The Valt Journal #37

Featuring latest research on Private Credit (KKR, Oaktree, JPM); PE (Partners Group, MS); Alts as an asset class (State Street, UBS, PWC); Real estate, Infra, Energy (BCG, Bain, M&G, Barings)

Hi, welcome to the new edition of The Valt Journal. In every issue, we cover the best and the latest insights into the global private markets. The Valt Journal is a repository of time sensitive and timeless research, delivered to your inbox every 2 weeks, so you don’t have to look anywhere else! Clicking the headlines is all it takes.

Check out TVJ Spotlights 🔦 including 1) Hares beware: Future proofing credit (by KKR); 2) Infrastructure secondaries at an inflection point (by Partners Group); 3) Real estate liquidity insights: An analysis of fund-level cash flows (by Stepstone)

The Valt Journal Library 🚀

Our private markets and alternative assets focused live repository featuring a collection of 1,500+ research reports and articles from 150+ global asset managers and experts across 4 categories and 40+ sub-categories for an efficient, fast and seamless research experience.

Quickly scan the list of all reports in this edition here!

Numbers this edition:

Links: 64

Authors: 36

PRIVATE CREDIT x FIXED INCOME

TVJ Spotlight 🔦

📝 Hares beware: Future proofing credit

KKR

KKR emphasizes on persistence, consistency, and a disciplined approach over-reactive strategies. In uncertain markets, prioritizing steady, diversified credit portfolios and focusing on long-term resilience over short-term gains is key. Demand for Reinsurance ($7T asset-intensive market) has been amplified by structural shifts in the global credit markets.

📝 Performing credit quarterly 3Q 2024

Oaktree

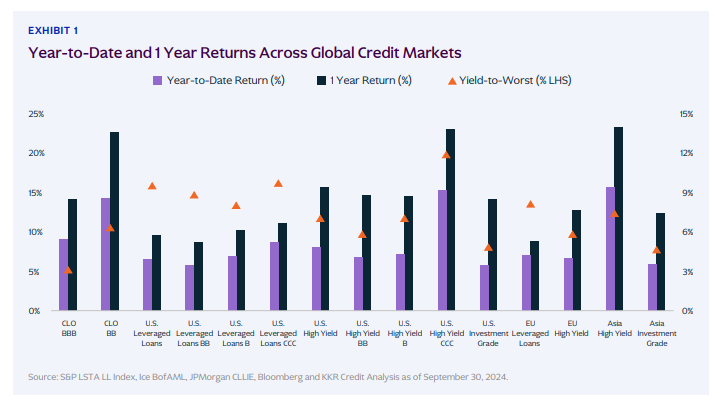

Oaktree's Q3 2024 report discusses shifts in the credit market, with a focus on opportunities in asset-backed finance (ABF) as traditional banks reduce exposure due to regulatory pressures. The report highlights strong performance across various credit sectors, including high-yield bonds and emerging market debt, and suggests that investors consider a diversified credit portfolio to navigate rising interest rate uncertainty and geopolitical risks.

📝 Utilising securitised credit within your asset allocation

HSBC Asset Management

Securitised Credit has outperformed other fixed income assets recently, offering benefits like diversification, yield enhancement, and low correlation to traditional asset classes, making it a valuable addition for multi-asset portfolios. Its floating-rate nature cushions against duration volatility, and regulatory improvements have strengthened the sector.

📝 Unpacking the $2 trillion wall of maturities

Principal Asset Management

Over the next three years, approximately $2T in commercial mortgages will mature, creating strong demand for refinancing capital. This "wall of maturities," primarily stemming from high 2021-2022 transaction volumes, presents investment opportunities in multifamily and industrial real estate, where demand is robust, and credit conditions favour lenders.

📝 Outlook for emerging markets corporate bonds: Why now?

