The Valt Journal #33

Featuring latest research on Private Credit (BlackRock, KKR, GS); PE (Pitchbook, Carlyle, Nuveen); Alts as an asset class (Partners Group, JPM, MS); Real estate, Infra, Energy (UBS, Abrdn, BCG)

Hi, welcome to the new edition of The Valt Journal. In every issue, we cover the best and the latest insights into the global private markets. The Valt Journal is a repository of time sensitive and timeless research, delivered to your inbox every 2 weeks, so you don’t have to look anywhere else! Clicking the headlines is all it takes.

Check out TVJ Spotlights 🔦 including 1) Private Debt: The multi-faceted growth driver (by BlackRock); 2) PE middle market report (by Pitchbook); 3) Solving the private markets allocation gap (by Partners Group)

The Valt Journal Library 🚀

Our private markets and alternative assets focused live repository featuring a collection of 1K+ research reports and articles from 150+ global asset managers and experts across 4 categories and 40+ sub-categories for an efficient, fast and seamless research experience.

Numbers this edition:

Links: 50

Authors: 25

PRIVATE CREDIT x FIXED INCOME

TVJ Spotlight 🔦

📝 Private Debt: The multi-faceted growth driver

BlackRock

Private debt is projected to reach $3.5T in AUM by 2028, driven by borrower demand for flexibility and clear pricing, expanding its competition with syndicated debt markets. Changes in public debt and equity markets, including larger deal sizes and companies staying private longer, enhance private debt’s role. Drivers also include reduced bank lending and increased investor demand as they get more confident and comfortable with the asset class.

📝 Why it’s (still) a good time to invest in private real estate credit

Principal Asset Management

With $2T in loans maturing over the next three years and diminished bank lending due to inflation and regulatory pressures, demand for private credit remains high. High interest rates offer opportunities for new investments with attractive returns, making private real estate credit a compelling option for investors.

📝 Benefits of multi-asset credit: Why choose one when you can have them all?

KKR

Multi-asset credit strategies provide dynamic risk management by diversifying across global credit asset classes, such as high-yield and structured credit, while adapting to market conditions. MAC offers flexibility, diversification, liquidity, and operational efficiency, making it a strong option for managing volatility and maximizing returns.

📝 The lower mid-market offers LPs an attractive diversification play

TPG

Lower mid-market (EBITDA <$25M) offers attractive diversification for institutional investors, providing better lender protections, lower leverage, and stronger borrower-lender relationships compared to the upper mid-market where larger lenders compete in commoditized deals. The lower mid-market continues to present opportunities for stable returns, particularly with experienced managers navigating macroeconomic shifts.

✏️ Finding the sweet spot in today’s private credit market

HarbourVest

The traditional view that smaller companies offer better pricing and less risk in private credit is shifting. Credit spreads and leverage levels have converged across company sizes, diminishing the premium for lending to smaller businesses. Larger companies now often provide better downside protection and faster EBITDA growth. Investors should target companies with $50-$150 million in EBITDA.

✏️ Private credit spectrum of solutions

Goldman Sachs

Direct origination models offer better risk assessment and returns. Transparency, customization, and strong investor relations are crucial for managers. While default rates remain low at c.2%, the industry is shifting towards a solutions-oriented approach, fostering closer collaboration between managers and investors.

✏️ The real estate credit opportunity is here

KKR

Commercial real estate transaction volumes have surged, creating opportunities for equity-like returns on real estate debt. Banks’ share of CRE lending fell from 40% to 30%, creating a $300B capital gap. Property values appear to have bottomed, and the scarcity of capital makes real estate credit an attractive, high-yielding investment.

✏️ The critical role of covenants in private credit

UBS

Tailored covenants, specific to the borrower’s industry, enable proactive monitoring and quick responses to potential issues. The lack of covenants, as seen in "covenant lite" deals, has contributed to lower recovery rates, especially in high yield markets, where default recovery rates have plummeted from 73.3% in 2014 to just 38.3% in 2023 for first-lien loans.

✏️ Private real estate credit: Capitalizing on today's market opportunities

Principal Asset Management

Private real estate credit is an attractive investment opportunity due to reduced lending by traditional banks, high interest rates, and strong demand driven by $2T in maturing loans. This has created a lender's market, with wider spreads and higher yields. The sector is poised to benefit as high capitalization rates reset valuations for new investments.

