The Valt Journal #35

Featuring latest research on Private Credit (M&G, Abrdn, MS); PE (FS Investments, JPM); Alts as an asset class (KKR, Robeco, Schroders); Real estate, Infra, Energy (BlackRock, BCG, Bain, Nuveen)

Hi, welcome to the new edition of The Valt Journal. In every issue, we cover the best and the latest insights into the global private markets. The Valt Journal is a repository of time sensitive and timeless research, delivered to your inbox every 2 weeks, so you don’t have to look anywhere else! Clicking the headlines is all it takes.

Check out TVJ Spotlights 🔦 including 1) Private debt in focus: State of technology (by BlackRock); 2) The advantages of disciplined lower middle market direct lending (by TPG); 3) Southeast Asia resetting expectation (by Lightspeed)

The Valt Journal Library 🚀

Our private markets and alternative assets focused live repository featuring a collection of 1K+ research reports and articles from 150+ global asset managers and experts across 4 categories and 40+ sub-categories for an efficient, fast and seamless research experience.

Quickly scan the list of all reports in this edition here!

Numbers this edition:

Links: 66

Authors: 35

PRIVATE CREDIT x FIXED INCOME

TVJ Spotlight 🔦

📝 Private debt in focus: State of technology

BlackRock

The tech sector showed resilience despite a brief market selloff in Q3 2024, driven by rising AI optimism and structural investment. While high inflation led businesses to cut tech spending, IT investment is rebounding. 45% of PE-backed tech companies have been held for 4+ years. Global M&A is showing signs of recovery, with deal value up 10-15% vs 2023.

TVJ Spotlight 🔦

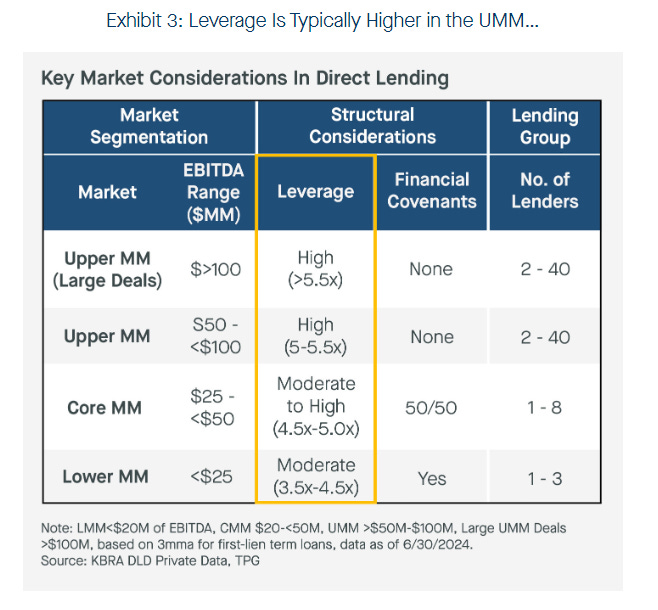

✏️ The advantages of disciplined lower middle market direct lending

TPG

The Lower Middle Market offers compelling opportunities for direct lending due to less competition, higher spreads, lower leverage, and stronger lender protections vs Upper Middle Market (UMM). LMM lenders benefit from better risk-adjusted returns, more meaningful portfolio diversification, and stronger recovery rates. With UMM becoming more competitive and offering lower returns, LMM provides favourable opportunities.

📝 Demand for duration

TCW

In securitized assets, agency MBS and non-agency MBS benefited from falling rates and rising prepayment assumptions in Q3, boosting lower-coupon bonds. Issuance in CMBS, CLOs, and ABS sectors surged, driven by strong investor demand for duration and premium assets, particularly in sectors like digital infrastructure and aircraft deals. Despite volatility, high-quality bonds backed by strong fundamentals and robust structures offer asymmetric upsides.

✏️ Navigating the asset-based finance frontier

KKR

The Asset-Based Finance market, valued at $6T, remains a largely untapped frontier in private credit. Success hinges on proactive origination, leveraging proprietary platforms, and cultivating long-term relationships (in sectors like music royalties and RV loans). With increasing demand and banks pulling back, ABF offers significant growth potential for those able to navigate its complex, diverse landscape with expertise and innovation.

