The Valt Journal #40

Featuring 2025 Investment Outlook reports for private markets and private credit.

Happy New Year 2025!

Welcome to the latest edition of The Valt Journal. In every issue, we cover the best and the latest insights into the global private markets. The Valt Journal is a repository of time sensitive and timeless research, delivered to your inbox every 2 weeks, so you don’t have to look anywhere else!

The Valt Journal Library 🚀

Our private markets and alternative assets focused live repository featuring a collection of 1,700+ research reports and articles from 150+ global asset managers and experts across 4 categories and 40+ sub-categories for an efficient, fast and seamless research experience.

Quickly scan the list of all 2025 investment outlook reports here!

TVJ Spotlights 🔦 featured in this edition:

1) Private markets outlook 2025 (by BlackRock)

2) SWFs and Public Pension Funds are reshaping private markets (by BCG)

3) Royalties: A primer (by Partners Group)

4) Demystifying the opportunity in investment grade private credit (by Apollo Global)

5) Asset-Based Credit: Easy As 1-2-3 (by TPG)

Numbers this edition

Links: 53

Authors: 31

PRIVATE MARKETS AND ALTERNATIVE ASSETS

TVJ Spotlight 🔦

📝 Private markets outlook 2025: A new era of growth

BlackRock

Private markets are set to grow from $13T to $20T+ by 2030, driven by rising investment activity, moderating financing costs, and demand for long-term capital. Key growth areas include private debt, infrastructure, and AI. As M&A and IPO activity rise, exits and distributions are accelerating, while secondaries play a crucial role in portfolio strategies.

TVJ Spotlight 🔦

📝 SWFs and Public Pension Funds are reshaping private markets

BCG

Principal investors, including SWFs and PPFs, are managing $36T of AUM as of 2024, with an expected 6% CAGR through 2030. Over the past decade, their allocations to private markets grew 10% annually, now controlling 70% of global private AUM. Infrastructure and private credit are gaining prominence and have grown at 14% and 20% CAGR, respectively.

TVJ Spotlight 🔦

📝 Royalties: A primer

Partners Group

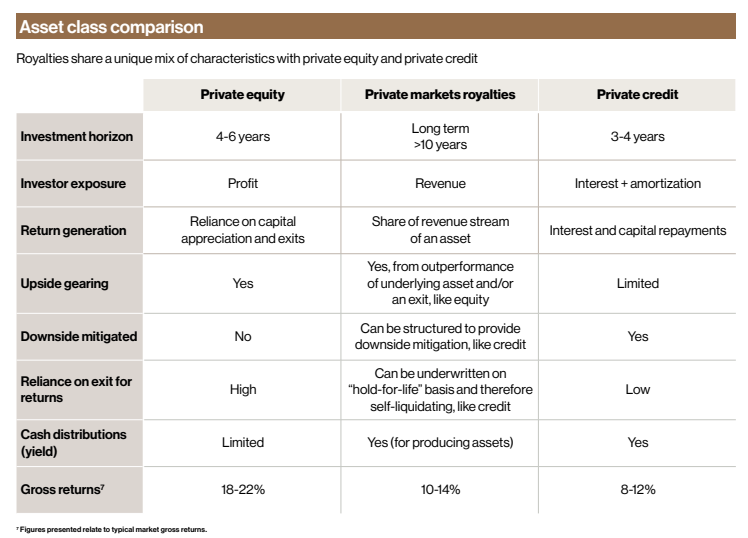

Royalties have emerged as a growing $2T asset class within private markets, offering investors diversification through predictable income streams (revenue-sharing or synthetic contracts), combining downside mitigation with the potential for significant upside. Spanning sectors like music rights, pharma, green metals, natural gas and carbon credits, royalties provide exposure to high-growth industries while delivering attractive yields.

✏️ How does the size of private markets compare to public markets?

HarbourVest

PE and VC encompass 215K+ companies, c.25x the number of public companies listed in the MSCI ACWI IMI Index (8,800 constituents). However, their combined AUM, at $11T (NAV and dry powder), represent just 12% of public equity market capitalization, totalling $87T as of 2024. This data highlights the breadth and growing opportunities within private markets.