✏️ The economics of corporate bond markets

Institutional Investor

High yield bonds correlate more with equities, while investment-grade bonds align with US Treasuries, although this correlation weakens during market stress. Investment-grade bonds, backed by corporate cash flows, are considered safer, while high-yield bonds carry higher risk, reflecting corporate financial health and exhibiting more equity-like risk.

✏️ Catastrophe bonds: Diversification, performance and impact

Man Institute

Catastrophe bonds transfer natural disaster risks from insurers to investors, offering equity-like returns with low volatility and minimal correlation to traditional assets. They provide fast payouts in developing markets via parametric triggers and are also recognized as socially responsible investments. With steady market growth, ‘Cat’ bonds deliver both uncorrelated returns and social impact for investors focused on resilience in disaster-prone areas.

✏️ Is investment-grade credit still worth considering?

Robeco

The stock-bond correlations are returning to negative, restoring bonds' diversification role. While US Treasuries offer attractive yields, investment-grade credit historically delivers higher long-term returns and benefits from falling interest rates. Strong corporate fundamentals and favourable market conditions support investment-grade credit as a compelling option.

✏️ Navigating volatility: The strategic advantage of bonds

Goldman Sachs

The strategic value of bonds for income, diversification, and stability in portfolios. Higher bond yields compared to the previous cycle offer attractive returns and help protect portfolios during downturns. Structural shifts reinforce the need for active investment strategies and core fixed-income allocations to navigate volatile markets.

✏️ DB Pensions: Investing to hedge buyout pricing

Abrdn

As a DB pension scheme nears a strong funding level, the focus shifts to preparing for an insurer buyout. To minimize volatility and manage financial risks, investment strategies must be optimized to align with insurer pricing sensitivities, such as interest rates, inflation, and credit exposure. Regular reviews and tailored investments ensure the scheme’s funding level is protected and facilitate a smooth, cost-effective buyout process.

📜 Periodicals »

📝 Global fixed income weekly (Goldman Sachs)

✏️ High yield monthly update (Nomura)

✏️ Emerging market debt: August 2024 review and outlook (Abrdn)

PRIVATE EQUITY

TVJ Spotlight 🔦

📝 PE middle market report

Pitchbook

In H1 2024, US PE middle-market dealmaking saw a modest recovery, with buyouts up 12% vs 2023, despite lagging behind corporate-led M&A. Volumes recovered from a soft 2023, but fundraising in the mid-market was down 10%, with a shift of interest toward mega funds. The small-cap public equity rebound could also boost valuations and drive more M&A activity.

📝 Secondaries : A growing opportunity

Nuveen

The secondary market is experiencing strong growth, with record deal volumes and significant demand for mid-market continuation vehicles. Buyers currently hold pricing power due to a supply-demand imbalance. Continuation vehicles are a growing trend especially in the mid-market. Despite challenges in the exit environment, secondaries remain undercapitalized, presenting further growth opportunities in both GP-led and LP-led transactions.

📝 Private equity for all

Neuberger Berman

Innovations such as open-ended and evergreen funds provide more flexible investment opportunities, allowing investors to maintain continuous exposure without traditional capital calls. These developments aim to make private equity more accessible, especially for institutional investors, while managing liquidity and risks effectively.

📝 Healthcare IT - VC update

Pitchbook

In Q2 2024, VC funding in healthcare IT remained subdued with 77 deals totaling $1.1B, reflecting a consistent trend since Q4 2022. Key challenges include valuation discrepancies and point solution fatigue. AI-driven clinical workflow automation and revenue cycle, particularly prior authorization, were prominent themes.

📝 Mobility tech report

Pitchbook

In Q2 2024, the autonomous driving segment boosted mobility tech funding, reaching $6.7B, a 14% increase vs Q1 2024. Additionally, the marine data and drone segment is emerging, with companies developing underwater drones for scientific, commercial, and defence applications, attracting significant investment. EVs segment had the second-highest deal value with $2B across 35 deals. Exit activity remained largely muted with 19 deals valued at $2.1B in total.

✏️ Opportunities in Japan’s maturing PE market

Carlyle

Japan’s PE market is growing, with $123B in deal value in 2023, driven by corporate reforms, low interest rates, and business succession needs. PE funds are helping firms focus on digitalization, AI, and global growth. The market has strong potential supported by strong local relationships and favorable geopolitical conditions, presenting multiple opportunities.