✏️ Private credit’s role in mid-market opportunities

UBS

The convergence of private credit and public markets is shaping investment strategies in the upper middle-market corporate credit space. Despite tighter spreads and competitive terms, private credit remains adaptable, offering flexibility to navigate evolving market conditions. Opportunities exist through diversified credit options, including direct lending, syndicated loans, and high-yield bonds, while managing risk and capitalizing on growing M&A activity.

✏️ Securitized credit: Normalizing, decelerating, or falling off a cliff?

Wellington Management

Securitized credit fundamentals are stabilizing from strong levels, though challenges remain in commercial real estate, with office sector prices down nearly 20%. Default rates in CLOs have moderated to 2.1%, but distressed exchanges bring the rate to 4.5%. Spreads in asset-backed securities (ABS) remain attractive above long-term medians, offering opportunities for active security selection across credit sectors.

✏️ Frontier bonds: are they worth the risk?

Abrdn

Frontier bonds, while riskier and more volatile than other emerging market debt, have outperformed EMD over one, three, and five years. Investors are compensated for the additional risk. As inflation cools rate cuts begin, demand for high-yield frontier bonds is expected to rise, supported by economic reforms in countries like Kenya and Zambia. Frontier bonds present a compelling opportunity for superior returns and diversification.

✏️ Strategic credit for your path to DB buyout

Abrdn

As DB pension schemes approach buyout, trustees should manage asset volatility by aligning credit portfolios with insurers' practices, as insurers typically favor high-quality, MA-eligible bonds. This reduces costs and improves hedging against buyout pricing. Standard credit indices may not meet insurer criteria, due to high BBB exposure and unpredictable cashflows.

✏️ IG credit: Idiosyncratic opportunities in a favorable environment

Barings

Investment-grade corporate credit is well-positioned due to elevated yields, solid fundamentals, and a resilient US economy. US IG yields are at 4.2%, 1.5x higher than the 10-year average, while US corporate EBITDA growth was 1.1% in Q2 2024. Despite risks, inflows into US IG funds reached $260B YTD, absorbing high issuance. Key opportunities include energy and financials, along with crossover credits poised for ratings upgrades.

✏️ CLOs go mainstream

Neuberger Berman

Floating-rate securities like CLOs and senior loans lure investors due to wider spreads and credit enhancements. These investments offer attractive yields, higher seniority in capital structures, and added protection via diversified portfolios and subordination. CLO mezzanine tranches trade at a 200-300 bps premium to similarly rated bonds, with a low cumulative default rate of just over 1%. Investors get to benefit from both yield and risk mitigation.

✏️ What the differing pace of central bank easing could mean for fixed income

Morgan Stanley

Central banks have been collectively cutting rates in 2024, but the pace varies. The US Fed cut rates by 50bps in Sep, with c.250bps of total cuts expected by 2025. Other banks, like Bank of Canada and RBNZ, are expected to cut similarly. Diverging policies present opportunities for fixed-income portfolios, with better value seen in New Zealand and Canada vs US Treasuries.

✏️ A tangled web: Avoid the venom in bond market tail risks

UBS

Different regions present varying risks and opportunities amid rate cuts: while US bonds face headwinds due to optimistic rate cut pricing, eurozone bonds may outperform as their market weakness isn't fully priced in. China's aggressive stimulus adds uncertainty, and global bond investors should actively adjust allocations and maintain liquidity for quick adjustments.

📜 Periodicals »

📝 Global credit outlook: Q4 2024 (BlackRock)

📝 Emerging markets debt monitor Q3 2024 (Morgan Stanley)

📝 Floating-Rate Loan Market Monitor Q3 2024 (Morgan Stanley)

📝 Corporate credit outlook Q4 2024: Jive like it’s 1995 (FS Investments)

✏️ Credit outlook Q4 2024: Glimmers of light, shadows of doubt (Man Institute)

✏️ Market view Sep 2024: High yield monthly update (Nomura)

🎥 Perspectives on private credit (Northern Trust)

🎥The blurring lines between public & private credit markets (Barings)

🎙Private Debt: The appeal, the fears & the facts (Neuberger Berman)

PRIVATE EQUITY

TVJ Spotlight 🔦

📝 Southeast Asia resetting expectation

Lightspeed

Southeast Asia has attracted significant tech investment, with $72B poured into the sector over the past five years. However, despite the region's potential, tech companies have struggled with capital efficiency, and consumer-class households remain smaller vs India and China. There remains a significant growth opportunity in digital services, supported by increasing tech talent and online advertising, a critical revenue stream for future profitability.