✏️Asset tokenization now and in the future

State Street

Asset tokenization is set to revolutionize capital markets by making them faster, cheaper, and more accessible, with bonds, commodities, and PE funds leading adoption. Tokenization could enable 24/7 trading, eliminate multi-day settlement times, and reduce reliance on intermediaries, unlocking new economic models. AI will further enhance productivity in portfolio management but challenges in regulation and cybersecurity will be critical.

✏️ Tokenized cash: A regulatory view of unlocking a digital financial market

State Street

The tokenization of financial instruments through digital cash instruments like stablecoins, tokenized deposits, and Central Bank Digital Currencies (CBDCs) is expected to transform capital markets. Markets are exploring or piloting CBDCs, while some initiatives aim to integrate tokenized cash with existing systems for seamless cross-border payments.

✏️ Fair Winds - Why private markets are positioned for growth

HarbourVest

Global PE deal value reached $1.3T in 9M2024, up 30% YoY, while secondaries are on track for a record $140B in volume. Exits showed promise at $634B, up from $555B in 2023. With increasing participation from individual investors (PE allocations grew to 15% in 2023) and rising demand for private credit, secondaries, and high-growth sectors like AI and climate tech, private markets are set for further growth in 2025.

✏️ The Attribution Advantage: Improving manager analysis in private markets

HarbourVest

Investors in private markets can now leverage advanced tools (like HarbourVest’s model) to differentiate GP skill from market-driven returns. Deal-level benchmarking, analyzing 70K+ deals across vintages, reveals key drivers like sector allocation and deal selection. These tools distinguish true selection skill from favorable conditions, aiding portfolio optimization.

📝 Assessing GPs and the tough environment

Goldman Sachs

Amid increasing fundraising timelines (12–18 months or more), some LPs delay commitments due to overallocation to PE or awaiting distributions. While GPs employ strategies like discounts or partially funded portfolios to attract LPs, one must evaluate funds through rigorous due diligence, balancing early and late commitments depending on capacity constraints. GPs diversify their investor bases and focus on exits to meet LP expectations.

📝 Fundraising challenges ease in Asia-Pacific

Nuveen

Real estate investment in Asia-Pacific is growing, with transaction volumes reaching $96B in 2024, up 28% from 2023. While sectors like logistics and real estate debt attract investor interest, China remains largely avoided due to geopolitical tensions and market challenges. Investors favor developed markets like Japan, Korea, and Australia, focusing on high-conviction opportunities and leveraging mega-mergers for scale and efficiency.

✏️ Can new structures — and new investors—fix a fundraising dilemma?

Institutional Investor

Private asset fundraising declined 3.4% in the past year, but secondaries surged, raising a record $100B, a 31% increase YoY. Asset managers are adapting with evergreen funds targeting HNIs, who could contribute $7T to private markets by 2033. Expanding access to 401(k) plans, holding $25T, is a key focus. If 5% of $450T of global wealth shifts to private assets, it could add $20T, underscoring significant growth potential for private markets.

✏️ Why gold is shining bright in retail portfolios

Institutional Investor

Retail investors are increasingly turning to gold for its versatility, liquidity, and accessibility, driven by the availability of smaller-sized contracts like Micro Gold (MGC) futures. Gold and crypto, often seen as rivals, can complement each other as traders explore both assets for diverse strategies. The introduction of even smaller contracts, such as 1-Ounce Gold futures launching in 2025, further enhances accessibility, allowing investors to tailor their portfolios.

✏️ Is it a golden era for gold?

JP Morgan

With central bank purchases at record levels, increasing retail interest, and geopolitical uncertainties, gold prices are projected to reach $3,150/oz by end-2025. Its low correlation with equities and bonds enhances risk-adjusted returns, making it a key asset for long-term investors seeking stability and diversification.