HSBC Asset Management

Emerging Markets Debt is positioned for growth, with high yields, easing inflation, and central bank rate cuts creating a favorable environment. EM corporates are particularly attractive for long-term investors due to supportive global interest rate trends, improved governance in emerging markets, and strong fundamentals and technicals that enhance their appeal.

📝 Direct lending emerges alongside special situations in Asia

Bain Capital

Direct lending depends on lending to performing borrowers with strong resilient cashflows, with good governance rights and solid downside protection. Direct lending in Asia involves a host of different types of financing to a much wider range of borrowers, including sponsors, but also entrepreneur-owned businesses and large corporates. The Asian credit market remains predominantly bank-driven, often limiting funding options for SMEs.

📝 French public debt: On the rise again?

Natixis

France's public debt is expected to keep rising until at least 2029, projected to stabilize around 120% of GDP. Despite fiscal slippage and a deficit over 6% in 2024, the government aims to reduce the deficit to 5% by 2025 and below 3% by 2029, with fiscal consolidation efforts potentially setting debt on a more sustainable path.

📝 Municipal market: Bonds are acting like bonds again

Nuveen

With the expected rate cuts, municipal bonds are gaining appeal for their tax-exempt income, potential capital appreciation, and reduced downside risk. A steepening yield curve favours longer-duration bonds, offering higher income and total return, while short-term yields are expected to decline. Current high market yields make municipal bonds attractive.

✏️ Time to extend from cash to bonds?

BNY Mellon

As central banks initiate rate cuts, cash rates are expected to decline, while elevated longer-maturity yields present attractive opportunities for bond investors. Historically, easing cycles have benefited bond markets through income and potential capital gains, especially when actively managed to capture value through strategic allocation and credit selection.

✏️ Why are yields moving higher?

JP Morgan

Short rates are expected to trend lower due to declining policy rates, reducing cash-like investments' appeal. Rising yields and volatility are likely to stabilize around 3.75%-4.25% in the coming year. Investors might consider intermediate-duration fixed-income and shorter-term corporate bonds for attractive yields amidst tight spreads and low recession risks.

✏️The tide turns for emerging markets’ debt

Morgan Stanley

Emerging markets debt performed strongly in Q3 2024, driven by favourable macro conditions, Fed rate cuts, and strengthening EM currencies. High real yields and positive net inflows are expected to support EM debt, especially local currency debt. However, careful credit selection remains essential due to wide variations across countries and issuers.

✏️ Emerging market debt reflections following IMF-World Bank meetings

UBS

A "soft landing" for the US allows for an aggressive easing cycle that could support emerging markets (EM) through a weaker dollar and renewed capital inflows. EM debt sentiment has improved, with several countries achieving debt restructuring and reforms, while debt risks shift towards developed markets (DM) due to fiscal concerns.

✏️ Emerging market credit: Untapped growth

Robeco

Emerging market credit has shown resilience in 2024, supported by proactive EM central bank policies and the appeal of higher yields vs developed markets. EM credit is growing in institutional interest and offers unique opportunities through sustainable transition investments, diversification, and strong risk-adjusted returns. With EM companies often underrated, investors can find value and growth in this expanding asset class.

✏️ Outlook for the CLO market amid macroeconomic challenges

UBS

The CLO market is navigating a complex landscape influenced by rate cuts, heightened volatility, and shifts between syndicated loans and private credit. Japanese demand for CLOs remains strong despite recent volatility. Securing high quality syndicated loans is becoming more difficult, which could lead to a need for innovation with CLO structures

✏️Are bond investors ready for a US industrial revolution?

Wellington Management

The US economy may be on the brink of a new industrial revolution, driven by sustained capital spending in areas like AI, energy, and reshoring. This structural growth, coupled with resilient consumer spending, could lead to higher-than-expected economic growth, even if a mild recession occurs. The nature of the capex, resulting productivity gains and urgency and scale of the investments needed are some of the critical factors for these emerging sectors.

✏️ Can investment-grade private credit boost DB schemes ahead of buyout?