✏️ Secondaries are pacing for a record year thanks to these investors

Institutional Investor

The secondaries market saw $72B in closed transactions by midyear and a projected total of over $140B. LPs contribute 57% of the volume due to liquidity pressures and attractive prices. Strong demand, fueled by $190B in dry powder and improved buyer optimism, has led to rising fund-level pricing, with buyout stakes reaching 94% of NAV, the highest since 2021.

✏️ Ownership trends in PE 2024

Carta

PE deal volume rebounded in Q2 2024, marking the strongest activity in two years. Major firms have committed to expanding equity ownership to employees beyond top management. Carta highlights a 172% increase in employee stakeholders since 2019, with more PE-backed companies issuing profits interest units (PIUs) to employees as part of equity sharing.

✏️ VC dealmakers weigh in on why dilution is declining

Carta

Median dilution in startup funding rounds has declined, with companies selling smaller portions of equity to VCs. Factors include smaller round sizes, increased bridge rounds, and founders' growing access to fundraising data. This shift reduces immediate dilution but could lead to significant future dilution when convertible notes from bridge rounds convert.

PRIVATE MARKETS AND ALTERNATIVE ASSETS

TVJ Spotlight 🔦

📝 Solving the private markets allocation gap

Partners Group

Private markets offer structural advantages and long-term outperformance potential, making them attractive for investors seeking diversification. However, they have historically been difficult to access for private wealth clients. Private markets have surpassed public markets in annual fundraising since 2016, and total AUM is expected to reach $30T by the early 2030s.

📝 Principles of alternatives investing

JP Morgan

Alternative investments are growing in demand due to muted returns in public markets and insufficient diversification in traditional portfolios. Alternatives in private markets offer diversification and income opportunities. They enhance portfolio attributes, fill financing gaps, and are becoming increasingly relevant with growing private markets.

📝 Global wealth investment playbook

KKR

Investors are shifting toward equity-based strategies, extending credit duration, and seeking downside protection through assets like infrastructure. Elevated inflation volatility is increasing stock-bond correlation, pushing investors to explore alternative diversification options, with rate cuts benefiting leveraged assets like private equity and real estate.

📝 The industrial reset in emerging markets

Morgan Stanley

The global manufacturing sector is experiencing a revival, driven by government-led industrial policies and reshoring efforts to build resilient supply chains. The exposed risks of overreliance on specific regions, lead to renewed investments in factory automation, semiconductors, and renewable energy. Emerging markets, esp. India and Brazil, are key regions driving growth.

✏️ What’s going on in alternative markets?

JP Morgan

The traditional 60/40 portfolio faces challenges due to high public market valuations, low bond yields, and stock-bond correlation. Investors are increasingly looking to alternatives to improve long-term returns and reduce volatility. Key opportunities include infrastructure investments driven by energy and AI transitions and discounted PE secondaries.

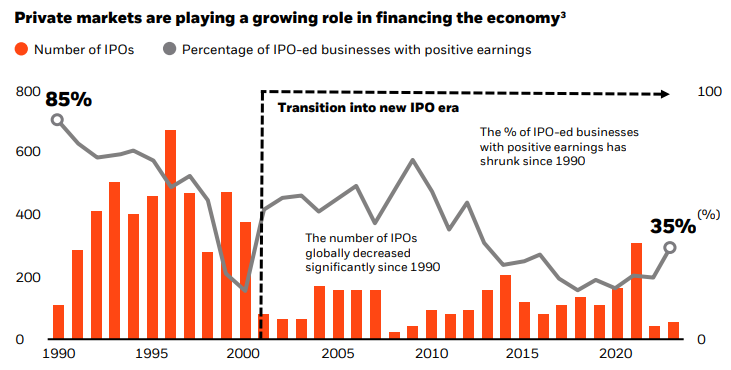

✏️ When public and private markets converge

Wellington Management

The equity market has shifted significantly as private companies stay private longer, with over 10K PE-owned companies compared to just 4K public companies today. Asset owners are navigating this public-private convergence, exploring opportunities in biotech innovation, climate-focused technology, AI, and financial inclusion.

✏️ Investment firms keep launching private asset funds

Institutional Investor

Institutional and retail demand for private assets is growing, with over 80% of asset managers launching new private market funds in the past three years, and 84% planning similar launches in the next three years. LPs like pension funds heavily invest in private equity and debt with Asset managers making the shift too, to meet rising demand.