📜 2025 Outlook and Periodicals »

📝 Cross Asset Investment Strategy December 2024 (Amundi)

📝 2025 Outlook: Long-term perspective on markets and economies (Capital Group)

📝 2025 Perspectives, Optimism through the obstacles (Principal AM)

📝 2025 Outlook: Seizing opportunity amid disruptive change (Impax AM)

📝The road ahead: 2025 private markets outlook (LGIM)

📝 Outlook for 2025 - Glass still half full (KKR)

📝 6 Key Themes - 2025 (MFS)

✏️ A semblance of a goldilocks ahead (Amundi)

✏️ Multi-asset investment views - December 2024 (Schroders)

✏️ The Investment Outlook 2025 (Abrdn)

PRIVATE CREDIT x FIXED INCOME

TVJ Spotlight 🔦

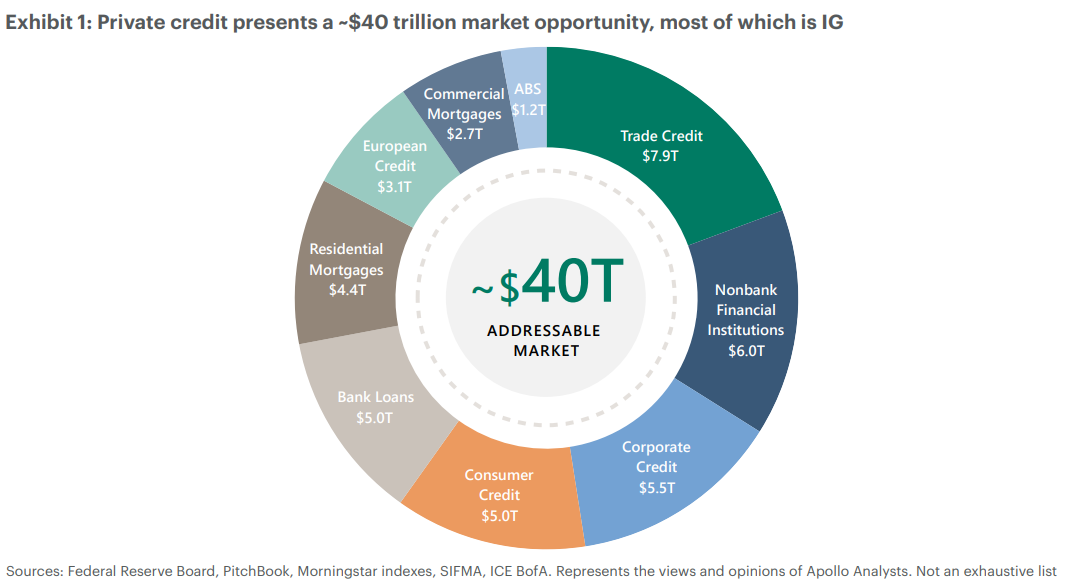

📝 Demystifying the opportunity in investment grade private credit

Apollo Global

Investment Grade Private Credit is a rapidly growing asset class with a $40T addressable market, offering attractive risk-adjusted returns, higher spread premia, and lower historical losses. Evolving beyond corporate private placements, it now includes diverse sectors like asset-backed finance and bespoke loans, providing senior security and diversification.

📝 Private Credit: An enduring opportunity in dynamic market cycles

Apollo Global

Private credit continues to see strong demand due to its customization, speed, and senior-secured structure, offering attractive yields and incremental spreads over public credit. The sector benefits from M&A growth, less stringent regulations, and resilience in volatile markets. Large-scale direct lending to established businesses remains a key opportunity.

TVJ Spotlight 🔦

✏️ Asset-Based Credit: Easy As 1-2-3

TPG

Asset-Based Credit is a $30T market offering diversified, collateralized cash flows from assets like mortgages, consumer loans, and receivables. Unlike corporate lending, it features self-liquidating structures, lower tail risk, and reduced correlation with traditional credit markets. Significant opportunity present in areas like home equity lines of credit (HELOCs), driven by high home equity and elevated mortgage rates.

✏️ 2025 Private Credit Outlook

Morgan Stanley

Private credit expanded to $1.5T in early 2024, up from $1T in 2020, and is projected to reach $2.6T by 2029. Sponsored middle-market loan activity has remained resilient, driven by demand for incremental financings and $1.6T in PE dry powder. Borrowers increasingly value private credit's speed, certainty, and flexibility amid tighter bank lending. Key growth areas include asset-based finance, hybrid capital for growth companies, and real estate lending.

✏️ Real estate credit: Poised to outperform

TPG

$570B in commercial mortgages maturing in 2025, requiring refinancing, elevated interest rates and a $2T CRE debt maturity wall through 2026 have created a financing gap as traditional lenders retreat, with active CRE lenders down over 30% in the past year. Private real estate credit is well-positioned to step in, offering attractive yields, enhanced downside protection from valuation resets, and favourable relative spreads vs corporate credit.