📝 From great to excellent

BlackRock

BlackRock emphasizes a partnership-driven approach to PE, focusing on aligning with management teams early to drive long-term growth and value creation. The investment strategy prioritizes companies with strong balance sheets, moderate leverage, and industry-leading management. Opportunities exist in sectors like healthcare, tech, consumer goods, and financial services. ROIC can be maximized through organic and inorganic growth.

📝 Venture capital market outlook

BlackRock

The VC fundraising environment has faced volatility and has significantly dropped, with 2024 on track to reach its lowest level since 2019, down from a peak of $323B in 2021 to $59B YTD. VCs hold a record $296B in dry powder, while exit value from IPOs in 2024 is $22B vs $674B in 2021. Delayed exits are leading to consolidation and a focus on proven managers.

📝 How to be the perfect partner

Nuveen

Co-investments are popular in private equity due to their benefits of higher returns, diversification, and favorable economics. Co-investing allows investors to deepen relationships with GPs and gain more control over portfolio exposures. It emphasizes the importance of building strong partnerships, proactive deal sourcing, and careful due diligence to secure access to high-quality deal flow, and is expected to grow in the coming years.

✏️ Finding a potential Goldilocks effect in buyouts

HarbourVest

A diversified portfolio of mid-market buyout funds offers higher risk-adjusted returns compared to portfolios of small or large buyout funds. Mid-market funds provide a "Goldilocks" balance, capturing upside potential while minimizing downside risk, resulting in better portfolio-level performance, as measured by the Sortino ratio.

✏️ For venture fund LPs, DPI is ‘the metric that rules them all’

Carta

Venture capital funds are experiencing delays in generating distributions to paid-in capital (DPI), a key performance metric for LPs. Recent fund vintages (2017-2022) have been slower in providing exits due to a decline in IPOs and M&A activity, driven by a valuation reset in public and private markets. Despite improving valuations, exit activity remains slow, heightening LPs' focus on DPI as the primary indicator of venture fund success

✏️ The case of manufacturing and natural resources sectors in Europe

EDHEC

PE investments offer high returns but come with significant risks, such as return dispersion and unfavourable exits. Sectors like Natural Resources exhibit higher volatility and risk vs Manufacturing. Accurate private asset risk measurement requires specialized indices that capture market dynamics, which uses transaction data to provide precise pricing and data.

✏️ Signs of hope in private equity consumer investing?

Bain

Consumer and retail investing is showing signs of recovery, with megadeals ($1B+) doubling in the H1 2024 vs H1 2023, highlighted by Roark Capital's $9.6B Subway investment. Simultaneously, platform building in consumer services has grown, with 80% of add-on deals valued under $50M, contributing to 45% of total deal activity in the sector.

✏️An introduction to private equity basics

Morgan Stanley

Private equity is a rapidly growing asset class (AUM at $8.5T in June 2023, vs $2.2T in 2000). PE strategies include buyouts, growth equity, and venture capital. While PE provides higher potential returns and portfolio diversification, it comes with illiquidity and higher costs. Despite challenges, it remains an attractive option due to its long-term return potential and alignment of interests between investors and GPs.

✏️ Differences in private markets ESG integration between US and Europe

LGT Capital

US private equity managers lag behind European counterparts in ESG integration due to regulatory resistance, with Europe leading in ESG standards. Geopolitical tensions and climate risks, along with US elections, are key factors influencing global ESG progress, particularly in decarbonization efforts.

📜 Periodicals »

📝Venture monitor Q3 2024 (Pitchbook)

📝US PE breakdown Q3 2024 (Pitchbook)

📝 First cut—State of private markets: Q3 2024 (Carta)

📝AI & ML public comp sheet and valuation guide Q3 2024 (Pitchbook)

📝Digital health & healthcare IT comps and valuation guide Q3 2024 (Pitchbook)

PRIVATE MARKETS AND ALTERNATIVE ASSETS

📝 The alpha equation: Myths and realities

PIMCO

Alpha’s calculation can be distorted by using improper benchmarks and omitting key factors, esp. in private assets and niche strategies. Active management has historically been more successful at generating alpha in fixed income vs equities, due to constraints faced by major investors. Understanding and measuring alpha requires attention to leverage, liquidity, volatility, time horizons, and valid benchmarks.