✏️ Startup M&A activity is holding firm in 2024

Carta

M&A activity, esp. in startups has been steadily increasing, with a 4% rise in Q2 2024, reaching 158 deals. While global M&A transaction counts are down, the value of deals rose by 12% in H1 2024, driven by larger deals. SaaS startups, particularly at seed and pre-seed stages, are the most common M&A targets. Sectors like technology, energy, and healthcare remain strong, with expectations that an IPO resurgence could boost M&A activity.

✏️ From pain to performance at mid-market companies

BCG

Mid-market companies, often burdened with higher borrowing costs and fewer resources, should embrace comprehensive transformation to focus on operational efficiency, customer satisfaction, and talent retention by addressing issues piecemeal. Employees and investors must align behind an ambitious transformation agenda with clear roadmaps.

📜 Periodicals »

📝 Guide to alternatives Q3 2024 (JP Morgan)

✏️ Market pulse September (Goldman Sachs)

✏️ Monthly markets review - August 2024 (Schroders)

🎙The BEAT for September –Key themes and top ideas (Morgan Stanley)

SECTOR FOCUS

Real Estate x Infrastructure

✏️ The case for mid-market infrastructure

Goldman Sachs

Mid-market infra presents significant investment opportunities as many GPs have shifted to large-cap infra funds. Mid-market companies (valued at $400M-$2B) offer attractive value creation potential, particularly in sectors like renewable energy, battery storage, and logistics. With strong demand from institutional investors, mid-market infra is expected to deliver consistent returns and see increased allocations due to its potential and diverse exit strategies.

✏️A new cycle commences for European real estate

UBS

Investment volumes are beginning to pick up in European real estate market, particularly in the UK, where valuations have adjusted faster vs EU. Additionally, risk-adjusted yields indicate that the pressure from higher interest rates has eased, with prices flattening in some sectors, such as German residential markets, where leasing fundamentals remain strong.

✏️European life sciences real estate

UBS

The life sciences industry's growing real estate demand presents a strong investment opportunity due to the need for specialized facilities. The sector's demand for R&D and manufacturing spaces is expected to increase. ESG requirements and energy efficiency are becoming essential as life sciences companies focus on reducing their carbon footprint.

✏️ The REIT place, the REIT time

Abrdn

This macro environment favors REITs, which are outperforming equities and private real estate, thanks to their correlation with bond yields. REITs also enjoy a cost-of-capital advantage, enabling growth through M&A, particularly in sectors benefiting from structural trends like data centers, logistics, and healthcare, giving an edge over private real estate.

✏️ Driving conversations and action on sustainability

UBS

Success factors in sustainability related investments include emphasizing sustainability throughout the investment lifecycle, prioritizing material topics, fostering collaboration, and acknowledging positive actions. As sustainability becomes more crucial for investors and regulators, engagement programs are essential for driving value in private markets.

🎥 Will it be a podium finish for real estate? (Abrdn)

🎥 Access compelling opportunities in commercial real estate (PIMCO)

AI x Tech

✏️ Artificial intelligence insights

UBS

AI is becoming a transformative force, driving efficiency, innovation, and new investment opportunities across industries, including real estate. While AI can enhance investment processes and productivity, AI is expected to mostly augment jobs rather than replace them, with potential for new job creation in AI development and implementation boosting growth.

✏️ The neobank era has arrived

Robeco

Neobanks are disrupting traditional banking with user-centric online services, transitioning from aggressive growth to sustainable profitability. Major players like Revolut, Starling, and Nubank have reported record profits, fueled by diversified revenue and efficient customer acquisition. While regional strategies vary, neobanks are well-positioned to grow.

✏️Winning strategies for B2B SaaS companies

BCG

Europe's B2B SaaS sector thrived in 2023, with top performers nearly tripling their revenue, particularly in HR, healthcare, and green tech. Growth is projected to accelerate by 2-3x in 2024. To sustain their success, companies should focus on targeting new customers, automating marketing, linking pricing to products, and fostering innovation.

Thank you for reading The Valt Journal!

Check out our other editions here.

Check out TVJ Library. A private markets and alternative assets focused live repository featuring a collection of 1K+ research reports and articles from 150+ sources across 4 categories and 40+ sub-categories. Get your access now!

Disclaimer:

The content provided on this platform contains references and links to external sources, including articles, reports, websites, images, or videos. We do not own or claim copyright over the content found in these external sources. The ownership and rights of the content belong to the original creators.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.