✏️ The case for euro credit

BNY Investments

Euro-denominated investment-grade credit markets offer compelling opportunities despite 2024’s spread compression. €750B+ in fiscal stimulus in Southern Europe, real GDP expansion, a boom in corporate issuance and high-interest coverage ratios at 14x provide a solid backdrop for active managers to exploit relative-value trades and yield strategies.

✏️ Emerging markets debt under Trump 2.0

Neuberger Berman

Fundamentals have strengthened, with emerging market’s high-yield corporate default rates down to ~3% from double digits in 2022. EMD high-yield spreads offer 100 bps more than US high-yield bonds, supported by robust reforms, improving credit ratings, and fiscal adjustments. Relative value opportunities in sovereigns like Ivory Coast and corporates like Argentina offer strong potential for outperformance in 2025.

📜 2025 Outlook and Periodicals »

📝 2025 outlook- Navigating a shifting landscape- Direct lending (Barings)

📝 Fixed income outlook: resilient US provides an anchor (Capital Group)

📝 2025 Fixed income outlook: Setting the pace (Nuveen)

📝 Quarterly Credit Outlook December 2024 (Robeco)

📝 Global fixed income views (JP Morgan)

✏️ 2025 credit outlook: Changing of the guard (Man Institute)

✏️ Fixed income outlook 2025: Managing uncertainty with flexibility (Abrdn)

🎙 From cash to bonds: A strategic shift in post-pandemic investing (PIMCO)

🎙 Private credit: Asset-based finance shines as lending landscape evolves (PIMCO)

PRIVATE EQUITY

✏️ 2025 Private Equity outlook

Morgan Stanley

PE is focusing on value creation and operational enhancements to drive EBITDA and profit growth. Global PE dry powder is expected to surpass $1.6T by year-end 2024. IPO activity remains muted, increasing demand for growth equity as VC-backed companies stay private longer, creating opportunities for mid-market firms with scalable value creation potential.

📝 State of private markets: Q3 2024

Carta

Valuations continue to face pressure, with IPO activity subdued, especially among unicorns with $1–5B market caps. Pre-seed funding remains a key area of focus, reflecting resilience in early-stage investing. Global fundraising slowed, with terms becoming more stringent, but substantial dry powder suggests potential for future growth.

✏️ Is/isn’t the number of venture funds shrinking?

Stepstone

The VC landscape shows signs of consolidation post the high-velocity period of 2020–2021. First-time fund formation peaked in 2022 with 804 funds but declined sharply to just 21% of that peak by 2024 YTD. 41% of funds raised since 2000 never raised a subsequent fund, with recent vintages like 2019 showing a 47% non-retention rate. However, resilience remains critical; successful turnarounds highlight the potential for adaptability in VC.

SECTOR FOCUS

Real Estate x Infrastructure

✏️ How is the AI building boom fueling opportunities in private energy infrastructure?

JP Morgan

The US data center capacity is undergoing a massive expansion, with 3,800 MW under construction, a 70% rise YoY, and an additional 7,000 MW in pre-construction stages. As AI adoption surges, data centers face grid constraints. By 2027, 40% of AI data centers may face operational limits due to power shortages. Private infrastructure investments in power generation and data center support are emerging as lucrative, lower-volatility alternatives.

✏️ Key trends to watch as real estate levels out

Goldman Sachs

The real estate market is showing signs of recovery after three years of dislocation, with CMBS issuance up 180% in 2024 and RE transaction volumes increasing 14% YoY in Q3. Rental housing demand remains resilient, and construction starts for logistics and housing assets are down over 50% from their peak. Over $3T in RE debt needs refinancing in the next 4-5 years, presenting opportunities for private credit funds. E-commerce, AI, and demographic shifts continue to drive sector-specific growth in logistics, healthcare, and sustainable buildings.

✏️2025 Real estate outlook

Morgan Stanley

NOI growth and lower yields are driving a positive outlook, with equity REITs outperforming private valuations. Industrial assets in high-growth, supply-constrained markets and housing segments like multifamily and senior housing present compelling opportunities. Market dislocation, structural demand shifts (e.g., e-commerce and ESG retrofits), and $3T in pending debt maturities are key factors shaping investment strategies.