Abrdn

As defined benefit pension schemes prepare for buyout, they typically avoid private assets for liquidity reasons. However, investment-grade private credit could provide attractive yields, diversification, and lower risk vs public debt, esp. in commercial real estate and private corporate credit. With the right asset manager, schemes can structure these investments to align with their buyout timeline, capturing additional returns without compromising liquidity.

✏️ Reasons to believe: time for fixed income

Abrdn

Robust corporate fundamentals and resilient credit spreads support investment-grade and selective high-yield bonds, while sustainable bonds focused on climate initiatives offer long-term impact. Investors may benefit from strategies targeting high-quality short-term bonds or BBB and BB-rated bonds for risk-adjusted returns amid a favorable fixed income environment.

✏️ Beware of buying the dip in bonds

Neuberger Berman

Government bond yields have surged recently, and market dynamics suggest that yields may continue rising rather than stabilizing. Investors are advised to remain cautious on government bonds and corporate credit, favoring structured products like CLOs or MBS for better risk-adjusted returns amid expected downside volatility.

📜 Periodicals »

📝 Global fixed income weekly (Goldman Sachs)

📝 Credit market update Q3 2024 (Permira)

✏️ High yield monthly update (Nomura)

PRIVATE EQUITY

TVJ Spotlight 🔦

📝 Infrastructure secondaries at an inflection point

Partners Group

The infrastructure secondaries market is poised for significant growth ($60B by 2030), driven by rising infrastructure AUM and greater adoption of secondaries. This evolving market favors mid-market investments, offering pricing advantages and unique diversification benefits but requires advanced underwriting expertise. Amid limited capital, a buyer’s market is emerging, providing attractive opportunities for investors.

📝 Venture Pulse Q3 2024

KPMG

In Q3 2024, global VC investment remained subdued, with c.$70B raised across 7,227 deals. The Americas led funding with notable investments in AI and defense tech. AI continued to attract significant interest worldwide, especially in sectors like defense, healthcare, and cybersecurity. IPO activity remained low, while M&A was the main exit route. Optimism is growing for a market rebound in 2025, bolstered by anticipated economic stability and continued interest in AI, healthcare, and biotech.

📝 State of pre-seed Q3 2024

Carta

The report highlights trends in early-stage financing, showing a dip in total cash raised from Q1 highs and a shift towards smaller deal sizes under $250K. SAFEs with discount-only terms and post-money conversions on convertible notes are increasingly popular, with hardware and finance sectors showing high valuation caps in post-money SAFE rounds.

✏️ Hands-on operational improvement key to creating alpha in the middle market

Morgan Stanley

A "buy and hold" strategy is no longer effective for PE today. Instead, hands-on portfolio operations and a strong alignment between investment and operating teams are crucial for value creation and profitability. Mid-market PE firms that build fully integrated and robust operational teams with a structured, repeatable playbook can achieve higher returns.

✏️ Can PE continue to produce excess returns above public markets?

KKR

As PE opportunities become more accessible, today’s environment—with lower public market returns, constrained liquidity, and ample dry powder—positions PE well for continued outperformance. The sector is benefiting from attractive buyout and carve-out opportunities, particularly as public companies are increasingly staying private or shedding non-core assets.

✏️ A simplified way to access private equity

JP Morgan

PE is becoming more accessible to individual investors through 40-Act tender offer funds (Tender Funds), which offer lower minimums, simplified tax reporting, and periodic liquidity. These funds allow new investors to build diversified portfolios across primary, co-investment, and secondary deals, with a focus on small to mid-market buyouts for enhanced returns.

✏️ Private equity report 2024

LGT Capital

Private equity is showing early signs of recovery after challenges from inflation, high rates, and geopolitical instability, with Q2 2024 deal activity doubling from the previous quarter. Valuations have stabilized, but exits remain challenging, and focus has shifted to distributions to paid-in capital (DPI) as GPs aim to generate liquidity to attract future investments.