📝 What will differentiate the asset management winners of tomorrow?

Barings

The rise of private assets is reshaping asset management, driving acquisitions and new product development, but managers must recognize that private markets will also experience cycles. Asset managers should avoid over-reliance on specific strategies and adapt to the blurring lines between public and private credit, focusing on fundamental credit analysis across assets.

✏️ The investment implications of the wealth surge

JP Morgan

The recent surge in wealth is driven by rising stock markets and home equity. While this wealth boost supports consumer spending and reduces credit risks, it is unevenly distributed. Investors should be cautious as recent market gains are primarily due to rising valuations, not underlying fundamentals, and it may be time to reassess risk and investment strategies.

✏️How higher yields and growing alpha opportunities may lift hedge funds

Morgan Stanley

The recent rise in fixed-income yields has created favourable conditions for hedge fund strategies, particularly those involving long/short equity and credit funds, as they earn more on cash collateral used for short selling. Hedge funds benefit from increased alpha opportunities due to the wider dispersion of returns.

✏️ Investing for more resilient future generations

GIC

The global landscape is shifting beyond cyclical trends, presenting both risks and opportunities for investors. Opportunities arise in supply chain restructuring, AI's potential productivity boost, and financing the climate transition. To navigate these uncertainties, investors should prioritize price discipline, diversification, and long-term partnerships.

✏️A transparent alternative to neural networks

StateStreet

Relevance-based prediction offers a transparent and interpretable alternative to neural networks for forecasting, delivering highly accurate predictions, including better performance in predicting S&P 500 volatility across market regimes. Unlike neural networks, which are complex and opaque, RBP uses a relevance-weighted average of past outcomes.

✏️Proving resilience and durability

UBS

Farmland has demonstrated strong growth potential and resilience as an asset class, offering high returns and low volatility, making it increasingly attractive to investors. With a global market value of c.$9T, farmland provides income, inflation protection, and portfolio diversification due to its negative correlation with equities and bonds. They offer stability and passive cash flow in various economic scenarios.

✏️ The benefits of ‘quantamental’ thematic investing

Robeco

Quantitative methods identify emerging themes and companies. Techniques like NLP and sentiment analysis enhance decision-making by evaluating companies based on value, momentum, and growth. While quantitative approaches have advantages, experienced portfolio managers are needed to ensure accuracy and refine insights. Combining human oversight with machine learning can enhance thematic investment strategies.

✏️ Alternatives managers need an upgrade to their tech

Institutional Investor

Investors are increasing allocations to alternative asset managers but are demanding better technology to improve portfolio insights and analytics. 62% of LPs plan to maintain or boost their alternatives exposure, while 59% seek improved report analytics and 81% desire better data aggregation across multiple funds. Despite some progress, many LPs remain frustrated by the lack of tech integration and unified platforms for monitoring their portfolios.

✏️ Sparse IPOs have paved the way for years of growth in private markets

Institutional Investor

Private market assets are growing rapidly, with AUM expected to increase by 9% p.a., reaching c.$60T by 2032. This growth is driven by higher yields, diversification, and inflation-hedging benefits offered by private equity, private credit, and infrastructure. As public markets face more regulation and fewer incentives for IPOs, investors, including retail clients, are shifting toward private markets, with alternative asset managers gearing up to meet this demand.

📜 Periodicals »

📝 Global outlook Q4 update (BlackRock)

📝Weekly economic commentary (Northern Trust)

📝 Sailing close to the wind: Vantage point Q4 2024 (BNY Mellon)

📝 Multi-asset outlook September 2024: Gold is back as an asset class (Robeco)

📝 Thoughts from the road: Asia (KKR)

SECTOR FOCUS

Energy Transition x Climate Finance

✏️ What is climate transition finance and why bother?

Robeco

62% of investors consider climate change central to their policies, with 69% committing to net-zero targets. 63% are focusing on transition strategies, investing in high-emitting companies with credible decarbonization plans. Transition investing and green bonds are seen as critical tools to drive real-world emissions reduction and generate returns.