✏️ Private infrastructure: An asset class for all economic conditions

KKR

Private infrastructure has outperformed all asset classes (except PE) over the last decade and proved effective during high inflation periods. With $3T in global AUM, it has shown lower volatility and higher risk-adjusted returns than public markets. It supports critical sectors like renewable energy, data centers, and logistics, addressing long-term growth trends.

✏️ Infrastructure: How investors can improve your quality of life

Abrdn

Infrastructure investment is surging globally, with spending forecasted to exceed $9T by 2025, driven by energy transition, urbanization, and demographic shifts. Private capital is crucial, with insurers alone increasing their allocation to infrastructure from 1.5% in 2019 to 2.5% in 2023. Infrastructure offers long-term, inflation-linked returns and aligns with tech-driven growth areas like data centers and clean energy.

✏️ The future of data centers: Trends, challenges and real estate opportunities

Institutional Investor

The growing demand for data centers is driven by cloud computing, AI, and big data, with global data volume expected to grow from 33 ZB in 2018 to 175 ZB by 2025. Data center supply is projected to grow at ~10% p.a. through 2028, yet vacancy rates remain low, supporting 10% annual revenue growth per foot for hyperscale centers over the next 3 years.

✏️ Powering up: Macquarie asset management's focus on green investments

Macquarie

The renewable energy sector is experiencing unprecedented growth, driven by stabilizing costs, strong policy support, and surging demand for green power from corporates and industries. Global clean energy investment reached $1.9T in 2023, outpacing fossil fuels, with solar and wind leading new electricity supply due to their low costs and speed of deployment.

AI x Tech

📝 Driving change: Autonomous vehicles revisited

Morgan Stanley

Autonomous vehicle technology is rapidly advancing, with US on track to realize significant benefits from its adoption. In 2023, trucks logged 180B miles in the US, and autonomous trucking could reduce costs to $0.65–$0.85 per mile, creating a $115–$150B addressable market. The robotaxi market also shows promise, with Tesla targeting costs of $0.40 per mile. Proper adoption offers opportunities in safety, cost efficiency, and urban planning.

✏️ Digital Assets: Trump comeback to usher in new era of financial innovation

Abrdn

Donald Trump's election has fueled optimism in cryptocurrencies, with Bitcoin surpassing the $100,000 mark amid expectations of a more crypto-friendly regulatory framework. Anticipated institutional adoption, such as through spot Bitcoin ETFs and potential US Treasury Bitcoin purchases, signals market growth. This regulatory shift enhances global competitiveness while driving broader adoption of tokenized assets and public blockchains.

✏️ The state of the AI Agents ecosystem: The tech, use cases, and economics

Insight Partners

The adoption of AI agents/tools is gaining traction across industries, revolutionizing workflows through automation, enhanced user experiences, and task-specific capabilities. Enterprises are exploring agentic architectures for customized, scalable solutions, balancing trade-offs between internal builds and external purchases. Major opportunities in infra and verticalized platforms are driving the next phase of private credit and enterprise innovation.

✏️ Financial services has a data problem: How AI is fueling innovation

Insight Partners

The financial services sector faces critical data challenges due to legacy infrastructure, data silos, and regulatory demands, compounded by the rise of AI-driven personalization and stricter compliance. Startups are reshaping the landscape by offering AI-powered tools for front-office analysis, middle-office data integration, and back-office automation, enhancing efficiency, compliance, and decision-making while modernizing operational workflows.

✏️ Private biotech: Immunology and inflammation’s third wave

Wellington Management

The immunology and inflammation sector is advancing into a promising third wave of innovation, driven by novel drug modalities, genomic insights, and repurposed tech. Emerging therapies target chronic diseases with enhanced efficacy and patient benefits, attracting strong investor interest through M&A, IPOs, and private financings.

Thank you for reading The Valt Journal!

Check out our other editions here.

Check out TVJ Library. A private markets and alternative assets focused live repository featuring a collection of 1,700+ research reports and articles from 150+ sources across 4 categories and 40+ sub-categories. Get your access now!

Disclaimer:

The content provided on this platform contains references and links to external sources, including articles, reports, websites, images, or videos. We do not own or claim copyright over the content found in these external sources. The ownership and rights of the content belong to the original creators.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.