✏️ Continuation funds come to venture capital

Institutional Investor

VC firms are increasingly turning to continuation funds to provide liquidity in a slow exit market, with newer firms expanding this model to EM in regions such as Emerging Europe, Turkey, and India. As older VC-backed assets struggle to exit, continuation funds are growing in popularity despite challenges, with some major VC firms now exploring this strategy.

✏️ Recent VC vintages struggle with a dip in TVPI and investment valuation

Carta

TVPI is a common metric used by venture fund managers to demonstrate fund performance, comparing the estimated value of holdings to invested capital. Recent vintages of venture funds have seen declines in TVPI, with challenges in accurately marking unrealized portfolio values due to fluctuating market conditions and fewer funding events.

✏️ Top secondary investment trends

Hamilton Lane

The secondary market in PE has seen significant growth, expanding from limited LP interest purchases to a diverse range of transactions, including GP-led continuation funds and preferred equity. With a supply-demand imbalance and reduced competition, buying opportunities are attractive, especially as LPs seek liquidity amidst slower distribution rates.

✏️ Buy, sell or hold? Is private equity cheaper now?

EDHEC

The current PE market faces valuation pressures from high interest rates, reduced exits, and lower distributions, but offers unique opportunities for savvy investors. Key findings include valuation dispersion in sectors like Retail and Tech, and a strong outlook for the Health sector despite high multiples. Subscription-based revenue models attract higher valuations compared to reselling models, indicating investor preference for businesses with recurring revenue.

🎙 Time running out for PE as clock ticks for trillions in dry powder (Institutional Investor)

🎥 GP-aligned investing - Multiple ways to win (Juniper Square)

PRIVATE MARKETS AND ALTERNATIVE ASSETS

📝 5 things to know about alternatives

KKR

The private markets are increasingly essential for economic growth, as government funding gaps drive the need for private capital, especially in infrastructure and alternative investments. PE and other alternatives are growing, offering diverse investment benefits such as yield, inflation protection, and growth potential. With retirement insecurity rising, individuals may rely more on private market returns, which provide a significant illiquidity premium over public markets, to bridge future savings gaps.

📝 Why transfer agents play a pivotal role in cross-border fund distribution

State Street

Transfer agents are essential in the evolving cross-border fund distribution landscape, adapting to new technologies, product distribution, and market entry. Key areas of change include modernization for trust, enhancing investor experience, adopting technologies like blockchain and AI, supporting new products, and expanding into new markets.

✏️Private market insights: October 2024

UBS

Real estate shows signs of stabilization with the potential for recovery as interest rates fall, while private infrastructure benefits from lower GDP sensitivity, interest rates, and moderate deal flow declines, presenting contrarian opportunities. PE may see increased exits and IPO activity. In private credit, compressing valuations in public markets create an opportunity, particularly in short-duration, asset-backed segments that offer favorable risk-return profiles.

✏️ Decoding impact expectations: best practices for impact investors and companies

Wellington Management

The impact investment industry surpassed $1T but faces challenges in measuring and managing impact amid its rapid growth. Effective impact investing requires clear communication, realistic expectations, and collaboration between investors and companies. Recommendations include investors aligning impact metrics with business outcomes, supporting companies' evolving impact measurement efforts, and fostering transparency.

✏️ Stop fighting data transparency in private markets

Institutional Investor

BlackRock discusses the push for greater transparency in private markets, driven by increasing investor demand for detailed risk insights, similar to those available for public assets. The historical opaqueness of private markets will likely shift with new age tools and platforms.

✏️ Replacing or complementing fixed income with alternatives

FS Investments

With the Fed easing rates, traditional fixed income faces challenges as bond yields fluctuate, creating potential mark-to-market losses. Alternative strategies, like commercial real estate lending, corporate private credit, and multi-strategy funds, offer compelling options to complement or replace fixed income. These alternatives provide higher income, lower duration, and less volatility, making them attractive for investors seeking stable returns.

