe ratio is widely used to assess risk-adjusted returns, it falls short when volatility is skewed positively. The Calmar ratio, which compares returns to the maximum drawdown, offers a better measure of risk, emphasizing the need to focus on capital protection. Alternative investments show more favourable asymmetric returns, making them a compelling option for investors seeking better risk-adjusted performance.

✏️ CAC is the new CapEx, EBIT“CAC” should be the new EBITDA

General Catalyst

Late-stage tech companies often underinvest in growth due to P&L and balance sheet constraints, prioritizing short-term profitability over long-term enterprise value. The solution lies in adopting a new framework like EBITCAC, which emphasizes investing in customer acquisition cost (CAC) for long-term ROI rather than focusing solely on EBITDA.

✏️Are digital regulations finally coming into focus?

State Street

In 2024, global regulatory progress on tokenized assets has accelerated, with the US, UK, and Hong Kong implementing clearer rules for tokenization, distinguishing it from cryptocurrencies. Regulators view tokenization as a way to enhance financial markets' efficiency, offering benefits like faster, cheaper, and more secure trading.

✏️ Every investor wants GPs to have a succession plan. Few of them do

Institutional Investor

Only 38% of GPs currently have a succession plan in place (vs 41% in 2023) as many prioritize other challenges in a tough market. Despite the growing investor anxiety, discussions about succession remain limited, which may be contributing to more consolidation in the asset management industry as managers seek to avoid succession issues by selling off funds.

✏️ Top technology trends in the private markets

Hamilton Lane

Hamilton Lane highlights the growing adoption of tech innovations in private markets, enabling broader participation in value creation opportunities. Key challenges like data transparency persist, but AI is driving improvements in diligence efficiency, investment insights, and content creation.

✏️ US and Europe private company trends: Resilience sustained

ICG

Private companies in Europe and the US maintained strong performance in 2023 and into H1 2024. EBITDA growth re-accelerated 2H 2023 due to stabilizing margins. Sector performance varied significantly, with consumer discretionary and industrials leading, while chemicals and healthcare lagged. Debt metrics remained solid, although interest coverage ratios declined due slower EBITDA growth. Equity cushions provided protection for debt holders.

🎙 Are investors over-allocated to private markets? (Institutional Investor)

Thank you for reading The Valt Journal!

Check out our other editions here.

Check out TVJ Library. A private markets and alternative assets focused live repository featuring a collection of 1K+ research reports and articles from 150+ sources across 4 categories and 40+ sub-categories. Get your access now!

Disclaimer:

The content provided on this platform contains references and links to external sources, including articles, reports, websites, images, or videos. We do not own or claim copyright over the content found in these external sources. The ownership and rights of the content belong to the original creators.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.