✏️ Not all net zero pathways are created equal

UBS

Improving real estate's sustainability is crucial for addressing climate change, as the sector accounts for 40% of global greenhouse gas emissions. Investors are increasingly demanding detailed net zero pathways to compare investment products' progress toward reducing emissions. This makes it important for investors to carefully examine the assumptions behind each product's net zero trajectory, as not all disclosures are equally reliable.

✏️ Middle East crisis: How oil price outcomes will impact wider financial markets

Schroders

The ongoing Middle East conflict raises concerns about oil supply disruptions, with potential impacts on inflation, interest rates, and economic growth. While OPEC has spare capacity, a disruption in Iran's oil exports could push prices above $100 per barrel, potentially spiking to $147. However, for inflation and central bank policies to shift significantly, oil prices would need to stay above $100 for an extended period.

✏️ Balancing sustainability and returns: What multi-asset investors need to know

Robeco

Sustainability has become crucial in multi-asset investing, improving risk-adjusted returns but introducing market deviations when excluding less sustainable investments. The demand for sustainability-focused funds has risen significantly, with over EUR60B flowing into these funds.

✏️ Reducing costs and carbon in manufacturing networks

BCG

Manufacturers face pivotal decisions on modernizing plant and distribution networks to balance costs, service, growth, sustainability, and resilience. Optimizing networks by integrating sustainability goals could boost EBITDA by 1-3%. Success requires a data-driven approach to navigate these complexities and adapt for future demands.

Real Estate x Infrastructure

📝Recipe for a rebound

FS Investments

The US commercial real estate market, after a prolonged freeze, is showing signs of recovery with prices down 10%-20% and stronger tenant demand. Although acquisition activity remains subdued, optimism is growing as market conditions improve, pointing to potential investment opportunities in 2025 and beyond.

✏️ Fiber optic infrastructure: A connection is made

KKR

Fiber optic investments are gaining traction as high-speed internet becomes essential for modern life. These investments require managing construction and customer acquisition risks, with operators needing to build scalable, competitive models for success. KKR highlights the potential for strong, predictable cash flows and significant long-term growth in fiber infra.

✏️ How does an aging population impact real estate?

Nuveen

The aging global population and shrinking working-age demographics are shifting real estate demands. Key opportunities for investors include developing and refurbishing senior care facilities, repurposing under-used office spaces for senior care, and tapping into increased healthcare needs. This trend presents significant potential in both residential and medical sectors, especially in regions with growing senior populations such as Japan, US, and UK.

📝 Current developments for the real estate industry

PWC

By reducing energy consumption and enhancing property value, energy-efficient upgrades can lower bills. Governments offer incentives like grants, tax breaks, and loans to encourage these investments. Navigating these programs can be complex, but this report highlights key incentives across 10 European countries to help property owners achieve sustainability goals.

📝 Roadmap for a REIT IPO or conversion

PWC

This guide helps real estate companies navigate the complexities of IPOs, REIT conversions, and raising non-traded property/credit products by covering processes, tax planning, corporate governance, and accounting. It addresses key challenges, timelines, compliance requirements, increased interest rates, potential spin-offs, and the expansion of REIT-qualifying properties.

AI x Tech

📝 Artificial General Intelligence (AGI) research

Pitchbook

AGI aims to create software capable of reasoning and adapting to new challenges without task-specific programming, unlike narrow AI. While AGI has historical roots dating back to the 1940s, significant breakthroughs in AI, such as DeepMind's AlphaGo, have fueled recent progress. Emerging tech like neurosymbolic AI and cognitive architectures hold potential for future advancements toward human-level intelligence.

✏️ The next frontier in enterprise automation

Lightspeed

The next wave of enterprise automation, powered by LLMs, will surpass the current robotic process automation (RPA) by enabling intelligent, adaptive workflows. LLM-driven automation can handle unstructured data, apply reasoning, and automate end-to-end tasks with greater accuracy and flexibility, unlocking significant productivity gains. Key market areas are domain-specific solutions, full workflow automation, and content generation.

Thank you for reading The Valt Journal!

Check out our other editions here.

Check out TVJ Library. A private markets and alternative assets focused live repository featuring a collection of 1K+ research reports and articles from 150+ sources across 4 categories and 40+ sub-categories. Get your access now!

Disclaimer:

The content provided on this platform contains references and links to external sources, including articles, reports, websites, images, or videos. We do not own or claim copyright over the content found in these external sources. The ownership and rights of the content belong to the original creators.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.