✏️ The future of portfolio company value creation

PWC

PE firms are increasingly focusing on innovative value creation strategies beyond traditional cost-cutting and financial engineering to meet LPs’ return expectations. With deal multiples often exceeding public market trends, firms are adopting longer hold times and exploring new approaches, such as pivoting business models, enhancing customer experiences, and pursuing digital transformation, to drive growth and strengthen fundraising appeal.

SECTOR FOCUS

Real Estate x Infrastructure

TVJ Spotlight 🔦

📝 Real estate liquidity insights: An analysis of fund-level cash flows

Stepstone

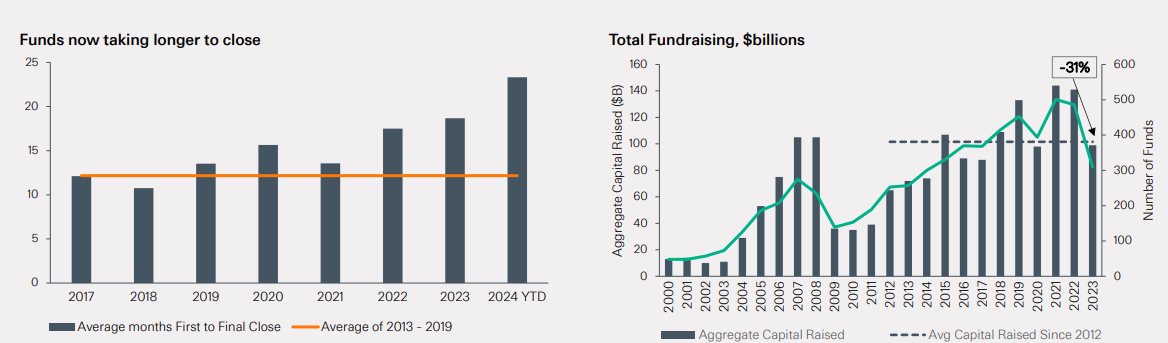

This report on non-core real estate funds highlights liquidity challenges driven by rising interest rates, causing asset value declines and overleveraged portfolios. Distributions have dropped, transaction volumes are down, and longer hold periods are increasing capital calls. Fundraising is also slower, with institutional investors leaning toward larger managers, leaving smaller and mid-sized managers struggling.

📝 Retail real estate is thriving

Nuveen

The retail real estate sector, especially grocery-anchored and necessity retail, shows resilience and growth potential with high yields and low vacancy rates, as consumer demand for essentials remains strong. Limited new supply and strategic store expansions have driven rents and investor interest in both US and Europe. Compatible with e-commerce, retail parks present further opportunities for growth through click-and-collect facilities.

📝 US real estate: A modest start to the recovery

Barings

Property markets are stabilizing as transaction activity and valuations bottom out, with moderate demand recovery and reduced supply supporting vacancy stabilization. Financing has improved, but leverage remains limited. Rents in office sector were relatively unchanged q-o-q while concessions continued to grow and are elevated.

📝 European real estate: Prime’s time?

Barings

Europe's economy remains sluggish, with hopes resting on real wage growth and stable labor markets. In property markets, core assets are expected to benefit from lower financing costs, while secondary assets may see delayed recovery; investment volumes will likely rise gradually, with strong rental growth in prime office, logistics, and residential sectors.

📝 Emerging trends in real estate 2025

PWC

Real estate is set for a potential upswing as post-pandemic disruptions ease and the rate cuts boost transaction activity. Key investment factors include modernized building stocks and supply-demand dynamics, such as senior housing and premium office spaces.

✏️ Why now is the time to invest in commercial real estate

JP Morgan

Commercial RE values, after a significant decline, are showing signs of recovery due to easing capital markets, falling rates, and strong occupancy rates. With transaction volumes rising and favorable valuations relative to other asset classes, CRE offers an attractive entry point, especially as rate cuts and healthy fundamentals signal potential for strong future return.

✏️ The convergence of data centers and power: A generational investment opportunity

Blackstone

The rapid growth of digital infrastructure, driven by data center expansion and AI, is fueling unprecedented demand for power, creating significant investment opportunities. Blackstone, focusing on data centers, renewable energy, and power infrastructure, sees immense potential in these sectors as power demand rises and the energy transition progresses.

✏️ Asia real estate: A key diversifier

KKR

Asian real estate markets present significant opportunities for investors, driven by robust GDP growth and diverse economic cycles. While Japan benefits from a resurgent economy, South Korea and China see rising demand for multifamily housing. Australia’s booming population growth supports housing needs, and China’s government support signals a potential recovery.

✏️ Global real estate market outlook Q4 2024 (Abrdn)

Energy Transition x Climate Finance

📝 Evolving data center sustainability and the role of the capital partner

Principal Asset Management

Data center providers are increasingly investing in sustainability including sectors like energy and water efficiency, greenhouse gas reductions, and waste management. Sustainability efforts also enhance business competitiveness, reduce costs, ease permitting challenges, and improve employee retention, making it a crucial focus for providers and their partners.

📝 Toward near-zero methane emissions in oil and gas

BCG

Reducing methane emissions is critical to slowing global warming, and oil and gas companies play a major role. Although some industry leaders have committed to near-zero emissions by 2030, the sector's overall pace of abatement remains slow, risking penalties and market access for laggards. Methane reduction is financially viable and essential for meeting global climate targets, yet a significant emissions gap persists, indicating the need for accelerated efforts.

✏️Analysing greenhouse gas emissions: It’s not as easy as 1-2-3

M&G Investments

Analyzing emissions data is becoming as crucial as financial scrutiny for finance professionals, especially with companies setting climate targets. Emissions accounting presents significant challenges due to inconsistent methodologies and sporadic reporting. Regulations aim to enhance disclosure for better analysis of companies' environmental efforts.

✏️ Green energy’s intermittency problem: mitigating power price volatility

Natixis

The transition to renewables is driving increased volatility in power prices due to the intermittent nature of wind and solar energy. Mitigating these price swings requires a diversified, flexible portfolio, investments in storage and demand management, and advanced risk management solutions. Partnering with banks experienced in commodity markets can further help energy providers navigate pricing volatility by effective hedging strategies.

AI x Tech

📝 AI and its impact on real estate

UBS

AI offers asset managers potential improvements in investment processes and property management while creating new market opportunities. AI is projected to boost productivity, increasing US GDP by c.3% by 2032. Sectors like office space may face demand challenges due to anticipated job shifts, esp. in office-heavy fields like tech and professional services.

📝 What GenAI means for health care investors

BCG

Generative AI is transforming health care by enhancing drug discovery, refining diagnostics, personalizing treatments, and expanding care delivery beyond traditional settings. Health care investors have opportunities to support this shift, from startups to mature operators, focusing on GenAI-enabled solutions across various domains.

✏️ The $100 billion opportunity for generative AI in P&C claims handling

Bain

Generative AI offers transformative potential for the insurance industry, particularly in claims handling, where it could reduce loss-adjusting expenses by 20-25% and decrease leakage by 30-50%, resulting in over $100B in benefits. By enhancing claims accuracy, customer experience, adjuster productivity, and litigation support, generative AI can streamline operations, reduce costs, and improve outcomes for insurers and customers alike.

🎙 Central bank digital currencies: A marriage of convenience? (State Street)

🎙 The consequences of the digital age (State Street)

Thank you for reading The Valt Journal!

Check out our other editions here.

Check out TVJ Library. A private markets and alternative assets focused live repository featuring a collection of 1,500+ research reports and articles from 150+ sources across 4 categories and 40+ sub-categories. Get your access now!

Disclaimer:

The content provided on this platform contains references and links to external sources, including articles, reports, websites, images, or videos. We do not own or claim copyright over the content found in these external sources. The ownership and rights of the content belong to the original creators.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.